What are Junk Bonds?

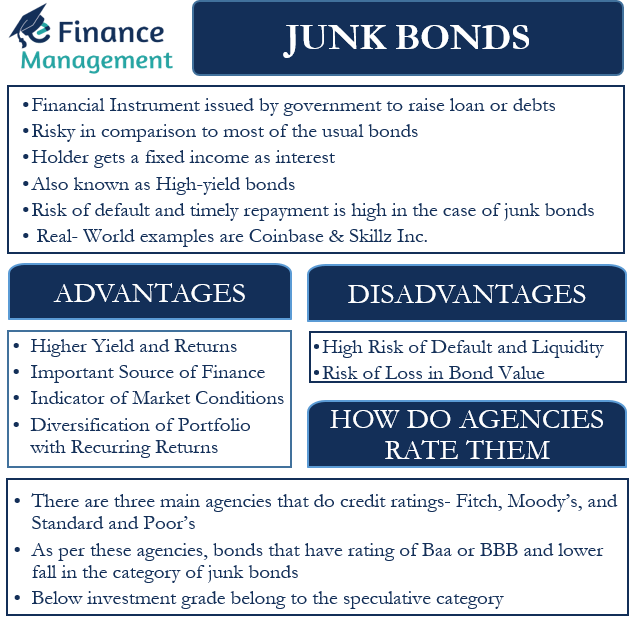

Bonds are financial instruments that governments and corporations issue to raise a loan or debt. They are fixed-income instruments, meaning that the owner or holder of the bond usually gets a fixed income as interest. The interest payment, along with a portion of the principal amount, usually takes place annually. Of course, there may be exceptions to it as per the terms of the contract. Bonds come with a rating by credit-rating agencies according to their risk of default and repayment. This assists the investors in choosing the right bond as per their risk appetite. Junk bonds are the bonds that come with a high risk of default and the poorest of poor ratings. However, they promise to pay high yields or interest to the holder or creditor to offset the risk of default. Hence, we call them as high-yield bonds.

Risk of Default Very High

Junk bonds are very risky in comparison to most of the usual bonds. Companies that are already highly leveraged or those which are finding it hard to raise finance from other sources often take the route of issuing junk bonds. Start-ups, too, may take the route of raising funds through junk bonds. Such companies may sometimes find it tough to even service their coupon commitments later on. Also, they may find it difficult to repay the principal amount or may do so in a delayed way. Thus, the risk of default and timely repayment of the principal amount always remains very high for such junk bonds. They fail to get an investment-grade credit rating.

On the positive side, these bonds are of high yield and pay a higher coupon rate than the usual bonds. Also, they may be issued at a discount to their par- value, giving further benefits or gains to the holder. Therefore, it remains attractive for risk-taking investors looking for a substantially higher return if it turns positive.

How do Agencies Rate Junk Bonds?

Several agencies rate bonds in the market as per their quality, chances of default, and ability to meet financial obligations in case of withdrawals. Fitch, Moody’s, and Standard and Poor’s are the three most popular rating agencies. As per these agencies, bonds with a rating of Baa or BBB and lower fall in the category of junk bonds. This means they are below investment grade and are in the speculative category. If the condition of the issuer worsens, they may downgrade it to a “C” rating. It will mean that there is a high default risk with the bond. If the bond actually defaults in payment, they further downgrade the rating to “D.”

What are the Advantages of Junk Bonds?

Junk bonds have a number of advantages. Some of them are as follows:

Higher Yield and Returns

As the saying goes- “With high risk comes high returns.” The yield on a junk bond is higher than most of the other available debt options in the market that pay a fixed return. Often, the issuer of the bond issues them at a discount to their par value too. Thus, the bond purchaser benefits from high coupon payments and the discount at the time of the issue. The issuer happily pays the higher coupon rate and bears the loss from a discount at the time of issue to lure the investors into investing in their junk bonds.

An Important Source of Finance

Junk bonds are an important source of finance for companies that are unable to raise funds from other available sources of credit. These bonds act as a savior to such companies as they get money for funding their day-to-day activities or for their expansion needs. Such bonds are a blessing for start-ups, too, as they do not have enough creditworthiness and goodwill as well as sufficient assets to provide as security to raise finance from banks and other financial corporations.

