Introduction to profit and loss statement

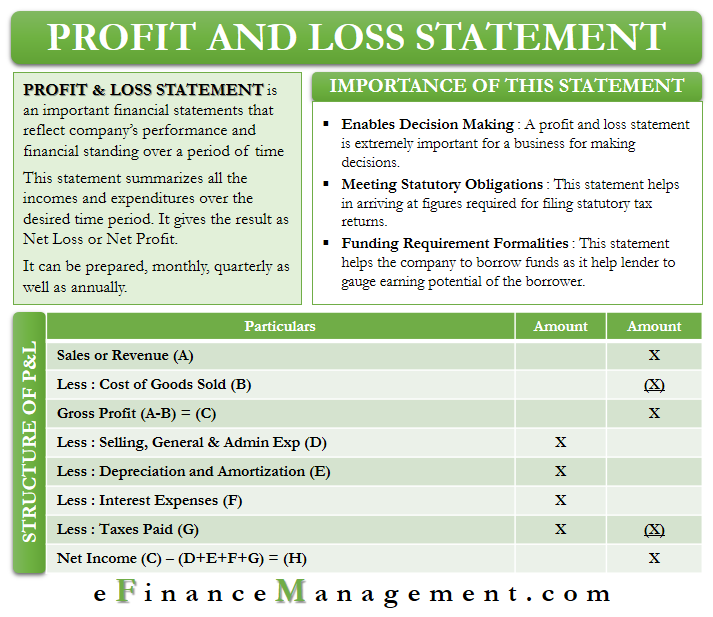

The profit and loss statement is one of the three most important financial statements that reflect any Company’s performance and financial standing over a period of time. The other two statements are the Cash flow statement and the Balance Sheet. Though the profit and loss statement can be prepared monthly too, quarterly and annually is the common trend in the industry.

The statement records and summarizes all the income and expenditure of a company over the desired time period. The resultant figure is the Net Income/ Loss earned by the company. The “bottom line” of a Company is its other name. The backbone of this statement is one basic equation:

Revenues – Expenditure = Net profit/ Loss

The profit and loss statement has other names, too, like-

Statement of income

Statement of earnings

Statement of operations

Importance of profit and loss statement

The Balance sheet shows the financial position of a company at a particular point in time. But the profit and loss statement shows the real strength and earning power of a company over a period of time. Also, it considers the accounting principles of Revenue recognition, matching, and accrual basis, which makes it more important and meaningful than the Cash flow statement.

Decision making

A profit and loss statement is extremely important for a business to make decisions. It gives a clear picture of whether the company’s operations result in a profit or a loss after taking into account all the related expenditures. Therefore, the company can take corrective actions if there is a need.

Also Read: Income Statement

Meeting statutory obligations:

Also, the statement helps in arriving at figures required for filing statutory tax returns. The net income figure from the profit and loss statement will be the base for calculating how much tax the business will have to pay for the corresponding financial year.

Funding requirement formalities:

A profit and loss statement for a few years is a must whenever the business wants to borrow funds from a bank or a financial institution. It will help the lender to gauge the earning potential and the steadiness of the borrower. Also, this will be the decider for the amount to sanction.

Also, since a new business will not have these required financial statements for the previous years, it will have to prepare a proforma or projected profit and loss statement for the near future. This statement, along with other statements and documents, will be the basis for funding the new business.

Structure of the profit and loss statement

The structure of this statement is as follows:

Sales or Revenue-

This figure is the total sales of a company over the prescribed time period. It includes both cash sales and the accounts receivable over the period. Also, any discounts, returns, or allowances have to be subtracted from the sales to arrive at the total revenue amount.

Also Read: Net Profit

Cost of Goods Sold-

The direct cost of producing goods is the cost of goods sold. This includes the cost of materials, labor, and overheads directly used to manufacture a product. Also, all the indirect costs of production like marketing and selling expenses are not a part of this cost.

Gross Margin-

Revenue earned less than the cost of goods sold is known as the gross margin. In simple words, all the direct costs relating to the goods produced or services rendered are deducted from the total revenue figure to arrive at the gross margin.

Selling, general and administrative expenses

Selling expenses are the expenses for selling a product or service. These expenses may be in the form of advertising and publicity costs, commissions and bonuses, salaries of sales personnel, freight, shipping and transportation charges, etc.

General and administrative expenses include other indirect expenses incurred for running a factory or an office. These expenses include rents, staff salaries, electricity, phone, and other utility bills, legal fees, fees for statutory compliances, insurance charges, repairs and maintenance, office supplies, etc.

Depreciation/ Amortization

Depreciation is the decrease or reduction in the value of a physical asset over time with its usage and wear and tear. Similarly, amortization refers to the acquisition cost of an intangible asset minus its residual value spread over a period of its useful life term. Thus, these are non-cash expenditures in such a statement.

Interest income/expense

A company may earn interest income from its deposits or holdings with a bank or a financial corporation. Also, it will have to pay interest on its borrowings and loans. Both these figures will appear in a profit and loss statement.

Taxes

This figure includes the current and deferred tax liabilities of a company.

Net Income

The final figure thus arrived at is the Net Income of the company.

Analysis of Profit and Loss statement

This statement needs to be professionally analyzed by a financial analyst. This will ascertain the financial standing of a company, its year-on-year progress, and whether it is attractive for investors or even for takeovers and mergers.

A few important aspects of such an analysis are:

- Year-on-year statements should be compared to check how the company is faring. Also, numbers should be compared with statements of other players in the industry or industry benchmarks. This will help to find where the company stands vis-à-vis the competition.

- Analyzing margins such as gross profit margins, operating margin, EBITDA, and net profit margin. By this, we can conclude that profit cannot be restricted to a level. After every activity, the company is required to find and evaluate profit. Hence, one needs more clarity on what is the best definition of profit for various evaluation purposes.

- Ratio and valuation analysis is done to give an overall view of where the company stands. Return on equity(ROE), Return on assets(ROA), P/E ratio, Interest coverage ratio, Inventory turnover ratio, Asset turnover ratio, etc., are a few important ratios. The profit and loss statement and balance sheet of the Company help in the calculation of these ratios.

RELATED POSTS

- Objectives of Financial Statement Analysis

- What is the Best Definition of Profit?

- EBITDAR – Meaning, Purpose, Example, Formula, and Differences

- Multi-Step vs Single Step Income Statement – All You Need to Know

- Difference between Income Statement and Statement of Comprehensive Income

- Accounting Profit vs Economic Profit – All You Need To Know