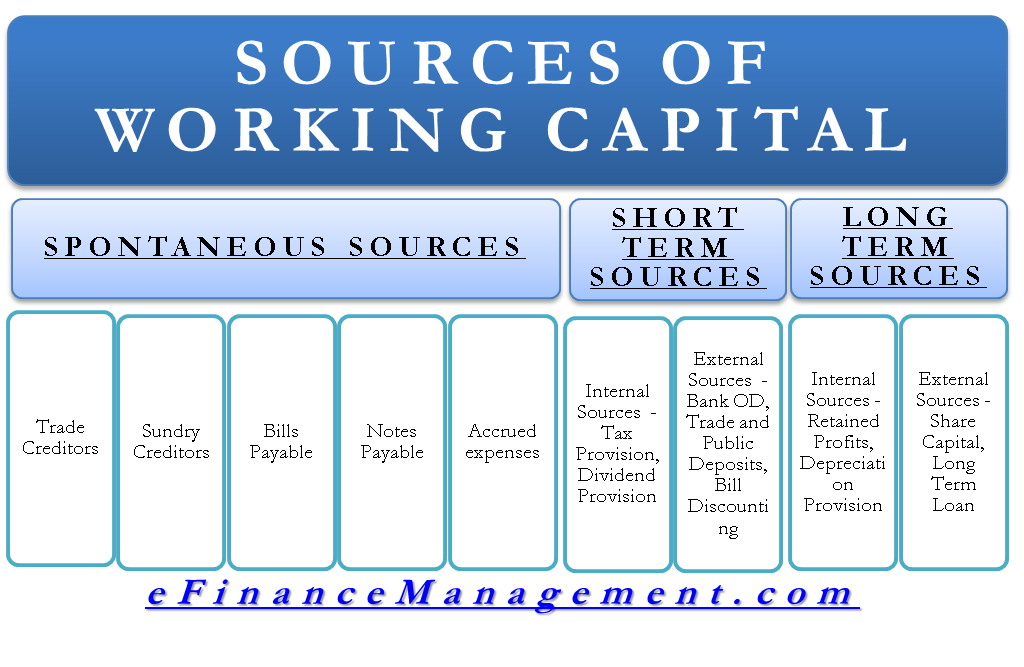

Every organization needs working capital to finance its daily operations and short-term assets (current assets). Working capital is essential to ensure the smooth functioning of a business. Therefore, businesses need to have access to a variety of sources of financing to manage their working capital needs effectively. These sources can be both internal and external and also spontaneous, short-term and long-term as well.

Sources of Working Capital Financing

| Spontaneous Sources | Short-Term Sources | Long-Term Sources | ||

|---|---|---|---|---|

| Internal Sources | External Sources | Internal Sources | External Sources | |

| Trade Credit | Tax Provisions | Bank Overdraft | Retained Profits | Share Capital |

| Sundry Creditors | Dividend Provisions | Trade Deposits | Depreciation Provision | Long-Term Loans |

| Accrued Expenses | Public Deposits | Debentures | ||

| Bills Discounting | ||||

| Short-Term Loans | ||||

Spontaneous Sources of Working Capital Finance

The word ‘spontaneous’ itself explains that this source of working capital is naturally available to the business in the normal course of business affairs. It refers to the funds that a business can generate through its day-to-day operations without any external borrowing or investment. The following are the spontaneous sources of working capital finance that are available to a company:

Trade Credit

Trade credit is the extension of credit by suppliers of raw materials to their buyers who purchase goods or services on credit terms. It acts as a source of working capital financing for businesses as it provides them with an interest-free credit period for making the payment. This allows businesses to use the cash they would have otherwise paid for the purchases for other short-term needs.

Sundry Creditors

Sundry creditors are also similar to trade credit when it comes to sources of working capital financing. The difference is that it is the extension given by the suppliers of other goods and services for making payments.

Also Read: Working Capital Loan and Finance

Accrued Expenses

Accrued expenses are those which are incurred by the business but not yet paid.

