Factoring means selling the invoices raised to the customers to a third party who makes the payment immediately after reducing a discount. Bill Discounting provides immediate operating capital by borrowing against the invoice raised to the customers. Both are means of short-term capital for running operating expenses. Let’s see in detail factoring vs. discounting.

Factoring and Bill or Invoice Discounting have been long established as reliable and widely used means of the short-term finance. Companies and manufacturers have short-term sources of financing needs to run the day-to-day operations. When a finished product/service is produced/rendered, the invoice or bill to the customer is generated. The customer can take few days to months’ time to pay as per their own liquidity and terms of the sale. For long-established customers, a “credit period” is common and the proceeds are shown as “Accounts Receivable” for the future in the books of the company.

This can produce a cash crunch to purchase raw materials and other inputs to keep the operations running. To tackle this cash crunch, bill discounting is one of the common methods along with factoring.

Definitions

Bill/Invoice Discounting

When a company issues a Bill of Exchange to the seller in lieu of the products/services purchased, it issues a “Promissory Note” or the promise to pay at a later date. When the seller goes for discounting, it presents this promise to a bank who purchases this bill, before its due date and pays the seller, the amount on the invoice after cutting a certain percentage called as a “Discount Charge”. This is actually like an advance against the bill which is like a security with the bank. And the discount can be looked at like an interest paid to the bank to take up that credit instead of the seller.

Also Read: Factoring

For a detailed understanding, read our post on INVOICE DISCOUNTING.

Factoring

Factoring is similar to bill discounting in many markets. It entails a bank or third-party intermediary buying the invoices at a value less than the actual total value (face value) of the invoice. This discount usually varies from 2 to 6 percent. Here the chunk of the invoice face value is paid to the seller called as “Advance Rate”. Factor companies can release the money within 24 hours to the seller and he can get instant liquidity to continue operations. The remaining face value of the invoice can be paid once the seller’s bank receives the buyer’s payment.

For a detailed understanding, read our post on FACTORING.

There can be various terms of the contract under Factoring and these can be utilized to set conditions for the cash management of the company. The upward cycle of companies and growth prospects helps them get credit purchases from a lot of sellers as their creditworthiness is high.

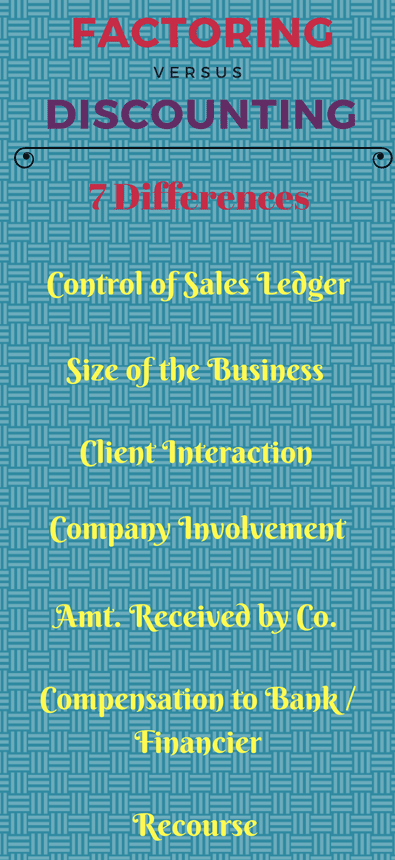

Difference between Factoring vs Discounting

The main differences between the two can be explained as follows:

Control of Sales Ledger

In factoring, the bank giving credit takes the onus of checking on the sales ledger, control of credit and chasing your clients for paying back. The work of collection and follow up is outsourced to the bank. Whereas bill discounting requires your own accounts team to take care of the sales invoice, follow-ups and the money is paid directly to you.

Size of the Business

Factoring is useful for larger businesses where an entire line-up of client credits have to be managed. Bill discounting might be useful for small businesses where you do not want your clients to deal with your bank/ third party intermediary and give them an impression of your cash flow situation. Also, bills might not be available on a continual basis for discounting.

Client Interaction

In factoring the client settles their payables with the factor (such as a bank). In bill discounting, the client will not really know the involvement of a third party. The transaction happens between banks where the confirming bank or the buyers’ bank does not intimate the seller of the reimbursement instruction but deals with his bank directly to determine the discounting terms.

Company Involvement

Taking factor services allows you to focus on your business, and the factor who is an expert in this field can provide a line of credit to you and collection services. Bill Discounting requires your team to be involved in the entire process of recovery.

Amount Received by the Company

The drawer company (which is the seller) receives the amount minus a small discount immediately in a bill discounting. Factor companies can release the money within 24 hours to the seller and he can get instant liquidity to continue operations. Here the chunk of the invoice face value is paid to the seller called as “Advance Rate”. The remaining face value of the invoice can be paid once the seller’s bank receives the buyer’s payment.

Compensation to Bank/Financier

The bank receives discounting charges for the credit and in factoring it charges commission along with interest.

Recourse

Factoring is only under recourse – i.e if the customer fails to pay to the financier, the credit has to be paid by the seller. In bill discounting, there are two methods to present the bills to the buyer’s bank – with recourse and without recourse.

Businesses giving 30- 90 days credit in their production and payment cycle can make use of either of the services. Construction, clothes and apparel manufacturers, wholesalers, courier companies, and various other manufacturers can use these.

I needed to create you that little bit of note in order to thank you once again considering the beautiful pointers you have discussed at this time. This has been simply strangely generous of you to allow unreservedly precisely what some people would have marketed as an e book to make some dough for themselves, most importantly considering that you could possibly have done it if you desired. Those things also worked to be a great way to be aware that someone else have the identical desire like my personal own to find out many more with respect to this problem. I am sure there are many more pleasant occasions up front for many who looked over your website.

We are in huge debts from sundry debtors n creditors with overdue interest accumulated over a very long time the amount may run to 100 crores approximately if any company can takeover this as 100 principal plus 24% interest compounded plus 25 % as their investment charges which they may take it as book adjustments of profit or loss on non-recourse basis than kindly contact if keen to takeover