Financial Institutions are the backbone of any economy. These are the institutions that facilitate all financial transactions in a country. Basically, these institutions carry out a broad range of financial activities, including giving loans, accepting deposits, facilitating investment, and more. Moreover, they help to connect an individual with the nation’s financial system and financial resources. Thus, almost every individual deals with one or more types of financial institutions on a regular basis.

Some financial institutions offer services to the general public, but some deal only with specific clients or with other financial institutions. Thus, to know which financial institution (or institutions) can meet your specific need, it is important to know about all the types of financial institutions.

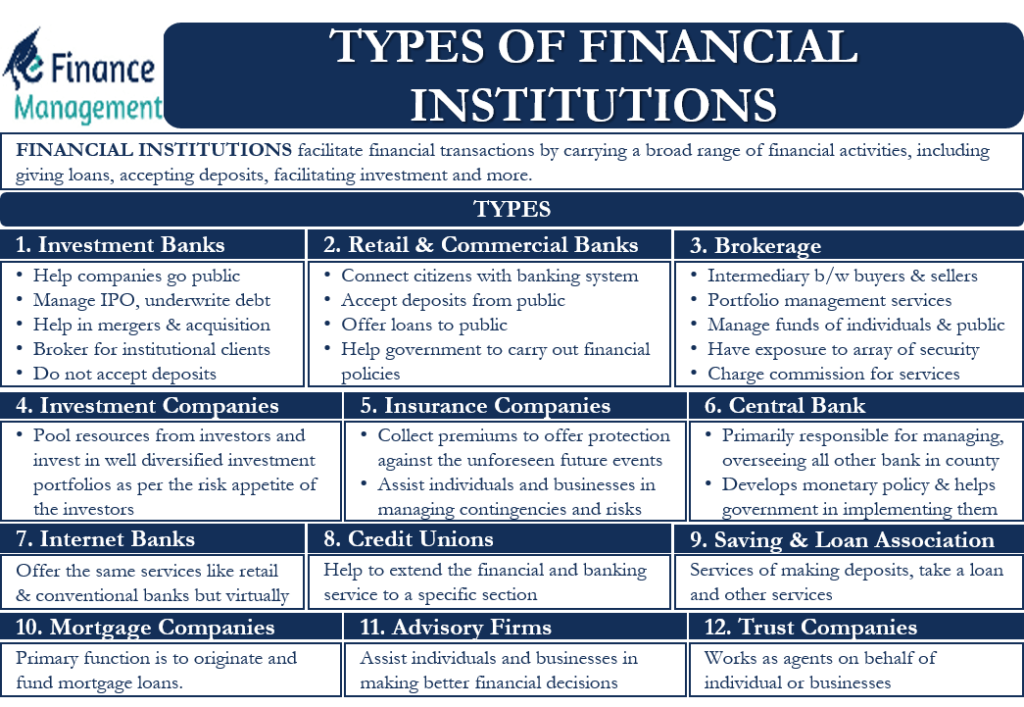

Types of Financial Institutions

There are twelve major types of financial institutions that usually cover all the financial companies in a country. Following are the major types of financial institutions:

Investment Banks

These are the institutions that offer a range of financial services to companies, agencies, other institutions, as well as governments. One of their most popular services is helping companies go public or manage their IPOs (initial public offerings). Their other services include underwriting debt, helping with mergers and acquisitions, broker for institutional clients, and more. A point to note is that investment banks do not generally accept deposits.

Retail and Commercial Banks

They are the most crucial part of any economy as they connect citizens with the banking or financial system. Retail and Commercial banks accept deposits from the public, as well as offer loans. These banks primarily earn revenue from the interest on loans they offer to their customers. These banks work with individuals, as well as with businesses. Moreover, these banks also help the government to carry out its financial policies.

