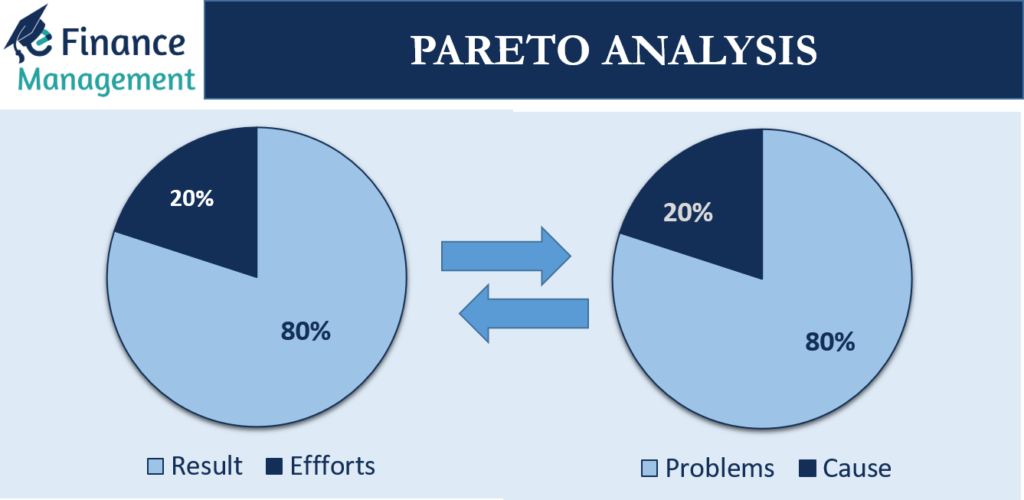

Pareto analysis is a strategic option. Firms use Pareto analysis for decision-making. It is a logical approach to understanding the problem. It says that 80% of problems result from 20% of causes. In another format, we can also say 80% of success is due to 20% of the work done for the project.

The Italian Economist Vilfredo Pareto propounded this Pareto Principle in the year 1906. While researching the property holding pattern, he noticed that 80% of the property in Italy was owned by 20% of the population. Wealthy individuals constitute the 20% bracket of landowners. This helps us understand the concept of unequal distribution of wealth. In many developing countries, 80% of the income of a country is contributed by 20% of the population.

Later on, an American Engineer and management consultant, Joseph M. Juran, surveyed other countries and noticed a similar trend. To his surprise, this was a common observation in his findings. He went ahead and named it ‘Pareto’s principle of unequal distribution.’

In the modern world, Pareto analysis is also applicable in various types of business. It is a high-quality decision-making tool that scores the problems or parameters. The parameter with the highest score is of the highest value to the firm.

Pareto Principles Application

Various fields use Pareto analysis, be it any business. However, the most popular application is quality control. For example, 80% of the delays are caused by 20% of the causes. 20% of the raw materials are responsible for 80% of the quality of the product. 80% of the product’s cost comes from 20% of the cost of raw materials. And the list goes on.

Steps of Pareto Analysis

There are five main steps for this analysis:

- The first step is to list down the problems affecting the business. A few common problems include customer complaints about product defects, delivery systems, etc.

- The second step is to identify different causes that are the root cause of the problems identified.

- The third step begins with scoring each problem according to its impact. The higher the score a problem carries, it will get, the higher its weight in the damage list.

- The fourth step is to group similar types of problems. It is about segregating issues according to their nature or form. For example, customer complaints regarding delivery and product defects are two different groups of problems.

- The fifth step is creating an action plan and devising a plan on how to solve such problems efficiently, smoothly, and quickly.

The Pareto analysis highlights issues that have a major impact on the business and are worth putting effort into. Minor issues can be managed for the time being, but identifying and solving the major issues is what creates huge value. And that is the focus and a priority area for the top management.

Pareto Charts

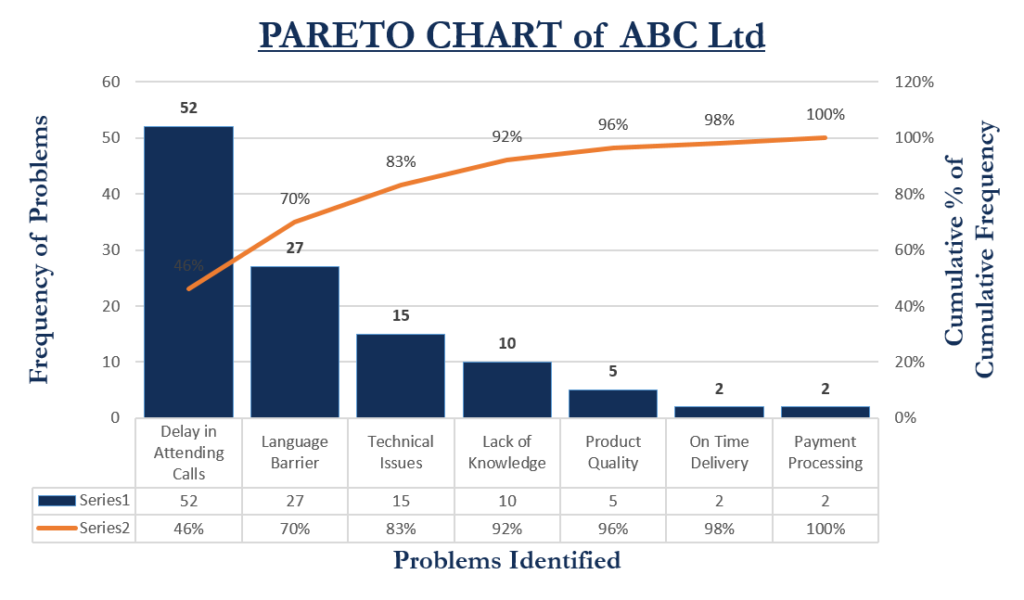

Pareto charts indicate the frequency of problems and the cumulative impact of the problems on the organization. To draw a Pareto chart, a mixed chart is used -A bar chart and a line graph.

