Factoring is one of the best ways to raise capital for a business. In this transaction, the owner of the business sells all or part of its invoices or accounts receivables to a third party at a discounted price. Such a third party assumes the credit risk of the business and is known as a ‘factor.’ ‘Accounts receivable factoring’ is another name for Factoring. Let’s see in detail the terms of factoring.

The main aim of the companies while entering into such a transaction is to receive cash speedily on their receivables. It allows businesses to build their cash flows stronger and make the payment cycle faster for efficient business handling.

Example of Factoring

Let us understand this by a simple example:

Suppose ABC Ltd. has a total of $1,00,000 receivables and it wants to release some cash immediately. In order to raise its capital and release cash, it shall enter into a factoring agreement. In such an agreement, depending upon the terms and conditions, the factor ‘X’ discounts the receivables by, say, 10% and agrees to make payment to the company within 2 days. Thus, in the end, the factor would end up paying $90,000 cash to ABC Ltd., and the margin of $10,000 would be either his factoring commission or fee.

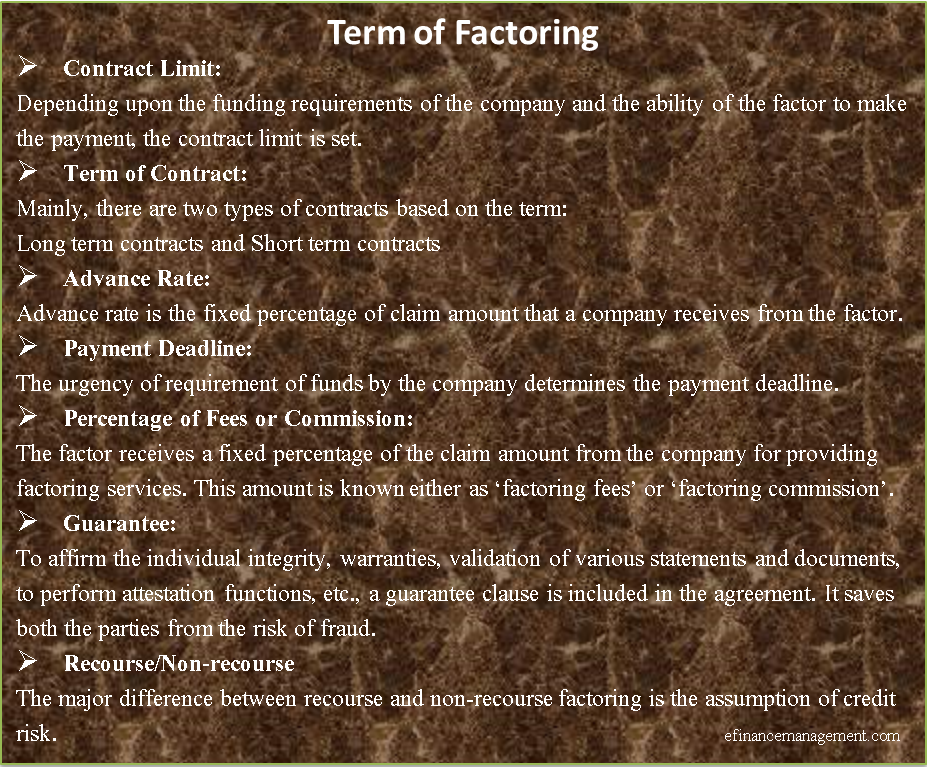

Terms of Factoring

In the above example, we saw how essential the terms and conditions are for any factoring agreement. On the basis of the following terms, one may decide whether to enter into a factoring agreement or not. These terms are:

Also Read: Advantages and Disadvantages of Factoring

Contract Limit

Depending upon the funding requirements of the company and the ability of the factor to make the payment, the contract limit is set. Each factor sets its minimum and maximum limit before entering into any factoring agreement with the companies.

Term of Contract

When the companies approach factors (or factoring agencies) for working capital finances, majorly, the ‘term of contract’ plays an essential role. Depending upon the period, one decides the term of the contract. Mainly, there are two types of contracts based on the term:

- Long Term Contracts: Long-term contracts are generally for a period of 12 months or more. In such contracts, the factor agrees to buy the receivables at a bargain/discounted rate. The major benefit of such a contract is that it not only builds a beneficial relationship between the factor and the company but it also results in lower factoring rates and other costs associated with

- Short Term Contracts: These short-term contracts are for a shorter period, say up to 6 months. Mainly, such factoring is very useful for continuously small business transactions. Though these contracts are more flexible than long-term contracts, they end up in high factoring.

Advance Rate

One of the most important aspects of these agreements is the advance rate. The advance rate is the fixed percentage of the claim amount that a company receives from the factor. Though this rate normally ranges from 85% to 90%, it is subject to modification depending upon the funding needs and type of business.

Payment Deadline

The urgency of the requirement of funds by the company determines the payment deadline. Mostly, the completion of the initial transaction takes place within 1 to 7 days, and funding takes place within 24 to 48 hours thereafter.

Also Read: Types of Invoice / Receivable Factoring

Percentage of Fees or Commission

The factor receives a fixed percentage of the claim amount from the company for providing factoring services. This amount is known either as ‘factoring fees’ or ‘factoring commission.’

Guarantee

A guarantee clause is included to affirm the individual integrity, warranties, validation of various statements and documents, perform attestation functions, etc. It saves both parties from the risk of fraud.

Recourse/Non-recourse

The major difference between recourse and non-recourse factoring is the assumption of credit risk. Generally, funding on a non-recourse basis is more popular as it provides protection against legal bankruptcy, insolvency, and loss on non-payment.

Any Other Terms or Conditions

There are no fixed tailor-made terms and conditions for entering into a factoring agreement. Depending upon the payment ability and risk assumption capacity of the factor against the necessity of funds by the companies, any additional clause may be included in a mutual agreement.

Conclusion

Factoring is one of the quickest and most flexible ways for businesses to build up their cash flows. Though this totally depends upon the unique needs of the business, it is today one of the most popular methods to raise finance.

Quiz on Terms of Factoring