Development Impact Bond (DIB) is a financial tool that helps to fund development projects, usually of social nature. Basically, DIBs come in handy in funding social projects in low-resource countries. They are very similar to social impact bonds (SIBs), or we can say that they are a type of SIBs. So, DIBs also involve private investors.

Development Impact Bond – Number of Parties Involved

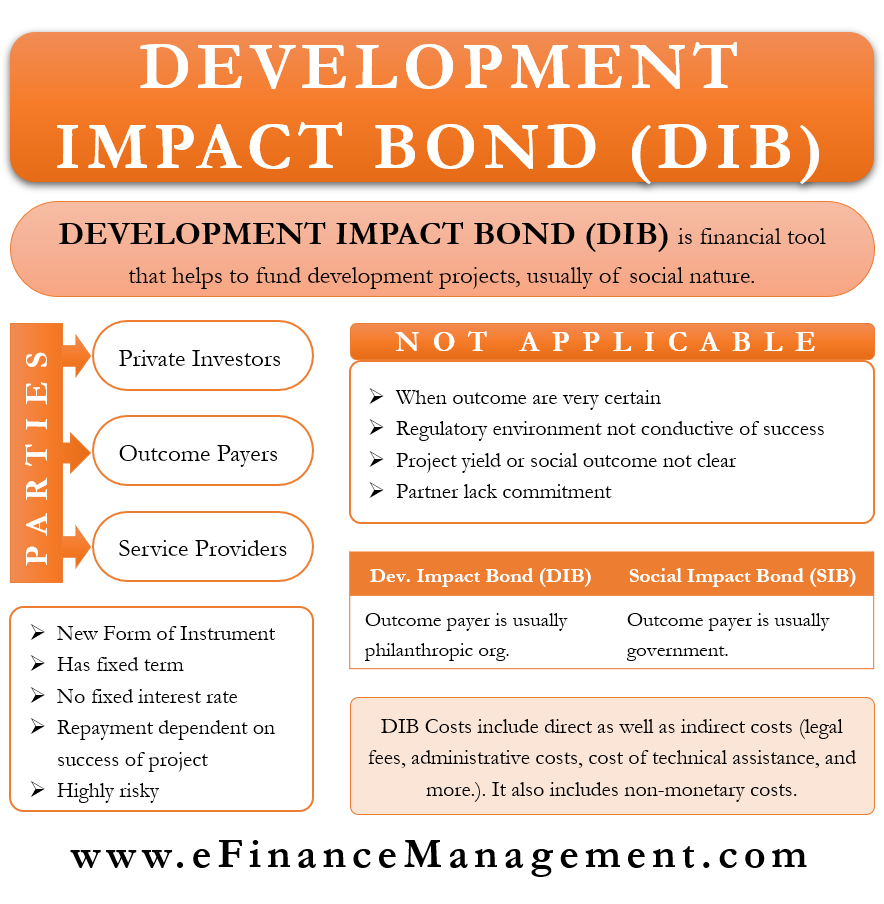

Usually, a DIB involves three types of parties. And these three parties are – a private investor, an outcome payer, and the service provider. A point to note is that there can be more than one of each type of party (such as two investors or three service providers).

- A private investor could be a group of investors or a fund. They give funds to implement a development project that has social benefits.

- The service provider is generally a nonprofit organization. This organization implements the project and is responsible for the results.

- If the project is successful, then the private investor gets the repayment (with interest) by the outcome payer. This outcome payer is generally a philanthropic organization. Since the repayment depends on the outcome, we also call DIBs a results-based financing instrument.

- Along with these three, there is one more party, and it is the evaluator. This party helps to determine whether or not the project is a success.

Are DIBs a Bond?

DIBs are a relatively new form of a financial instrument as they came into existence only in 2012. Though we call it a Development Impact Bond, it doesn’t have the usual features of a bond. DIBs do have a fixed term, but they do not give a fixed interest rate to the investors. Instead, the repayment to the investors depends on whether or not the project is successful.

