What is the Meaning of Harmonization of Accounting Standards?

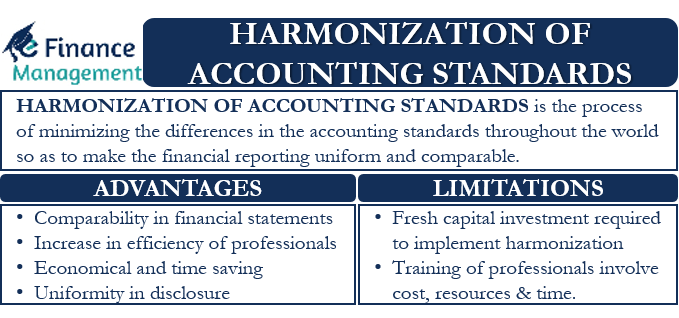

Harmonization is the act of making an activity, situation, or process consistent and compatible with other similar works. Harmonization of Accounting Standards is the process of minimizing the differences in the accounting standards worldwide. This is to make the financial reporting uniform and comparable. The basic objective of this harmonizing exercise is to improve the comparability and compatibility in preparing and presenting the accounting reports, records, and statements. In the present era of globalization, it has become essential for capital markets to rely upon common accounting reports. Countries can achieve international harmonization of accounting standards only with mutual cooperation and understanding. They must follow similar recording and reporting procedures and rules when preparing financial reports.

Harmonization of accounting standards results in the building of international investor confidence and knowledge. Investors and lenders can easily interpret and compare the financial statements of companies from any part of the globe. They can correctly recognize, evaluate and identify the companies with strong financials that meet their investment requirements. This helps to boost cross-border investments. Also, it helps to make a fair judgment of the companies to invest in. Good investment decisions are the key to creating a competitive edge and increasing the return on investments.

Difference Between Harmonization and Standardization

Harmonization of accounting standards is different from its standardization. Harmonization sets limits on how much the accounting practices can vary so that the results can still be comparable. On the other hand, standardization promotes uniform and rigid rules that all should adopt and follow. It is inflexible and does not allow the adaptation of accounting procedures in accordance with local practices and conditions. In the real world, it is impossible to achieve standardization in accounting standards globally. This is so because of differences in thought processes, procedures, reporting standards, tax laws, etc. The harmonization process is an effort to minimize these differences on a global level.

What are the Advantages of Harmonization of Accounting Standards?

Here we list out the key advantages of harmonization of accounting standards in detail.

Comparability in Financial Statements

The most important advantage of the harmonization of accounting standards is that it enhances the comparability of accounting reports and statements across companies and industries on a global level. Companies follow different accounting standards as per the regulatory requirements in their respective countries of operations. This obviously makes the end result different with regard to the process of preparation and presentation of accounting reports.

Also Read: GAAP vs IFRS – All You Need To Know

For example, a multinational corporation working in different countries will have to adhere to the accounting standards and requirements of each of the countries separately. It cannot prepare the financial reports of all of its entities according to the accounting standards of just one country or of the country where it is headquartered.

This situation creates a lot of confusion for stakeholders such as the management, shareholders, investors, lenders, etc. They cannot compare the financial reports of companies domestically as well as internationally. Moreover, new investors also find it difficult to understand the reports of companies operating in other countries.

Solution

Harmonization of accounting standards provides a solution to the above problems. It makes the financial reports comparable. It minimizes the differences in the accounting standards across the world and makes them compatible. The financial reports become comparable with similar sequencing and terminologies for reporting. Investors find it much more convenient to understand the financials and performance of companies from other countries. It helps them to make prudent investment decisions. Therefore, it results in the free flow of capital internationally.

Increase in Efficiency of Professionals

Harmonization of accounting standards helps in increasing the efficiency of financial reporters, accountants, and auditors. In the absence of harmonization, such professionals face numerous problems while working on financial reports of companies from different regions and countries. Their skill-sets have a limit, and a lot of time is wasted in adapting to local reporting standards when working in a new country.

Also Read: Importance of GAAP

Harmonization solves the above problems. They need not learn new formats, terminologies, and standards of each and every country while working on reports of different countries or while moving to a new country for work. This increases efficiency, faster processing of financial data, and quicker preparation of final reports. Also, these professionals can work in any country across the world without facing any knowledge problems or problems of unfamiliarity.

Economical and Time-Saving

Harmonization of accounting standards results in saving a lot of money, resources, and time for people other than professionals too. The stakeholders and other users of financial reports will not have to go through incompatible and incomparable reports and understand each one of them distinctly. The whole assessment process becomes a lot simpler and faster with harmonization. The items of the financial statements will also appear almost in the same place and sequence in the financial reports across the world. The nomenclature will also be more or less similar.

Harmonization also helps in bringing uniformity in the use of multiple financial ratios. The users will know that the ratio calculation is uniform across companies and countries, and the same inputs have been used. This will help in saving a lot of time by simply using the financial ratios to compare multiple companies rather than calculating the ratios after going through their financials individually in detail.

Uniformity in Disclosures

Harmonization of accounting standards will result in comparable financial disclosures in the accounting reports. This can greatly help to achieve regularity and consistency of all required information among its users worldwide. Transaction costs and time spent going through lengthy disclosures will reduce, and all the stakeholders will benefit from it.

Limitations of Harmonization of Accounting Standards

While the aim is laudable and an attempt in the right direction, however, there are a number of limitations too of adopting harmonization of accounting standards. Initially, fresh capital investments may be required on the part of companies to implement harmonization. The professionals around the world need to be trained and educated as per the new accounting practices, which may involve significant costs, resources, and time. Educational institutions will also need to revise their courses to incorporate the changes.

Corporations around the world will have to incorporate changes in their accounting software to bring it in line with the new requirements. Also, small companies that still rely on book-keeping and engage in little or no use of computers will have to buy expensive hardware to adhere to the new accounting norms. These bottlenecks in the line of harmonization of accounting standards have to be carefully addressed before adopting the same.

Summary

The emergence of multinational corporations and their increasing control of world business have led to the need for some common form of accounting practices around the world. Harmonization of accounting standards is the key to prepare financial reports that are for the general use of stakeholders not in just one company or country but worldwide. It helps to blend together the different accounting practices of the world by giving us a common platform and common results.