Carriage and Insurance Paid To or CIP is one of the Incoterms commonly used in international trade. It is the standard term that allows buyers and sellers to clear their rights and responsibilities in international trade. As the word suggests, in a CIP agreement, the seller pays for insurance as well as the freight to deliver the items to the agreed final destination of the buyer.

Parties can use the Carriage and Insurance Paid To (CIP) agreement for all modes of transport (rail, sea, road, air, or inland waterway) or multimodal transport. Also, a shipping agreement usually uses the term CIP along with the final destination place. For instance, if the destination is China, the agreement will say CIP China. This means the seller would have to pay the freight and insurance charges up to China.

In a CIP agreement, the buyer must also get clarity on the THC (Terminal Handling Charges). These charges are made by the terminal operator and may or may not be part of the freight rate. Thus, the buyer must clear if THC is part of the freight charges or not.

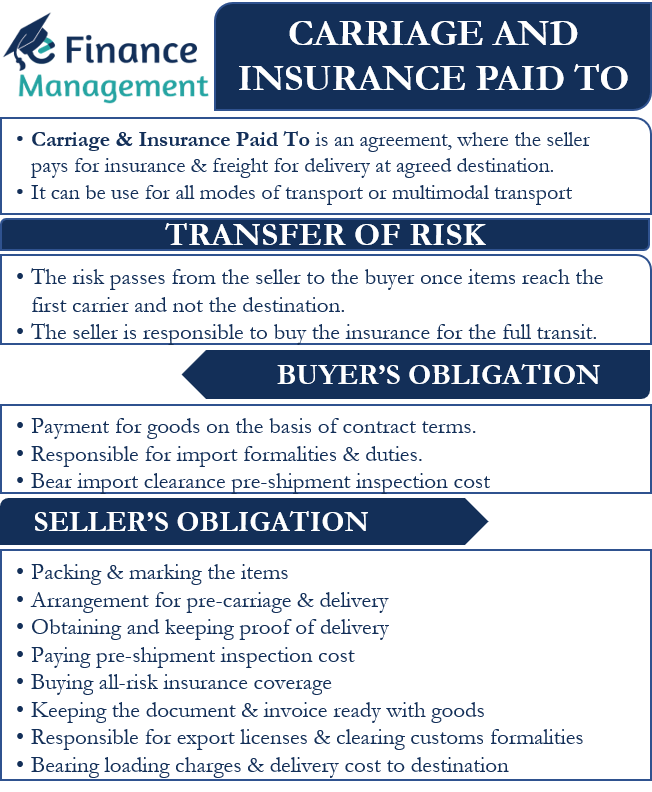

Carriage and Insurance Paid To – Transfer of Risk

In a CIP agreement, the risk passes from the seller to the buyer once the items reach the first carrier (not the destination). Even though the seller’s responsibility ends after delivering to the carrier, the seller needs to buy the insurance for the full transit route of the goods.

Or, we can say that seller buys insurance cover against the buyer’s risk of loss as well. Thus, it is the duty of the seller to make available all insurance documents that the buyer may need to claim the insurance in case of an accident (if any).

However, it is important for buyers to know that in a CIP agreement, the seller needs to get only minimum insurance cover. Still, it is the obligation of the seller to get insurance for 110% of the contract value.

If a buyer wants more insurance cover, then they need to get the seller’s consent or make their own arrangements. And, if the buyer does not want the seller to get the insurance cover, then the two parties can go for a CPT agreement.

For example, Apple in the U.S. wants to ship a container of iPhones to Alibaba in China. If the shipping terms are CIP, then Apple would have to bear the full freight cost and insurance cost to deliver the container at the agreed place in China. But, Apple’s obligation (risk) is complete once it delivers the container to the first carrier or an agreed person. After this, all the risks are with Alibaba though insurance is arranged by Apple.

Obligations under Carriage and Insurance Paid To

Seller’s Obligations

These are the obligations of a seller in a CIP agreement:

- Readying the goods in question, readying the documentation, as well as a commercial invoice.

- Properly packing and marking the items so that they are export-ready.

- Getting export licenses, as well as clearing customs formalities.

- Seller needs to arrange for pre-carriage and delivery.

- Bearing the loading charges, as well as the delivery cost and freight to the final destination.

- Obtaining and keeping the proof of delivery.

- Paying for the cost of pre-shipment inspection.

- Buying an all-risk insurance coverage till the goods reach the final destination.

Buyer’s Obligations

These are the obligations of a buyer in a CIP agreement:

- Make payments for the items purchased in line with the contractual arrangement.

- Clearing import formalities, as well as paying relevant duties.

- Paying for pre-shipment inspection (if any) for import clearance in his country.

Final Words

Carriage and Insurance Paid To or CPT is one of the most popular shipment arrangements in international trade. Most of the responsibilities lie with the seller, including carrier, export formalities, and documentation, and insurance. However, a seller may go for less comprehensive insurance coverage to save on costs. In such a case, the buyer may have to spend extra to get the insurance cover they want for the cargo. For a buyer, it is the most convenient mode as all costs and responsibilities with regard to dealing and movement of goods in a foreign country remain with the seller. The buyer does not need to make any such arrangement or worry about the rules and regulations of the foreign country.

Continue reading – Incoterms.

RELATED POSTS

- Cost and Freight – Meaning, Obligations, and Use

- Delivered at Terminal – Meaning, Obligations and More

- Free Alongside Ship – Meaning, Obligations, Advantages and Disadvantages

- Delivered Ex-Ship – Meaning, Example, and Relevance

- Inland Bill of Lading – Meaning, Importance and More

- Delivered Duty Paid – Meaning, Obligations, Advantages and Disadvantages