Junior Debt: Meaning

Junior Debt is a source of finance issued by the company with a lower repayment priority. It is a type of debt issued by the company which gets lesser repayment priority than the senior debt at the time of default. Junior Debt can be in the form of bonds, debentures, or any other debt instrument. Since this debt gets a lower preference in repayment, they are very risky in nature. In comparison to Senior debt (which gets the first priority for repayment at the time of default), Junior Debt gives higher interest rates. The same principle applies here, High Risk- High Returns. The other name of Junior Debt has Subordinated Debt or Mezzanine Debt.

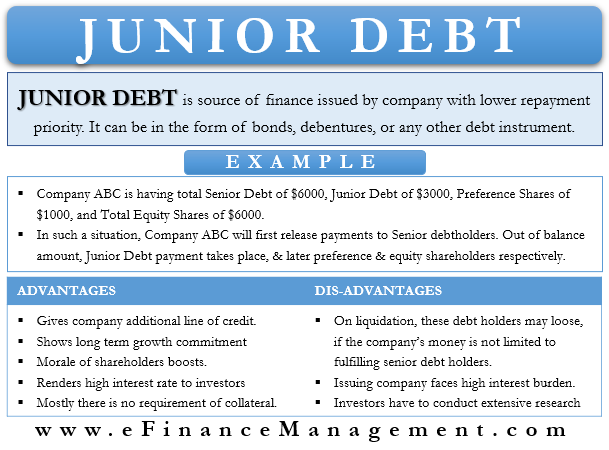

Understanding the term: Junior Debt

Senior Debt is the first-tier debt, and Subordinate Debt is the second-tier debt. Since there is no backing of any collateral security in Junior debt, it renders high-interest rates to the investors. Subordinate debt is a fixed-income security that gives fixed but risky returns to the investors. It is the super risky debt instrument, as, at the time of liquidation or bankruptcy, it gets the least priority of repayment amongst all the debt holders. Repayment Priorities of companies start with the first priority given to Senior debt holders, followed by subordinated debt holders, later preference shareholders, and equity shareholders, respectively. Trading of mezzanine debt takes place in both the secondary market and the primary market.

In the case of risk profile, equity shareholders and junior debt carry almost the same level of risk with no collateral security in place. The company’s long-term growth is beneficial for both stakeholders. Mostly the investors of subordinated debt are internal or near to the company. These investors are generally shareholders of the company or the parent company of the issuing company, or general investors at large, depending on the situation.

Treatment of Junior Debt in Books of Accounts

Recording of Junior Debt takes place in the Balance Sheet on the ‘liabilities side’ under the head Non-current liabilities or long-term liabilities. In the long-term liabilities section, firstly, the recording of senior debt takes place and later subordinate debt. The recording in the Balance Sheet takes place according to the repayment priorities. The funds raised by issuing mezzanine debt enhance the cash balance in the books of account. And if the money is used for buying any asset, then the asset purchase entries happen in the Balance Sheet, and the cash outflow is recorded accordingly.

Advantages of Junior Debt

- It gives the company an additional line of credit when all normal limits and securities are over.

- Having Mezzanine Debt in the company shows the long-term growth commitment of the company.

- The morale of shareholders gets a boost when the company has subordinate debt on its Balance Sheet. It’s a positive sign.

- It renders high-interest rates to the investors, and so it attracts investors.

- Mostly there is no requirement for any collateral security for the issuance of this debt.

- A company with good credibility can only get subscriptions for subordinated debt. Thus subordinated debt in the Balance Sheet shows high credibility.

These advantages are non-exhaustive in nature.

Disadvantages of Junior Debt

- In the case of liquidation, the mezzanine debt holders can lose all of their money if all the resources of the company get extinct after the repayment to senior debt holders.

- The issuing company also faces a lot of high-interest rate burden due to the mezzanine debt.

- Investors must conduct extensive research on the company’s resources before investing in it. This takes a lot of investors’ time.

These disadvantages are non-exhaustive in nature.

Example

Let’s understand this with an example:-

Company ABC is having a total Senior Debt of $6000, Junior Debt of $3000, Preference Shares of $1000, and Total Equity Shares of $6000. Let’s say the company has undergone liquidation due to some reason, and the total cash after disposing of all resources is $16000.

In such a situation, Company ABC will first release payments to the Senior debtholders of the company. Out of the balance amount of $10000 ($16000 – $6000), payment of Junior Debt holder takes place, and later the preference shareholders and equity shareholders respectively.

Conclusion

Junior Debt has always been an important source of finance for companies, irrespective of all its limitations. When the closing of all sources of senior debts takes place, the credit line of junior debt opens. It is an investment instrument that gives the investor high fixed returns. It not only provides finances to the issuing company but also enhances the shareholder’s confidence in the company. Junior Debt helps the company in long-term growth and diversification, thereby boosting profitability. The only thing the investor has to consider before investing in the company’s credibility. The company should have enough resources to pay back all the senior and subordinated debt holders of the company in case of liquidation or bankruptcy.

Read Senior Debt vs Junior Debt to learn how it is different from senior debt.