Insurance Underwriters: Meaning

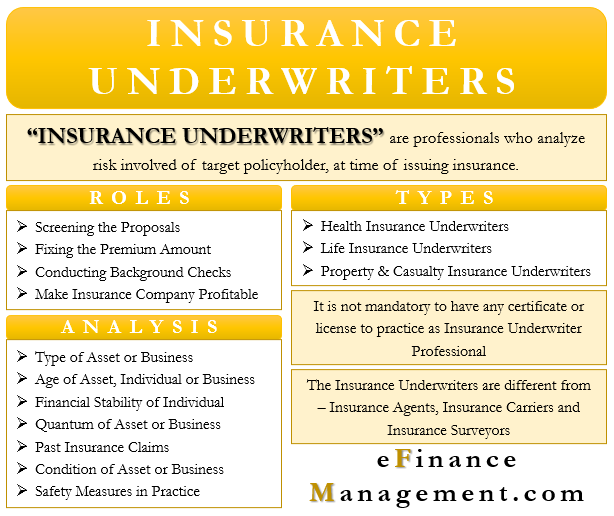

Insurance Underwriters are the ones analyzing the risk involved of the target policyholder at the time of issuing the insurance. As Insurance covers the risk, it is very important to first calculate the risk of the target insured. And these underwriters continuously calculate the risks of the people or assets. Moreover, they have to decide how much Insurance cover has to be given with the given level of risk.

In other words, insurance underwriters are professionals who use actuarial data, statistics, and various software for performing the underwriting process by calculating the risk. And on the basis of the coverage of risks, the determination of the amount of premium takes place. Moreover, underwriting by these Underwriters takes place at the time of issuing a new policy, renewal, or on a continuous basis.

- Insurance Underwriters: Meaning

- Major Roles/Responsibilities of Insurance Underwriters

- Analysis of Common Factors by the Insurance Underwriters

- Types of Insurance Underwriters

- Is Certification/Licensing compulsory for Insurance Underwriters?

- Insurance Underwriters Vs Agents/Brokers

- Insurance Underwriters Vs Insurance Surveyors

- Insurance Underwriters Vs Insurance Carrier

- Conclusion

The ultimate target of Insurance Underwriters is to boost the profits of the insurer by taking into consideration the risk, premium, and tenure of the policyholder. Therefore, the Underwriter charges higher premiums if the risk is higher. And as there are changes in insurance clauses and changes in risks, the involvement of the Underwriter is seen.

They are specialists who decide the insurance coverage after analyzing the risk factor with the help of a special skill set and computer software.

Major Roles/Responsibilities of Insurance Underwriters

Screening the Proposal

Firstly, the Insurance Underwriter will completely analyze and do a screening of the proposal. And the Underwriter, after analyzing the proposal, has to decide on the issuance or otherwise of the policy or with what extra clauses to include.

Also Read: Types of Underwriters – All You Need To Know

Fixing Premium

The next role after analyzing the proposal is to come up with a premium amount for the policyholder. The decision of premium and quantum depends upon the total anticipated risk. Here the Underwriter uses many statistical and actuary tools to come up with a premium amount after considering all factors.

Background Checks

At this stage, the Underwriter collects additional information to come up with the exact level and quantum of risk. Here Information can be taken from external parties like doctors, banks, asset manufacturing companies, etc. Therefore, at times, the history of claims, events, and status of family members are also evaluated for the purpose.

Make Insurance Company Profitable

At this stage, the Underwriter has to come up with the best possible insurance coverage regulations and premium rates with the given level of risk. Here at times, the Underwriter sanctions the insurance proposal with a lot of coverage limitations if there exist higher risks. The idea is to mitigate the risk for the insurance company to the maximum extent. Thereby ensuring that any such risk does not eat into the business profits of the insurance company.

Analysis of Common Factors by the Insurance Underwriters

- Type of Asset or Whole Business

- Age of Asset, Individual or Whole Business

- Financial Stability of an Individual

- Quantum of Whole Business/Asset

- Past insurance claims

- Condition of Asset/ Whole Business

- Safety Measures in practice

The above-mentioned factors are not exhaustive in nature. Apart from this, there are many other things that are looked at for analysis; these are basic factors. According to the type of Insurance, these factors modify and change on a case-to-case basis.

