Activity / Turnover Ratios are a set of financial ratios used to measure the efficiency of various operations of a business. Activity ratios measure the firm’s efficiency in using its resources/ assets. These ratios are also known as Asset Management Ratios because these ratios indicate the efficiency with which the firm’s assets are managed/utilized.

Activity / Turnover Ratios essentially evaluate the operational efficiency of any business by measuring the rate of utilization of various assets. These ratios are directly linked to the lifeblood of a business, i.e., Revenue. And the efficiency is measured in terms of revenue generation by the respective assets. Moreover, these ratios are also known as performance/efficiency ratios.

Assets such as machinery, raw materials, debtors, etc., are introduced to a firm to generate sales for the firm and thereby generate profits. These turnover ratios indicate the speed at which these assets are converted into sales. For example, the inventory turnover ratio shows the number of times the inventory is converted into sales in a year.

The result of an activity/turnover ratio is an absolute number representing asset utilization efficiency. The higher the ratio better is the efficiency.

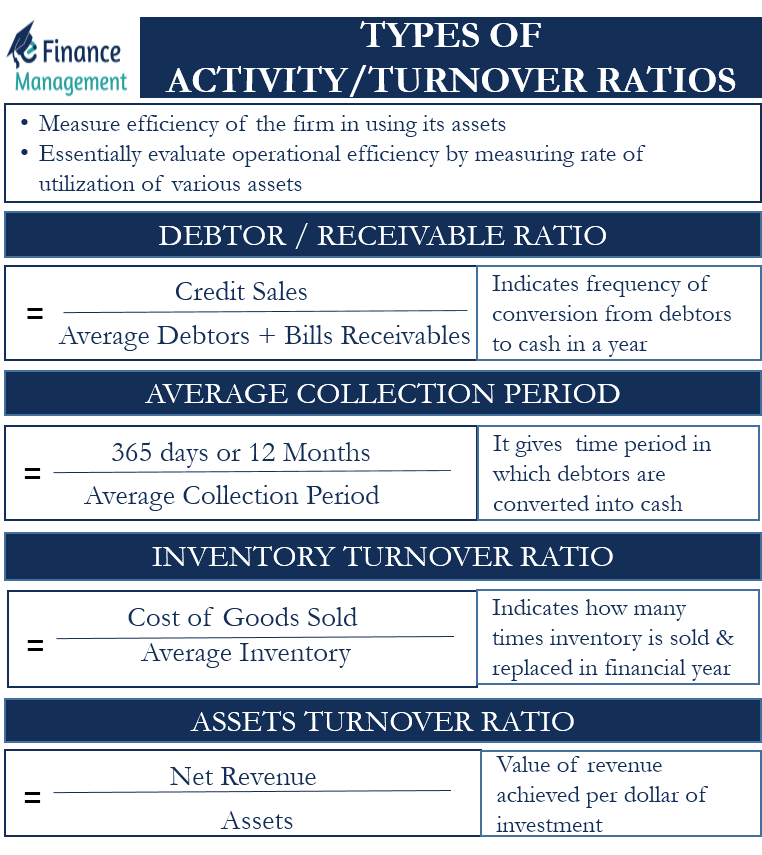

Types of Turnover Ratios

As we can make out, the turnover ratios are essentially a relationship between sales and the firm’s assets. Based on the different types of assets, the activity/turnover ratio is classified into the following types.

Also Read: Turnover Ratios

Debtor / Receivable Turnover Ratio and Average Collection Period

The receivable turnover ratio indicates the frequency of conversion from debtors to cash generally in a year. It also suggests the extent of liquidity of debtors. The average collection period gives a time period in which debtors are converted into cash. Both the ratios indicate the same thing but in different terms. The former is expressed in no. of times, whereas the latter in no. of days or months. The formula for debtor / receivable turnover ratio and average collection period is as follows:

Formula

| Debtor/Receivable Turnover Ratio = Credit sales / Average Debtors + Bills Receivables |

| Average Collection Period = 365 days or 12 Months / Debtor or Receivable Turnover Ratio |

Stock / Inventory Turnover Ratio

The inventory turnover ratio indicates how many times inventory is sold and replaced in a financial year. In other words, the ratio gives the frequency of conversion of inventory into cash in a given financial year. Usually, a higher ratio is considered good as it suggests better inventory management.

Formula

| Stock / Inventory Turnover Ratio = Cost of Goods Sold / Average Inventory |

Assets Turnover Ratio

Asset Turnover Ratio calculates the value of revenue achieved per dollar of investment. A higher ratio indicates better asset management and utilization and vice versa. The ratio also depends on the business to business based on their profit margins. With lower margins, this ratio is normally high. The ratio is calculated as below:

Formula

| Asset Turnover Ratio = Net Revenue / Assets |

This ratio may have different variants depending upon the asset category.

Great article.

This is a great blog. A great read. I’ll certainly be back.