The Y-axis of the Pareto Chart indicates the ‘frequency of the identified problems, and the X-axis represents the problems or issues. For example, Customer servicing is an issue, and the frequency of the occurrence of the problem is 25. The bars are in descending order; that is, the problem with the highest frequency is first, and so on.

The line graph on the charts shows the percentage of cumulative frequency of the issues. For example, if two issues together have a cumulative frequency of 68%, then these are the major defects affecting or spoiling the operations of an organization. Hence, working out a solution for these issues will help mitigate the issues to a large extent.

Advantages

Simple and Effective

Pareto analysis is simple, logical, and an effective tool in the decision-making process of the firm. Identifying major problems caused by 20% of the reason helps the organization to go to the root cause of the majority of the issues. Even if the rule might not always imply an 80:20 ratio, it can also be applicable to other problems. The ratio can vary slightly; however, the concept remains the same and have similar significance.

Understanding of Problem

Pareto charts are an effective tool for determining the major problems caused. It also helps us understand the overall impact on the organization. Removing the major block of the problem helps a firm achieve fast-paced growth and gain a competitive edge in the industry.

Increased Productivity

The Pareto principle is very helpful for managers to identify which are the areas where they should focus their efforts and resources to get maximum results. By using the 80/20 rule of the Pareto principle, managers and employees can design their schedules to focus on the crucial 20% of the tasks. This principle helps managers and employees to avoid wasting time on many trivial matters which will not contribute significantly to the results. Hence, this principle enhances productivity.

Increased Profitability

Using the Pareto Principle, a firm can definitely improve its profitability. In our previous example, we established that 20% of the clients for that IT firm would provide 80% of the business or profitability. If the firm starts focusing more on this 20 % of clients, it can significantly increase its profitability as the top 20% of clients represent most of the firm’s business.

Website Optimization

Pareto Principle can also help you with website optimization. The 80/20 rule suggests that an overview of your business’s website analytics will show that 80% of the traffic on your website goes to 20% of the website’s pages. So, 20% of the pages become critical for the success of my website. Hence, you will ensure that 20 % of the pages are appropriately designed and easily accessible to anyone.

Decision Making Skill

Pareto analysis can help an organization identify problems and find alternate solutions quickly. The whole process sharpens the decision-making skills and creates a practice of dealing with problems as they come by.

Improve Customer Satisfaction

Customer satisfaction is important for any business, and the Pareto principle can help you to improve it. As per the Pareto Principle, 80% of customer complaints will relate to 20% of the causes. So, if you focus on those top 20% causes, you can eliminate 80% of the problems out of the system. Hence, lesser problems and better customer satisfaction.

Disadvantages

Use of Past Data

It is based on past data. Pareto analysis cannot predict uncertainty that will arise in the future. It helps in mitigating the issues faced in the past but does not predict concerns in the future.

Identification of Problem

It’s a problem and causes identifying the issue. The Pareto analysis does not provide insights into the potential solutions to solving the issues.

Inaccurate Decisions

The Pareto Principle may result in making inaccurate decisions because of a narrow view. E.g., the Pareto principle will suggest that 20% of the clients account for 80% of the profits. So, as per the principle, a business should focus most on this 20 % of clients. However, the remaining 20% of the clients may be thinking about bringing more business in the future. If a manager ignores this 20 % of clients, he may harm the future profitability of the business.

Qualitative Insights

Pareto charts reflect qualitative insights and are not of much use in summing up quantitative solutions. For example, one can easily understand the main issues by observing the graph and line chart. But, finding the mean and standard deviation or applying other mathematical solutions will not provide any meaningful insight.

Ignores Qualitative Aspect

The Pareto Principle deals with only quantitative aspects and not qualitative aspects. This may result in inaccurate problem-solving. E.g., suppose a business wants to cut costs and identifies 20% of the top cost centers, which are responsible for 80% of the costs. But these top 20% of cost centers may be critical for the success of the business. A cost-cutting in such centers may do the business more harm than good.

Scoring

To be able to find solutions effectively, the scoring of each problem has to be accurate. The decision is sensitive to the scoring of each issue. Improper scoring will identify incorrect problems that have a huge impact; further, the solutions identified will not improve the issues as they should. The spilt of 80/20 by the Pareto Principle may not always hold true. For instance, 35% of the workers may produce only 65% of the output. In such cases, the Pareto Principle will fail to be of any use. This repeats the fact that the Pareto Principle is only an observation and not a law.

Final Words

Whatever we say, Pareto Principle is an important, critical, and effective tool in the hands of management. It facilitates the identification of problems with their magnitude and thus helps management prioritize the issue resolution.