Brokerages

These companies act as a financial intermediary between the buyers and sellers of securities. Generally, a brokerage company will offer portfolio management services and manages funds of the individuals and the public at large, execute the trade on behalf of clients, give investment advice, and more such services. Such companies have exposure to an array of securities, including shares, mutual funds, bonds, options, and more. Brokerage companies charge a commission or fee for their services.

Investment Companies

These are the corporations or trusts that facilitate people seeking professional management and diversification. These companies pool the resources from investors and then invest in a well-diversified investment portfolio as per the risk appetite of the investors and/or specific objectives of the scheme. Professionally experienced managers manage these. Apart from traditional investment companies, the advent of the internet has given rise to a new breed of investment company – Robo-advisors. Such companies use mobile technology to offer investment services to a larger audience base, and that too at a very less cost.

Insurance Companies

These companies collect premiums from people and companies to offer them protection against unforeseen future events, including fire, car accidents, death, disability, disease, and more. Primarily, insurance companies assist individuals and businesses in managing contingencies and risks. Almost every individual and business avail of one or more kinds of insurance. Different types of insurance products are life insurance, health insurance, property-casualty insurance, and more. One insurance company can offer one or more kinds of insurance products.

Also Read: Types of Investment Banks

Central Bank

It is undoubtedly the most important type of financial institution in an economy. A central bank is primarily responsible for managing and overseeing all other banks in the county. Moreover, it is the central bank that develops monetary policy and helps the government in implementing its financial policies. A central bank does not deal with the general public. However, it does remain the banker for the Government. The Federal Reserve Bank is the central bank in the U.S.

Internet Banks

These are relatively newer types of financial institutions. Such banks offer the same services like retail and conventional banks. But, unlike the brick-and-mortar structures of conventional banks, internet banks have a virtual presence. There are two categories of internet banks – Digital and Neo-banks. Digital banks are affiliates of traditional banks but are online-only platforms. Neo-banks, on the other hand, are pure digital native banks that do not have an affiliation with any other bank.

Credit Unions

Such institutions help to extend financial and banking services to a specific section of society, such as teachers, military personnel, and more. These institutions work similarly to retail banks but offer relatively fewer services. Mostly, these institutions are owned and managed by the members of the respective demographic. Thus, credit unions operate only for the benefit of their members.

Savings and Loan Associations

These institutions are held mutually and depend upon collaborative efforts to achieve their financial objectives. Moreover, individuals can also use the services of these institutions to make deposits, take a loan, and avail of other services.

Mortgage Companies

The primary function of these institutions is to originate and fund mortgage loans. Most mortgage firms offer services to the individual consumer market. But, there can also be mortgage companies that serve clients with real estate transactions only, individual and organizations both.

Advisory Firms

These companies include experienced financial advisors. Such companies assist individuals and businesses in making better financial decisions. The financial advisors analyze their clients’ risk level and financial objectives to recommend to them the best assets to invest in as also to avoid and manage risks. Moreover, they continuously monitor their clients’ investment performance and offer correction, if necessary.

Trust Companies

These are legal entities that work as agents on behalf of an individual or business. Trust companies mainly help with the management and transfer of assets. Other services they provide are wealth management, brokerage services, real estate planning, inheritances, and asset management services on behalf of their clients. These companies charge fees depending upon the size of their trust.

Final Words

Using the services of financial institutions is the best way to invest your hard-earned money and earn attractive returns on it. This, in turn, helps in the growth of the economy. However, some financial institutions carry some degree of risk. Thus, it is important that customers carefully understand the financial institution (or institutions) to whom they will be handing over their money, depending upon their past credentials and objectives.

Frequently Asked Questions (FAQs)

1. Facilitate all financial transactions in a country

2. Provide loans

3. Accept deposits

4. Facilitate investments

5. Helps to connect individuals with the nation’s financial system and financial resources.

6. Some financial institutions offer services to the general public, while some deal only with specific clients or with other financial institutions.

These institutions offer a range of financial services to companies, agencies, other institutions, and governments.

Primarily, insurance companies assist individuals and businesses in managing contingencies and risks.