Types of Insurance Underwriters

There are majorly three types of Insurance Underwriters; they are as follows:-

- Health Insurance Underwriters

- Life Insurance Underwriters – Simplified Issue Underwriting & Fully Underwritten

- Property and Casualty Insurance Underwriters

Mostly, all types of Underwriters do the same thing; the difference exists in the level of risk analysis, paperwork, and usage of actuary tools.

Let’s understand this with an example.

In the case of Car Insurance, the calculation of coverage becomes easy. Completely opposite is in the case of Life Insurance; many things are taken into account for coverage calculation. In some types of Insurance Underwriting, only statistical tools are enough. In some complex situations, a lot of Background check along with statistical tools may be the need for the case.

The underwriting process of Life Insurance can be done in two different ways. And the choice of the underwriting method depends on the type of Life Insurance subscribed. Moreover, the Underwriter’s responsibility also slightly changes according to the type of Insurance.

Is Certification/Licensing compulsory for Insurance Underwriters?

It is not compulsory to avail of a particular certificate or license for practicing Insurance Underwriting as a profession. This certification shows the level of skills and knowledge with the Underwriter. An Authorized certification under the name ‘Associate in Underwriting (AU)’ is issued by the Insurance Institute of America. This is a valid certificate for the job of Underwriter.

Insurance Underwriters Vs Agents/Brokers

At times Insurance Agents/Broker and Insurance Underwriters are considered as same. However, both these are quite different, and all have completely separate work profiles. The main differences are as follows:-

| Insurance Underwriters | Insurance Agents/Brokers |

|---|---|

| Decides whether to issue the policy or not. | Sells Insurance policies to the companies and individuals after the approval of the Underwriter. |

| There is no direct interaction with the policyholders. | They directly interact with the final policyholder. |

| They have decision-making authority. | These people don’t have any decision-making authority. |

| They work closely with Insurance companies. | They work closely with both the Insuring company and the target customer. |

| The main target of Insurance Underwriters is to make Insurance companies profitable. | The main target of Insurance Agents is to satisfy customer needs. And arrange business for the insurance company and self. |

| An Underwriter fixes the premium. | Agents/Brokers have no control over the fixing process of premium. |

| There is a high requirement for knowledge and skillsets. | A very routine level of knowledge and skillsets are required. |

Insurance Underwriters Vs Insurance Surveyors

The other major misconception is between Insurance Surveyors and Underwriters. At the time of insurance claims, Insurance Surveyors are contacted. At the time of issuing a policy, Underwriters come into the picture.

The main role of Surveyors is to identify the cause/s of the claim and calculate the amount of incurrence of loss. The main role of an Insurance Underwriter is to calculate risk. Surveyors calculate the amount of claim settlement, and the Underwriters calculate the premium rate and coverage regulations.

Insurance Underwriters Vs Insurance Carrier

Insurance Carriers are Insurance companies or Insurers who have involvement in the Insurance business. They are the ones under whose name issuance of Insurance policies takes place. Insurance Underwriters work for Insurance Carrier. Such Carriers employ Agents, Underwriters, Surveyors, etc. It concludes that the Insurance carrier gives employment to the rest of all involving parties.

Conclusion

To conclude, Insurance Underwriting is a foundation for the Insurance industry. Insurance Underwriters are popular amongst all other Types of Underwriters. Most importantly, they play a vital role in making the Insurer and the insurance business profitable. It is necessary that they should perform assessing the risk of the policyholder with utmost diligence. Ignorance of the slightest information can be an expensive deal for the Insurance company. An Insurance Underwriter should use their knowledge and skills, statistical and actuarial tools, and external parties’ information to efficiently and effectively analyze the risk factor.

RELATED POSTS

- Loan Underwriters: Meaning, Factors useful for the process, licensing and More

- Mortgage Underwriters: Meaning, Useful Factors, Outcomes and More

- Underwriting Syndicate

- Adverse Selection – Meaning, Drawbacks and More

- Bancassurance – Meaning, Advantages, Challenges, and More

- Carriage and Insurance Paid To – Meaning, Obligations, and More