Underwriters are important in the financial world. They basically help in lowering the risk of the other party, but for a fee, commission, or interest. There could be several types of underwriters depending on the industry—for instance, equity markets underwriter, mortgage industry underwriter, insurance industry underwriter, etc.

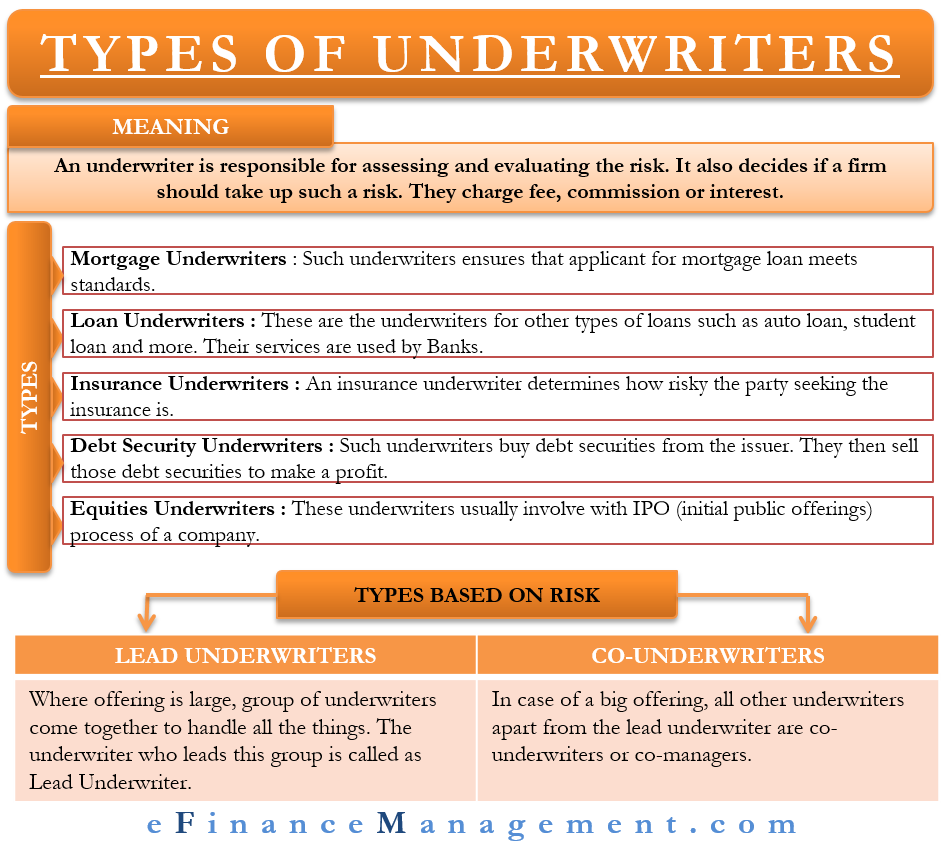

An underwriter is responsible for assessing and evaluating the risk. It also decides if a firm should take up such a risk. Moreover, as said above, the underwriter also, in some cases, shares the risk in exchange for a fee or commission.

Types of Underwriters

Underwriters could be in every industry, but some of the most common types of underwriters are:

Mortgage Underwriters

Mortgage underwriters need to ensure that the applicant for the mortgage loan meets the standards. For this, the underwriter needs to check the history of the applicant, credit score, and their present standing, such as a type of job and steady income. Underwriters also need to analyze the property under consideration to ensure the purchase price and the loan amounts are in alignment.

Loan Underwriters

Even though the mortgage is a type of loan, there are underwriters for other types of loans as well—for example, auto loans, student loans, and more. Moreover, banks, both small and big, use the services of the underwriters to ascertain the risk of giving a loan. Also, the need for underwriters is not just when giving a loan to an individual but also while lending money to businesses.

Insurance Underwriters

Another common type of underwriter is an insurance underwriter. An insurance underwriter determines how risky the party seeking the insurance is. There are specialized underwriters for each type of insurance, such as auto insurance, life insurance, health insurance, etc. Along with determining the risk level, the insurance underwriter also has to ascertain if the applicant qualifies for a policy or how much cover is applicable. Insurance underwriters also review the coverage given to the existing policyholders to decide if the same coverage should continue or not.

Debt Security Underwriters

Such underwriters buy debt securities, including municipal bonds, government bonds, corporate bonds, and preference shares from the issuer. They then sell those debt securities to make a profit, or “underwriting spread.” Such underwriters may sell these financial instruments in the open market or to the agents, who then resell them to the end buyers.

Securities or Equities Underwriters

Such an underwriter is very different from other types of underwriters. These underwriters are usually involved with the IPO (initial public offerings) process of a company. Securities or Equities Underwriters, which are primarily investment banks, enter into an agreement with the company to ensure that the public subscribes to the shares that a company issues.

Basically, they guarantee the sale of a certain minimum amount of shares by the public. If the public fails to subscribe to that amount of shares, then the underwriter takes up the balance shares. For this, the underwriter charges a commission.

Along with the guarantee thing, these underwriters also closely work with the company to ensure that they meet all the regulatory requirements, determine the price of the share, promote the securities, sell the securities, and more.

Usually, there are two types of securities underwriters – Institutional underwriters, which are specialized financial institutions, and Non-Institutional underwriters, which are mainly brokers.

On Basis of Risk

We can further classify securities and equities underwriters on the basis of the risk they assume. Usually, there is more than one underwriter handling the IPO (initial public offerings), and they are:

Lead Underwriter

It is a financial institution or an investment bank that has the primary responsibility for managing the IPO. Or, if an offering is large, then a group of underwriters comes together to handle all the things. The underwriter leading this group is the lead underwriter. In case the offering is small, and only one financial institution gets the responsibility to handle the IPO. Then that underwriter is the lead underwriter.

Co-managers or Co-underwriters

In case of a big offering, all other underwriters apart from the lead underwriter are co-underwriters or co-managers.

RELATED POSTS

- Loan Underwriters: Meaning, Factors useful for the process, licensing and More

- Mortgage Underwriters: Meaning, Useful Factors, Outcomes and More

- Underwriting Syndicate

- Types of Investment Banking Services

- Financial Intermediaries – Meaning, Functions And Importance

- Types of Financial Institutions – All You Need to Know