Indicator of Market Conditions

The demand and the frequent issue of such Junk bonds are good indicators of the market conditions. A high capital inflow in such bonds shows that investors are in an aggressive mood and are willing to undertake high risk. The companies and issuers can take a cue from such a situation. They can launch more aggressive and risky products in the market. On the other hand, in case of very limited capital inflow in such bonds or an outflow of capital from junk bonds will indicate that investors are turning cautious and risk-averse. Companies can accordingly shape their new product offerings and launch them in the market.

Diversification of Portfolio with Recurring Returns

Junk bonds help the investors in the diversification of their portfolios. Also, it has the added advantage of providing recurring and regular returns to the investor in the form of coupon payments. Even risk-averse investors can invest a small percentage of the funds they have allocated for investment in the markets and enjoy high returns.

What are the Disadvantages of Junk Bonds?

High Risk of Default and Liquidity

The biggest disadvantage of a junk bond is that it comes with a high risk of default. The issuer sometimes even fails to pay the due coupon payments. This puts the principal amount of the buyer too at risk. The credit rating of such bonds is very low. In case the economy goes southwards, the issuing company may fail and go bankrupt, wiping off the hard-earned money completely of the investors in these bonds.

Needless to say, these bonds come with a high liquidity risk too. Investors may want to offload their junk bonds in times of urgent need and may be unable to do so at the correct price. Or investors may not be willing to buy those bonds.

Risk of Loss in Bond Value

In times of recession or faltering of the economy, the investors rush towards bonds of better quality and with higher ratings. Such a situation will see a market scenario where there are only sellers of the bonds. The gap in demand and supply of junk bonds will widen, and the prices will fall sharply.

As we discussed, depending upon the market conditions and status of regular interest payments, rating agencies may further downgrade these bonds. Hence, these bonds always carry a risk of a further downgrade if things do not work for the issuer. The company issuing them is usually not in a sound financial position or is new. If the company’s performance further worsens, the rating agencies will immediately downgrade the bond rating. This will compel the company to sell such bonds at a deeper discount from the par value. Thus, the market value of the bond will further go down. And it can be a cause for concern for the existing investors.

What are the Real-World Examples of Junk Bonds?

Junk bonds have seen a steady and consistent rise in demand in the current times. According to JPMorgan Chase & Co., investors are putting in close to $1 billion of funds every week in the US junk bonds even after the Covid variant Omicron scare. Bloomberg index data suggests that junk bonds have gained about 1.3% in value in the current month of December 2021, whereas bonds with much better ratings have gained just 1.1% over the same period. Also, the junk bond sales have crossed all earlier records in the US and have topped $432.4 billion in the year 2021.

Coinbase

Coinbase Global Inc. is a cryptocurrency company and is thought to be in a risky trade because of the volatile nature of cryptocurrencies and the absence of proper regulations. It decided to raise money through the issue of bonds in 2021. Its bond has been rated one step below the investment grade bonds and hence, comes in the category of junk bonds.

They saw a mammoth demand for their bonds. After initially offering $1.5 billion worth of bonds, they raised the offer to $2 billion. In fact, the total orders were estimated to be $7 billion! The yield for the bonds is around 3.5% which is lower than what the company had planned for initially.

Skillz Inc.

The present craze for junk bonds in the US is motivating many companies, including start-ups, to take this route for raising funds. A gaming company named Skillz Inc. is planning to raise $300 million by issuing junk bonds for the first time. It will offer a yield of around 11%. Also, it plans to issue the bond at a discount of 3% from its par value. Thereby making the offer a win-win game for the issuer and the investors of these bonds.

Conclusion

Junk bonds offer high yields but are susceptible to non-payment of coupons and principal amounts. Thus, they should comprise only a small portion of an investor’s portfolio, not exceeding 8%-10%. An investor can even forgo buying such bonds if he is very risk-averse.

If an investor wants to invest in junk bonds, a good way for him is to invest in diverse ETFs, which will invest in a bunch of junk bonds. The returns will not depend upon the performance of just one or two junk bonds. Even if a bond fails, there will be other bonds in the bouquet to preserve the capital of the investor and hence, minimize his risk.

Also, read – All the 21 Types of Bonds.