When we talk about investments, we never think about whether we are dealing with economic or financial investments. In the absence of this clarity, the two terms are often used interchangeably. Most often, when people talk about investments, they most likely refer to financial investments. Although both investments help companies to generate more profits and improve their supply, the two terms are very different. To understand the two terms clearly, we need to understand the difference between Economic Investment vs Financial Investment.

Economic Investment

This investment refers to the money spent on the purchase of new or replacing the capital assets of a company. The capital assets here are all things necessary for the production of goods or services. A few examples of such investments are retail stores, factories, equipment and much more. Investments in raw materials will also fall under economic investments.

Apart from this, such investment also includes adding more workforce to improve the earnings of a company. Moreover, human capital is also a part of this investment. For example, if a company hires a sales manager, it is an economic investment, because it would allow the company to expand its business.

However, there is no guarantee that such an investment will deliver the results that a company expects, and we can say that the ultimate goal of such an investment is to improve the productivity of the company.

Financial Investment

Financial investment is a much broader concept, and we can say that economic investment is a part of it. This type of investment involves the purchase of an asset with the goal of financial gain. This investment could be made in the new asset or in any old assets.

A company makes a financial investment in assets that it expects to make a profit on for a number of years. This investment could be in financial assets, including stocks, bonds, and more, or in tangible assets such as land, buildings, machinery, and more.

Economic Investment vs. Financial Investment – Differences

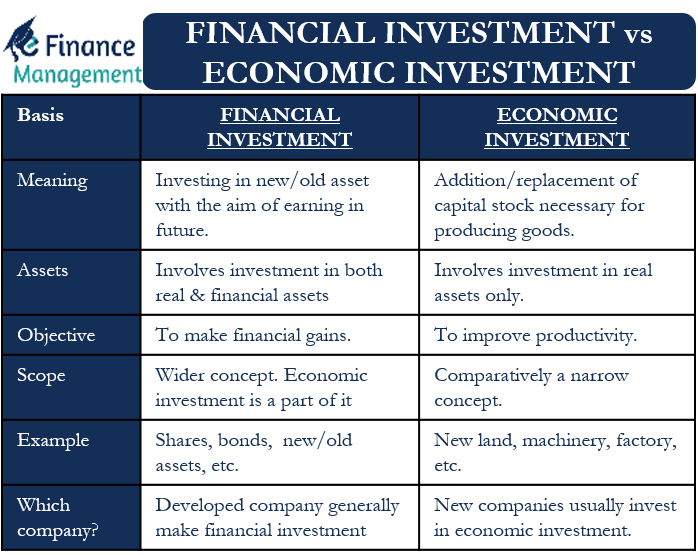

Now that we know what economic and financial investment is, let’s take a look at the main differences:

Meaning

Economic investment is the complement or replacement of the organization’s share capital/assets. Financial investment, on the other hand, means investment in new or old assets.

Assets

Economic investments only include investments in real assets. Financial investments, on the other hand, include investments in both real and financial assets.

Objective

The goal of economic investment is to improve a company’s productivity and production efficiency, whereas the purpose of financial investment is to generate or increase financial profit.

Also Read: Types of Equity Investments

Broader Concept

Financial investment is a much bigger concept. Economic investment is a part of financial investment. In general, when we talk about investment, we are talking more about financial investment.

Example

The purchase of new land, factories, machinery and more are examples of economic investment. The purchase of shares, bonds, new or old land and more are examples of financial investment.

Which Company?

Normally, a developed company makes financial investments rather than just economic investments. Or, say, a company decides to make financial investments as soon as it has enough capital or cash at its disposal. Or, if a company is able to stabilize its growth, it would be able to invest in financial assets or make financial investments.

Economic Investment vs. Financial Investment – Importance

Both types of investment help a company grow and maintain stability. However, both offer a different form of stability. Usually, a company starts with an economic investment, and when it grows, it begins to make a financial investment.

An example on an individual level gives us more clarity about this aspect. When a person starts a career, their goal is to earn enough money to buy a home. As soon as they climb the corporate ladder and buy a home, they buy a car and start saving and investing. In this case, buying a home is an economic investment, and buying a car, savings and investments fall under financial investment. We can say that a person through a financial investment tries to buy protection, security, and stability against an uncertain future.

Both economic and financial investments are interdependent to a certain extent. Thus, for example, a company can use the dividend or income from financial investments for economic investment. Similarly, the benefits from economic investments help a company to make more profit, and the company could use that profit for financial investments.

It would not be wrong to say that it can be very difficult for a company to grow beyond a certain point if it only makes economic investments.

Drawbacks

A major disadvantage of both investments is that there is no guarantee that the investments will pay off. Managers are aware of this disadvantage, but the chances of success are higher in the investments that yield neutral or negative results.

Another major disadvantage of economic and financial investments is that their failure could directly impact the profitability of the company. If, for example, a company buys a share capital, it can also hire more employees to manage the new share capital. Furthermore, the company could hire additional sales staff to sell more products because it produces more due t the new share capital. If the company cannot sell more products now, it would have a significant impact on profitability.

Final Words

If a company is to survive in the long term, it is imperative to make both types of investment. Although the types of investment are to some extent interdependent, they are also different. Before making any of the two investments, a company must conduct an appropriate cost-benefit analysis to ensure that it achieves an appropriate potential return.