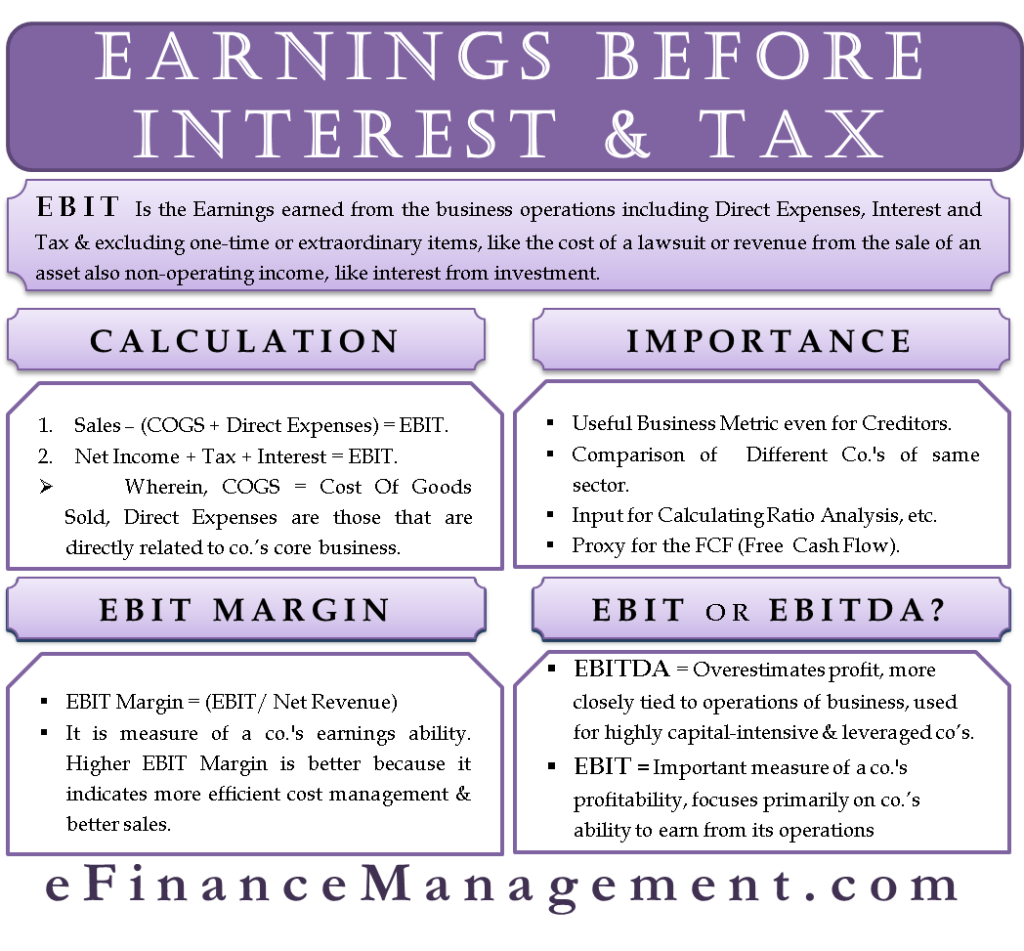

EBIT, or Earnings Before Interest & Tax, is an important measure of a company’s profitability. It measures the profit a company earns from its operations. EBIT ignores tax and interest expenses and focuses primarily on the company’s ability to earn from its operations. Operating profit, operating earnings, and profit before interest and taxes are also called operating profit.

How to Calculate EBIT?

There are various ways to calculate EBIT. The most commonly used method is to subtract the cost of the goods sold (COGS) and other direct expenses from the sales. Direct expenses are spent on a regular basis and have a direct relationship with the company’s core business, like wages.

So, while calculating the Earnings Before Interest & Tax, one-time or extraordinary items, like the cost of a lawsuit or revenue from an asset sale, are excluded. Further, the non-operating income, like interest from investment, must also be excluded.

An alternative way to calculate the Earnings Before Interest & Tax is to work back ways. We take the net income or net profit figure for this method and add back the tax and interest expenses.

Let’s understand the calculations with the help of a simple example. Assume Company A has Sales of $50000, COGS is $30000, Selling, general and administrative expenses are $5000, Interest expense is $800, tax of $200, and net income of $14000

With the first method; EBIT = $50000 – $30000 – $5000 = $15000

With the second method; EBIT = $14000 + $800 + $200 = $15000

Why is EBIT Important?

EBIT is a useful business metric that comes in handy in several scenarios.

For example, when an investor is buying a company, its earning potential is more important to him than the existing capital structure. Also, Earnings Before Interest & Tax helps an investor or an analyst compare different companies in the same sector. Such a comparison indicates if a lower margin of a company is due to the slowdown in the industry or if it is specific to the company.

Earnings Before Interest & Tax is also used as an input for calculating other business metrics, like in ratio analysis. Further, creditors also closely monitor the EBIT as it gives them an idea about the pre-tax cash that the company generates to pay the debt and creditors.

EBIT can also be used as a proxy for the FCF (free cash flow) in industries with consistent capital expenditures. FCF is an important input in the valuation of a business.

Also Read: EBITDA

EBIT Margin

While comparing companies on the basis of EBIT, a more effective metric is EBIT margin. It is the ratio of Earnings before Interest and Taxes to operating sales or net revenue. Since it is in the form of a ratio or percentage, comparing it with other companies is easier.

EBIT Margin = (EBIT/ Net Revenue)

It is also a measure of a company’s earnings ability. The higher the EBIT margin, the better it is. A higher margin would indicate more efficient cost management and better sales. If a company fails to generate a positive margin over time, it must rethink its business model and strategy.

One can easily use the EBIT margin for cross-industry and international comparisons. However, the margin varies greatly among industries. For instance, the retail industry has a small margin but a high volume. Other industries may have small volumes, but margins would be high.

Should you use EBIT or EBITDA?

As EBIT, EBITDA (Earnings before Interest, Taxes, Depreciation, and Amortization) is also a crucial measure of a company’s profitability. While the former excludes only interest and taxes for calculating profitability, EBITDA excludes depreciation and amortization.

Since EBITDA does not include depreciation, it overestimates a company’s profit. But, we can say that EBITDA is more closely tied to the operations of the business as it removes all non-cash expenses from the operating income.

Deciding which of the two is more important is a tricky question. Both are equally important, and their use often depends on the type of analysis of the company or the purpose of the analysis. For instance, EBITDA usage is usually for highly capital-intensive and leveraged companies. Since these companies have high debt and more fixed assets, it often leads to poor earnings.

So, using EBITDA gives a good idea of the profitability of such companies. Analysts also prefer EBITDA for valuing such companies as negative earnings make things complicated. Read EBIT vs. EBITDA to learn more.

Also read – EBITDAR and EBITDARM.

Quiz on EBIT.

This quiz will help you to take a quick test of what you have read here.

Thanks for keeping it simple!