All of the above-mentioned sources are a way of delaying immediate cash payments. By delaying payment to suppliers, businesses can free up cash to use for other working capital needs. Each supplier will have a maximum credit limit defined for the buyer depending on the business capacity and creditworthiness of the buyer. Similarly, the credit period is defined say 30 days, 45 days, etc. If the buyer makes payment immediately on buying the materials, he can avail of a discount on cash payment. Else, this discount turns out as an opportunity cost to the buyer.

Short-Term Sources of Working Capital Finance

These can be further divided into internal and external sources of working capital finance.

Short-term Internal Sources of Working Capital

The following are the two short-term sources of working capital financing:

Tax Provisions

The tax provision is the amount that a business has set aside for making the payment of taxes. It is a form of self-financing, as the business is effectively borrowing from itself to pay its taxes, rather than relying on external sources.

Dividend Provisions

Similar to tax provision, dividend provision is the amount kept aside for paying dividends to shareholders.

While these amounts are kept for future payments, they can be used by the company to fund its short-term operations. The fund that would have been used in paying these provisions act as working capital till the point these are not paid.

Short-term External Sources of Working Capital

Short-term external sources of working capital financing are generally obtained from the banks and include:

Bank Overdrafts

A bank overdraft is an extension of credit from a bank that allows businesses to overdraw their account up to a certain limit. It is convenient as a business can quickly access additional funds to cover short-term expenses without having to go through the process of applying for a loan.

Cash Credits

Cash credit is a form of short-term financing in which a business borrows money from a bank by using its assets of higher value than the loan amount as collateral.

Trade Deposits

Trade deposits refer to advance payments made by customers for goods or services to be delivered in the future. These advance payments provide a business with an immediate infusion of cash that can be used to finance current operations.

Bills Discounting

Bills discounting is a tool that acts as a source of working capital financing for a business. It provides businesses with immediate access to cash, allowing them to cover their short-term cash needs without having to wait for their customer to pay before the end of their credit period.

Short-term Loans or Working Capital Loans

As the name suggests, working capital loans are short-term loans designed to meet the working capital financing requirement of the business.

Commercial Paper

Commercial paper is a short-term debt instrument that can provide businesses with access to low-cost, short-term financing.

Vendor Financing

Vendor financing is the financing provided by a supplier to its customer to help them purchase goods or services. This help businesses maintain a stable supply chain while also ensuring access to the working capital.

Short-term working capital finance availed from banks and financial institutions are costly compared to spontaneous and long-term sources in terms of rate of interest but has great time flexibility. Due to time flexibility, the finance manager can use the funds and pay interest on the money his business utilizes and can pay them anytime when cash is available. Overall, in comparison to long-term sources where you have to hold funds even when not required, these facilities prove cheaper.

Long-Term Sources of Working Capital Financing

Long-term sources can also be divided into internal and external sources. The internal sources of finance include retained profits and provision for depreciation, whereas external sources include share capital, long-term loans, and debentures.

Long-term Internal Sources of Working Capital

Long-term internal sources of working capital financing include:

Retained Profits

Retained earnings are a source of working capital financing for a business. It provides access to internal funds that can cover short-term working capital requirements.

Provision for Depreciation

Similar to tax and dividend provisions, a company creates provision for depreciation regularly. Therefore, the company can use this amount to finance its working capital needs.

Retained profits and accumulated depreciation are as good as funds available to the business without any explicit cost. The business earns and owns these funds completely. The utilization of these funds is for expansion as well as working capital finance.

Long-term External Sources of Working Capital

The following are the long-term external sources of working capital financing:

- Share Capital

- Long-term Loan

- Debentures

Conclusion

Working capital can be classified as temporary working capital and permanent working capital. Therefore, it is advisable to use long-term sources for permanent and short-term sources for temporary working capital requirements. This will optimize the working capital cost and enforce good working capital management practices.