What is the Opposite of Risk Aversion?

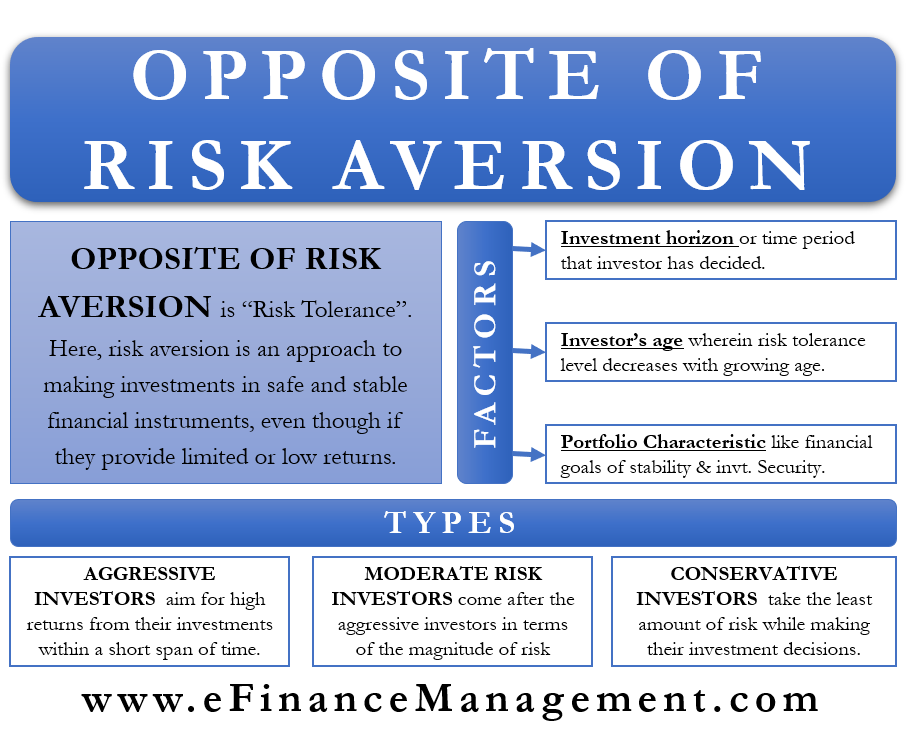

Risk aversion is an approach to making investments in safe and stable financial instruments, even though if they provide limited or low returns. Risk-averse investors choose instruments that provide maximum security to their investments. