Bancassurance is the new term that has come to the fore in the last decade or so. As the word implies, it is a combination of two words – bank and insurance. A simple meaning of this term is the use of the bank’s resources by insurance companies to sell their insurance products. In other words, in this agreement, the bank and insurance company come together, whereby the insurance company, directly or through bank employees, begins to sell its insurance products to the bank’s large customer base.

In such an arrangement, the banks may act as intermediaries between insurance companies and their customers. Or, insurance companies may use the banks “existing distribution network to sell insurance. In return, the banks receive a certain fee from the insurance companies.

Such agreements are helpful for both banks and insurance companies. Banks generate additional revenue from the sale of insurance policies. The insurance companies, on the other hand, are able to gain more customers.

Bancassurance Market

This term first came into existence in France in the 1980s, when many believed that such things would make the banks more powerful, so several restrictions were put in place.

Now, such types of arrangements are very popular throughout the world, especially in Europe. Companies such as BNP Paribas, ABN AMRO, and others are major players in the bancassurance market. We can say that such an agreement provides insurance companies with immediate reach for millions of potential customers.

It is a massive industry now. As per an estimate, the size of this industry was $1.66 billion in 2018. The future estimate suggests that this sector could grow by more than 6% between 2019 and 2024.

Models of Bancassurance

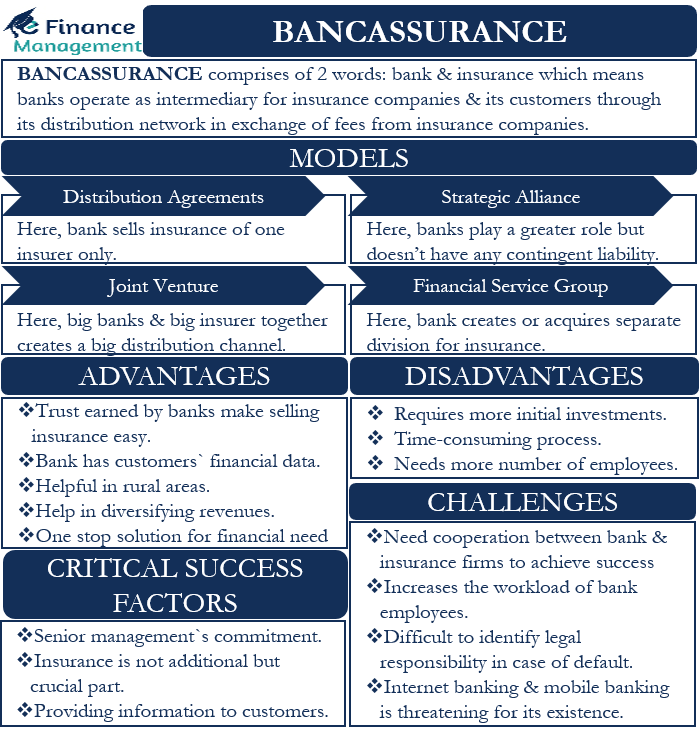

There are four different types of models that make the Bancassurance arrangement works. A bank and an insurance company can choose one of these models for their arrangement. Moreover, the selection of models is also relevant to the rules and regulations of the country where this arrangement will work. These models are:

Distribution Agreements

A bank sells insurance products from only one insurer. A bank can either sell the insurance product separately or bundle it with its own products. We also call this model a ‘tied agent.’

Also Read: Types of Investment Banks

Strategic Alliance

The strategic alliance is another model of bancassurance. The Bank plays a greater role in the insurance business when it comes to product development, channel management, and more. However, it remains the role of the Bank to only design and market the products. All other liabilities remain with the insurance company.

Joint Venture

In a joint venture, a big bank and an insurer of the same size will join forces to create a larger distribution model. Moreover, a bank and the insurance company may decide to have joint participation for profit sharing.

Financial Service Group

A bank or insurance company integrates further with each other. A bank can acquire or establish an insurance division or vice versa.

Advantages and Disadvantages of Bancassurance

Bancassurance is beneficial for banks, insurance companies, and consumers. The following are the advantages of bancassurance:

- Such a scheme is very convenient for customers, as they can easily buy insurance by visiting their bank, saving time and energy.

- As customers trust banks more, it is relatively easier for banks to sell an insurance product.

- Banks have customers’ financial data and are therefore better placed to recommend insurance products to customers.

- This arrangement helps people in rural areas who normally do not have access to insurance products.

- It helps banks improve the productivity of their employees.

- For banks, such an arrangement will help to diversify their sources of revenue and generate significant commission income.

- Insurance companies gain access to the large customer base of banks, increasing turnover and customer numbers, resulting in higher profits.

- Two sectors – banks and insurance companies – can benefit from the existing network of banks.

- Banks will become a one-stop solution for all financial needs of their customers, including insurance needs. This will help to increase customer loyalty and longevity towards the bank.

The following are some of the disadvantages of such an arrangement:

- Such an arrangement requires more initial investment and more employees.

- In general, it is useful to sell only a few insurance products.

- Bank staff needs to be properly trained to know all the details of insurance products. This is a time-consuming process.

Challenges

From the outside, bancassurance may seem attractive and easy to implement, but both banks and insurance companies face several challenges in implementing it. These include:

- Banks and insurance companies must work together to make such an agreement a success. In reality, it isn’t easy to bring two different companies together.

- Insurance companies have no direct control over the sale of their product. This may make it more difficult to manage marketing strategies.

- It increases the workload for banks, as their employees need to fully understand insurance products.

- If a bank has more than one such arrangement, it will sell the products that give it more income.

- Furthermore, these arrangements make it difficult to determine legal liability if a customer registers any disputes.

- The growing trend towards internet banking and mobile banking threatens the existence of bancassurance. Likewise, the development of new distribution channels could make it more difficult for banks to sell insurance products.

Critical Success Factors

As with any successful arrangement, the success of bancassurance depends on the following decisive factors:

- The top management of the banks must show commitment and make insurance sales part of the core strategies of the banks.

- Banks must see insurance not just as an additional product but as a vital part of their business.

- Efforts should be made to change a bank’s culture to be more insurance-friendly.

- Customers should be given all the information they need when buying an insurance product.

Final Words

Bancassurance is very popular worldwide because it is beneficial to banks, insurance companies, and customers. But certain risks, such as strict rules and regulations for banks/insurance companies, have made it less popular in some regions. Indeed, many countries have banned such an agreement. However, as globalization and the relaxation of banking rules has progressed, more and more countries are adopting this type of coordination between banks and insurance companies for the mutual benefit of all parties.