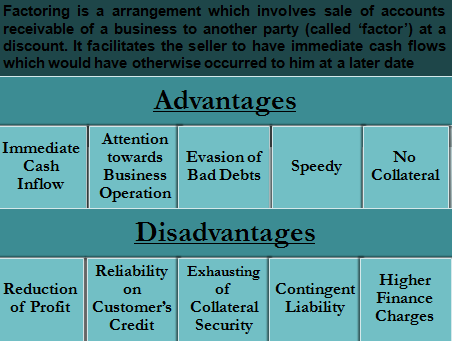

Factoring is a financial arrangement that involves the sale of accounts receivable of a business to another party (called ‘factor’) at a discount. It facilitates the seller to have immediate cash flows that would have otherwise occurred to him later. There are various advantages and disadvantages of factoring, which are listed below:

Advantages of Factoring

Immediate Cash Inflow

This type of finance shortens the cash collection cycle. It provides swift realization of cash by selling the receivables to a factor. Availability of liquid cash sometimes becomes a deciding factor for grabbing an opportunity or losing it. The cash boost provided by factoring is readily available for capital expenditures, securing a new order, or meeting an unforeseen condition.

Attention toward Business Operations and Growth

By selling off invoices, business managers can feel stress-free with the task of collection from the customers. Resources employed in the receivables department can be directed toward business operations, financial planning, and future growth.

Evasion of Bad Debts

Factoring is of two types – with recourse and without recourse. Under without recourse factoring, in the case of bad debts, the loss is borne by the factor. Hence, the seller is under no obligation to the factor once it sells off its receivables.

Also Read: Factoring

Speedy Arrangement of Finance

Factors provide funds more rapidly than banking companies. Factoring companies offer a process of factoring that is a quicker application, lesser documentation, and swifter realization of funds compared to other financial institutions.

No Requirement of Collateral

The advances are extended on the basis of the strength of accounts receivables and their credit healthiness. Unlike cash credit & overdraft, factors do not require any collateral security to be pledged/hypothecated. New businesses and startups can easily avail the advances provided they have strong receivables.

Sale Not Loan

Factoring transaction is a transaction of sale, not a loan. Unlike other types of finances, factoring does not result in an increase in liabilities of the business. Hence, there are no adverse impacts on the financial ratios as well. It just involves the conversion of book debts into liquid cash.

Customer Analysis

Factors provide valuable advice and insights to the seller regarding the credit strength of the party from whom receivables are pending. It helps in negotiating better terms between the parties in futures contracts.

Also Read: Types of Invoice / Receivable Factoring

Disadvantages of Factoring

Reduction of Profit

The factor deducts a certain discount from the value of accounts receivable as fees for the services offered. Moreover, in some instances, the factor also charges interest on the advance made. Consequently, profit of an entity is reduced by a significant margin.

Reliability of Customer’s Credit

The factor assesses and evaluates the credit wellness of the party who owes bills receivables. This is a critical factor that is outside the control of the seller. A factor may refuse to extend advances due to the poor credit ratings of the concerned party.

Exhausting of Collateral Security

Factoring exhaust bills receivables of an entity as the entity is no longer entitled to receive payments from them. The seller is no longer holding any control over the book debts. Hence, they can not be provided as collateral security while obtaining any other type of finance.

Presence of Contingent Liability

The liability of the seller is not completely waived in case of with recourse factoring. If a party fails to pay its debts to the factor, the factor is legally entitled to recover it from the seller. Thus, the seller is contingently liable to the factor for paying the debts in the future in case of default. This situation would impact business operations and financial plans which are under execution.

Higher Finance Charges

Factors usually deduct 2% to 4% of the total amount involved as their fees for the duration of 45-60 days. Computing it annually, the cost of finance turns out to be around 18% to 24% p.a. which is very higher than other sources of finance.

Loss of Personal Touch

The buyer may not be willing to deal with a factor because of their professional nature and stringent methods. Factoring agencies even send notices at regular intervals to the buyer as a reminder of the debt. The buyer may develop a negative image of the seller through factoring. Loss of personal touch may lead him to consider switching vendors.

Conclusion

Although factoring offers many merits to the seller, it cannot be said to be the perfect source of finance for businesses. A person should carefully assess the business needs and the present situation, which warrants the need for funds. Taking a factoring advance without proper consideration may adversely affect the business profitability and customer relations.

My brother suggested I might like this website. He was totally right. This post actually made my day. You can not imagine simply how much time I had spent for this information! Thanks!

This article is really helpful. This will definitely give me a lot of information about factoring. This article is very informative. Thanks for sharing this article. I think that factoring can definitely give a lot of