So, if the project goes well, the investor (investors) will get the repayment from the outcome funder, who is usually a philanthropic organization. But, if the project is unsuccessful, there is no repayment to the investors. Thus, we can say that DIBs are high-risk instruments for investors.

In the real world, it is seen that the outcome payer pays back the investor even if the project fails, although a lesser amount. If the project fails, the outcome payer could pay back the investor, but without any interest, or forfeit some amount of capital.

Payments could also be made on a reducing basis. For instance, if the results are 80%, then the outcome payer could pay 70% of the working capital. Or, if the 70% work is complete, the payment could be 60% of the capital.

The Objective of the Development Impact Bond

The primary objective of DIBs is to encourage private investors to fund and subsidize development projects in countries that lack resources.

Basically, DIBs are useful when a party is willing to pay for a project with a social cause. However, it is not willing to take any risk about the success or failure of the project and, therefore not willing to put its money at stake. So, such parties remain on the lookout for investors who are willing to take that risk in return for a premium.

Another reason why DIBs are growing in popularity is that the service provider gets the funds upfront. This means the provider can work without worrying about funds or wasting time in raising funds continuously.

Usually, in a DIB project, there are a lot of funders, and each funder has its own set of conditions. This may make it very challenging to complete the task. But, since they get the funds upfront, the service provider gets greater flexibility in executing the project.

However, a major criticism of DIBs is their dependence on data. It is the data that determines the success of a DIB, so any error in data could have serious consequences. Moreover, this also makes the whole process expensive and time-consuming.

When are DIBs Applicable?

DIBs have more chances of being successful if they have:

- Clear project yield, as well as measurable social outcomes.

- The service provider (or providers) gets a reasonable time to implement the project.

- The project has the availability of relevant outcome data.

- There is a decent level of funding available for the project.

Following are the scenarios when DIBs are not applicable:

- When the outcomes are very certain.

- The regulatory environment isn’t conducive to the success of the project.

- Project yield and measurable social outcomes are not clear.

- If the partners lack or don’t show commitment.

How Development Impact Bond Works?

The DIB process kicks off when the outcome payer comes up with an idea of a project that can address some issues in low-income countries. Now, the philanthropic organization (outcome payer) gets in touch with the potential investors and the service providers.

The outcome payer explains the project to these two. Also, it promises to repay the investors with interest if the project is successful. Once they decide to work on the project, they settle on the quantifiable metrics to measure the success of the project.

The private investors fund the project by buying its bonds. And the service providers then use the proceeds to work on the project.

After the end of the pre-decided period, the parties or an independent auditor measure the success of the project on the basis of pre-defined metrics. If the auditor tags the project as a success, then the outcome payer makes the repayment to the investors.

Social Impact Bonds (SIBs) vs. Development Impact Bond (DIBs)

DIBs are very similar to SIBs, but there are a few differences between them:

A major difference between the two is that the outcome payer is usually the government in a SIB. In DIBs, the outcome payer is generally a philanthropic organization.

A government has many incentives to go for a public-private partnership. So, the government uses SIBs and directs the public funds for the development projects. Also, with SIBs, the government doesn’t take the full risk; instead, the risk is spread across stakeholders.

How Much DIBs Cost?

Like any other project, the cost of a DIB depends on the result of the project and its specifics. These constitute the direct cost for the project. There are indirect costs as well. The indirect costs are legal fees, administrative costs, the cost of technical assistance, and more. Since DIBs are a relatively new financial instrument, the indirect costs are usually higher.

Apart from these costs, development impact bond has non-monetary costs as well. These costs include the time that the project leader and key personnel give in overseeing the project. Another cost we can associate is the reputation cost if the service provider is unable to successfully complete the project.

Final Words

DIBs are an innovative financial instrument that can help solve difficult issues. However, they are not fit for all projects. But, in cases they are applicable, they result in efficient outcomes and create space for more innovation.

Read about other Different Types of Bonds.