What is Adverse Selection?

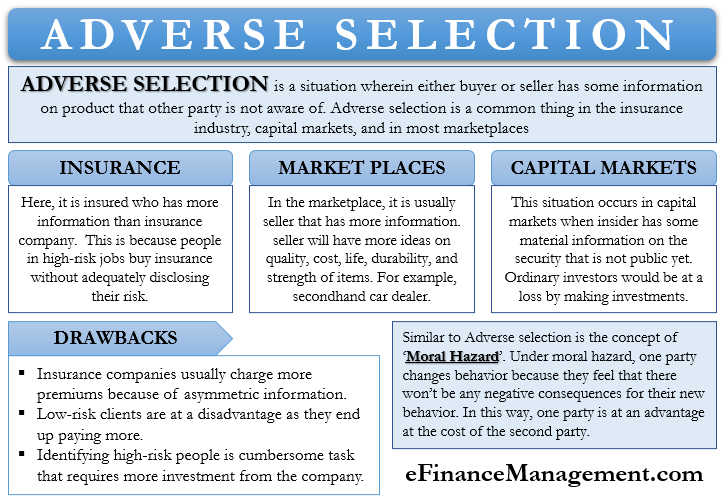

Adverse selection is the situation of asymmetric information. Or, we can say it is when either the buyer or seller has some information on the product that the other party is not aware of. Another name for this phenomenon is information failure, and it happens when either buyer or seller has some material information on the product which the other party does not have.

Such information asymmetry results in inefficiency in the prices communicated. Adverse selection is a common thing in the insurance industry, capital markets, and in most marketplaces, wherever there is an element of risk or price differential.

Another interesting and significant variation of this issue is when both the parties- buyer and seller have some private information about the deal. However, the information available is different for both parties.

Adverse Selection in Insurance

Failure to provide adequate information and disclosure is a widespread practice in the insurance industry. Generally, it is the buyer who has less information, but in insurance, it is the opposite. Usually, people in high-risk jobs buy insurance without adequately disclosing their risks. Thus, in such a case, it is the insured who has more information than the insurance company, which is dependent upon the information provided by the insured.

To overcome such information failure, insurance companies prefer to lower the exposure while covering such people. Moreover, the companies may also increase the premium while protecting such high-risk people from compensating for the high-risk or information absence.

Thus, the role of underwriters is crucial in the insurance industry. They evaluate each applicant and come up with the coverage levels and the premium. Underwriters consider all aspects when assessing an applicant, such as height, weight, medical and family history, occupation, and more.

Examples of Adverse Selection in the Insurance Industry

For example, car race drivers have to pay more premiums. Similarly, those living in areas with a high crime rate may have to pay more premiums.

People who smoke have to pay more when taking health insurance. Smoking is one area that sees most cases of adverse selection. Usually, smokers misrepresent themselves as non-smokers when taking health insurance. This way, they get lesser premium rates, but it increases the risk for the insurance firm.

Also Read: Types of Underwriters – All You Need To Know

Adverse Selection In Marketplace

In the marketplace, it is usually the seller that has more information. The seller will have more ideas on the quality, cost, life, durability, and strength of the items. For example, a second-hand car dealer would have more information on the defect, if any, the car has, and they may sell the car without disclosing that defect to the buyer.

Adverse Selection in Capital Markets

Information asymmetry happens in the capital markets when the insider has some material information on the security that is not public yet. In such a case, the ordinary investors would be at a loss and incur massive losses by making investments.

For example, in the latest internal audit, a company realized that it would be unable to pay its debt in the coming year. The company, however, does not disclose it in its annual report. This way, investors who buy the shares assuming everything is all right with the company would be at a disadvantage. Or a lender who lends additional money to the company takes the risk of non-payment.

On the other hand, if the company mentions the debt-paying concern in its annual report, then any decision would be an informed decision based on this information. And there would be no adverse selection.

Drawbacks

The following are the drawbacks of adverse selection:

- Companies (mainly insurance firms) usually charge more premiums because of asymmetric information. They do this to average out, i.e., taking more from low-risk people to pay for high-risk people.

- Low-risk clients are at a disadvantage as they end up paying more. Thus, in many cases, they drop their plan to purchase an expensive product.

- Identifying high-risk people is a cumbersome task that requires more investment from the company.

Moral Hazard and Adverse Selection

Both these concepts are common in the insurance industry and are crucial in risk management. Adverse selection, as you know, is when one side has more details than the other. A moral hazard is also information asymmetry between the buyer and seller, resulting in a change in behavior by one party after agreeing. Like adverse selection, moral hazard usually occurs when both parties have signed an agreement.

Under moral hazard, one party changes behavior because they feel there won’t be any negative consequences for their new behavior. In this way, one party is at an advantage at the cost of the second party.

Let’s consider an example to understand moral hazards better. Suppose a homeowner lacks flood insurance and burglary insurance. Though the homeowner does not have insurance protection, he has made other arrangements to lower the chances of damages. The homeowner takes the service of the home security system and clears the drains regularly to minimize damage from a flood.

However, one day the homeowner buys the home and flood insurance. Now, after purchasing the insurance, there is a change in the behavior of the homeowner. He unsubscribes the home security system and does not clear the drains regularly as well. It is a case of moral hazard, where the insurance company will now be at greater risk.

Lemons Problem

This issue refers to the erosion in the value of the investment or product because of the adverse selection. Economist George A. Akerlof was the first to present this problem in a research paper – The Market for ‘Lemons’: Quality Uncertainty and the Market Mechanism – in the late 1960s.

Akerlof gave the example of second-hand cars to explain his research on information failure. The defective, used vehicles are also called lemons.

This lemon problem is there in almost all the markets, wherever there is some amount of risk involved, including investing. In the investing world, it arises due to the distinction in perception between the purchaser and the seller. Such a problem also exists in the financial and insurance sector. For instance, the lender may not have all the details on the financial credibility of the borrower.

Akerlof’s research notes that a potential buyer of a second-hand car may not quickly determine the real value of the vehicle. Thus, to avoid paying more, the potential buyer would not want to pay higher than the average price. This average price lies in the middle of the bargain and the premium price. Such a strategy gives the buyer some satisfaction from the risk of purchasing a lemon.

Beneficial to Whom?

Such a strategy is in favor of the seller, Akerlof notes. The average price that a seller gets would still be more than the price the buyer would pay if they had information that the car is defective or is a lemon.

Akerlof also points out that the lemon problem is not in the interest of the seller if he wants to sell an expensive car. Because of asymmetric information, the potential buyer may hesitate to offer more price, fearing he may get a lemon. Thus, the potential buyer doesn’t provide a premium for a premium car due to the lemon problem.

Final Words

The absence of complete information or the availability of some private information with one of the parties to the deal is a common phenomenon. And this is applicable in the world of insurance, investment, and the economic marketplace. That’s why there is a need for due diligence, vetting, analysis, and judgment. Hence, negotiation and dealing become art and science together. Deals are never closed, just based on either information or judgment. Both aspects play their essential part.

RELATED POSTS

- Hedging

- Contingent Liability – Meaning, Importance, Types And More

- Financial Risk – Meaning, Types, Management And More

- Poison Pill: Meaning, Pros & Cons, Types, Examples, and More

- Loan Underwriters: Meaning, Factors useful for the process, licensing and More

- Carriage and Insurance Paid To – Meaning, Obligations, and More