What do we mean by a Promissory Note and a Loan Agreement?

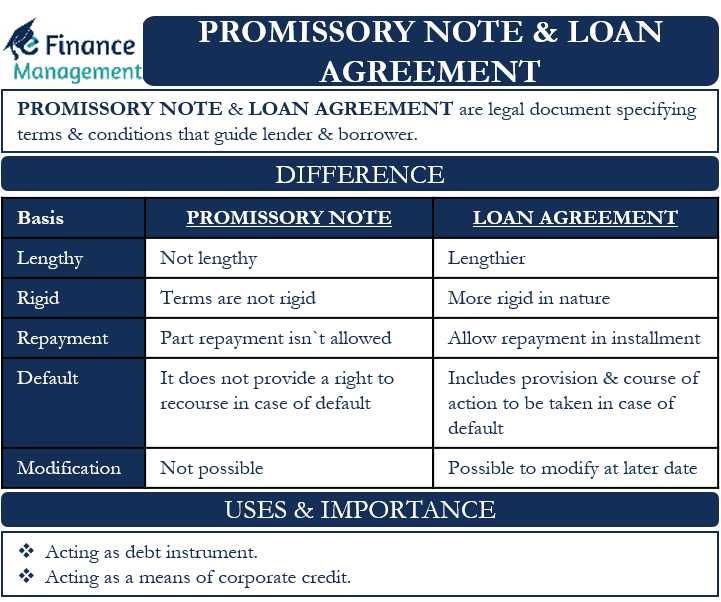

A Promissory Note is a legally binding financial document for the repayment of a loan amount by the issuer to the lender. He is also known as the payee. He receives the loan back after a pre-determined term or on-demand. Both parties can agree on certain conditions to be observed at the time the promissory note is issued. A loan agreement is also a legal document that specifies the terms governing a loan between a lender and a borrower. Loan agreements are more rigid and lengthy than promissory notes.

Loan agreements specify in detail the consequences and legal recourse that a lender can take in the event of default by the borrower. Also, it would determine the lender’s course of action in the event that the borrower deviates from the terms of the contract.

Financial institutions, companies, banks, and even individuals issue these types of instruments. In both cases, the common inclusions are the principal amount, due date, and, if applicable, specific repayment terms, the interest rate, details of the lender and the recipient, their signatures, etc. A promissory note is generally not secured against assets. While a loan agreement generally provides security. It includes the rights of the payee if the maker of the instrument defaults on repayment. It may also include foreclosure rights or the acquisition of the assets of the maker of the instrument.

What are the main differences between a Promissory Note and a Loan Agreement?

Rigid and lengthy

A loan agreement is more lengthy than a promissory note. It contains every single provision of the loan in detail. In addition, it is rigid in nature. Changes or modifications cannot easily be made by the parties concerned.

Repayment

There can be a big difference in the repayment of a loan in both agreements. Loan agreements allow the repayment of a loan in parts or installments. This may not be the case with promissory notes.

Detailing with regards to default in case of a promissory note and a loan agreement

A loan agreement contains provisions and a course of action to be taken by the payee in the event of default on a loan by the maker of the instrument. It can allow the payee to foreclose the asset mentioned as security under the loan contract. This is generally not the case with promissory notes. Therefore, a promissory note does not offer a right of recourse.

Modifications in a promissory note and a loan agreement

By mutual agreement of all parties, amendments to the original contract are possible, namely by means of an amendment agreement. However, this is generally not the case with promissory notes. Once it is made, changes are not possible.

Uses and importance of a Promissory Note

As debt instruments

Promissory notes act as debt instruments and allow an individual or a company to get finance or a loan without having to follow the rigorous procedures of a bank. Therefore, they are an effective means of obtaining finance if the payee is willing to grant the loan.

Also Read: Notes Payable

Acting as a means of corporate credit

Promissory notes can be very useful when a company has exhausted its credit line with a supplier. It can issue a promissory note to its supplier in which it promises to repay the additionally delivered goods within a set timeframe. It can repay the goods as soon as it has received its outstanding payments from its debtors. Thus, there will be no effect on its supply chain and no loss of orders, customers, and reputation.

Promissory notes in case of student loans

Promissory notes can also come into play when a student takes a loan, particularly from private lenders and institutions, to fund their education. Such notes will include the size of the loan, details of the educational institution and the student’s employment, personal contact details, repayment period, interest amount, etc.

Take-back mortgage promissory notes

Promissory notes are helpful in the purchase of a house for the borrower too. The seller of the house may provide a mortgage arrangement on the house he sells. The buyer signs a promissory note confirming the debt and giving the interest details and repayment plan. In this way, it helps the buyer buy a house without dealing with the rigid formalities of bank financing.

Uses and importance of a Loan Agreement

A loan agreement is much more than a simple promissory note. And a loan agreement usually fulfills and covers all the functionality expected of a promissory note. The main advantage of a loan agreement over a promissory note is that it provides a right of recourse. The contract is legally binding, and thus the lender has the option of knocking on the door of the law in the event of default to reclaim his money.

The payee can also foreclose the asset the borrower provides as collateral if the issuer does not meet the conditions of the contract. Therefore, the payee has the assurance that his loan amount will be repaid, or he can take over the asset and not lose his money.