Loan Underwriters: Meaning

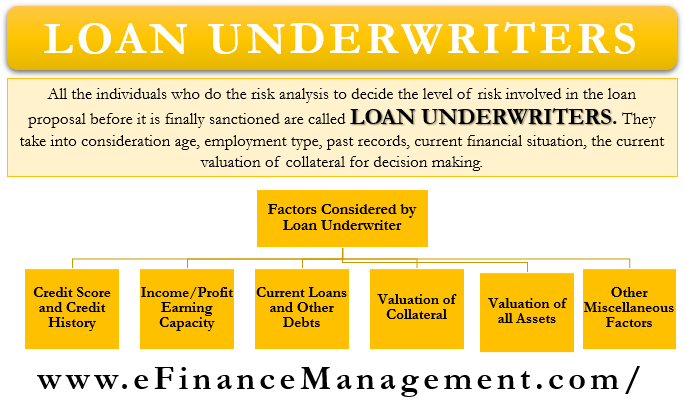

Each loan, whether for an individual or a business, goes through a rigorous process of analysis to see and estimate the extent of risk involved in the loan proposal before it is finally sanctioned. All those individuals who do this analysis to decide the level of risk are known as Loan Underwriters. And their main objective is to see that the business/individual meets the loan sanctioning criteria of the lender. Loan Underwriters, by taking into consideration age, employment type, past records, current financial situation, the current valuation of collateral (in case of a secured loan), etc., decides whether to sanction a loan or not. If the loan applicant does not meet the given criteria, the Underwriter has the full right to decline the loan. In short, these underwriters have to make sure and convince themselves that there are fewer defaults by both the business sector and the personal (individual) sector.

This analysis of risk is the Underwriting Process. Loan Underwriters use various electronic tools while conducting the Underwriting process. They also examine a lot of documents for thorough scrutiny of the proposal to determine and form their opinion. Loan Underwriters analyze various types of personal loans and business loans like car loans, travel loans, renovation loans, education loans, term loans, working capital loans, etc. Though Mortgage loans are part of lending, special Mortgage Underwriters are assigned for them by giving them a special category.

The Loan Underwriters should ensure that the lending company gets enough Return on Investment (ROI) from the lending. The loan applicant should be sound enough to repay back to the Lending Company. Loan Underwriters should check both willingness and ability of the loan applicant to repay back the loan timely.

Factors used for Loan Underwriters

Loan Underwriters take into account a lot of factors before sanctioning the loan. The key factors are as follows:-

Credit Score and Credit History

A credit score is the most important factor in the underwriting process. In the case of personal loans, an analysis of personal credit scores takes place. While in the case of business loans, analysis of business credit scores takes place. The Credit Score gives an indication of the creditworthiness of the applicant. This score is derived based on the past history of loan payments of the applicant.

Along with Credit Scores, a lot of credit history digging also occurs. All those businesses and individuals who have earlier defaulted over the principal or interest repayments struggle a lot for loan sanctions. The reason for the default is tried to establish whether it was willful or circumstantial.

At this stage, the Underwriters also tries to understand the nature and payment pattern of the applicant. Few applicants have a nature to indulge in practices of late payments every time. All these things create a negative impression. If enough pieces of evidence are not provided for such practices, then the Loan Underwriter may ask for additional details and pieces of evidence. And if those pieces of evidence are not proper or not available, then the underwriter might cancel the loan proposal.

Income/Profit Earning Capacity

The next important thing Loan Underwriters consider is the financial stability of the business or of an individual. In the case of Business, analysis of the ‘type of business’ and ‘production capacity’ takes place along with the current profitability and industry outlook. Individuals availing for loans have to show their source of income, the number of earning family members, occupation, etc. Occupation also stands important here, a salaried person has more preference than an entrepreneur/businessman. These lending companies fix a certain income/profit limit for loan approval. The Underwriters need to check whether the loan applicant is financially stable enough to repay the EMIs (Equated Monthly Installments) timely.

At this stage, they can also analyze various bank statements of the applicants for a better and more accurate process. They can also initiate a proper Debt-Income ratio to understand the Income stability of the applicant. And all this is to establish and confirm the loan repayment capabilities of the borrower. Moreover, this process of capacity judgment applies to all loan proposals, be it personal or business loans.

Also Read: Types of Underwriters – All You Need To Know

Current Loans and Other Debts

If the business or an individual already has a lot of debt commitment, it becomes difficult to repay all of them simultaneously on a continuous basis by setting a priority. As a result, at this stage, the Loan Underwriters make sure that the loan applicant is not having too much of debt obligations. And if there are a lot of Debt commitments, there should also be enough sources of funds.

Valuation of Collateral

In the case of a secured loan, which is backed by an asset, it is very important to compute the current market price (CMP) of the asset. The Loan Underwriter has to see; that the value of the collateral asset is in synchronization with the loan amount, i.e., either it should be the same or higher. Even in the case of unsecured loans, the loan applicant has to show enough asset backing to show financial soundness.

Valuation of all Assets

The Loan Underwriters also do a valuation for all fixed assets and financial assets shown by the applicant. These lending companies have a direct right over the collateral assets at the time of default. Rest all assets have an indirect right. As a result, the valuation of those assets becomes necessary to check that the value of security in the proposal is not lower but rather more than the loan amount. And in the case of multiple loans, the total asset value is more than all the loan liabilities put together.

Miscellaneous Factors

There are also other factors taken under the Underwriting process like age, residential status, how old the house property is, the disposal of the loan amount, permanent address and current address, etc.

Sometimes these Loan Underwriters, along with the electronics tools, also use some external experts (verification agencies, valuers) to help accurately conduct the Underwriting process.

Licensing of Loan Underwriters

It is mandatory for all the Loan Underwriters to have a valid license under the SAFE Act of the U.S. Department of Housing and Urban Development. Moreover, for continuing to the business or practice, they need to regularly renew these licenses timely. The award of this license takes place on the successful completion of the course syllabus and exams. Before issuing the final license, a background check takes place. As a result, this license gives authenticity to the functioning of the Loan Underwriter.

Conclusion

Loan Underwriters have a very important role in the process of sanctioning the loan. They have full decision-making power over whether or not to sanction a loan. They are licensed Experts whose primary role is ensuring the lending company makes profits by avoiding the probability of defaults. The only limitation of this process is if the underwriter does not do his job properly or sanctions a loan with a higher level of risk, etc.

Read more about various other Types of Underwriters.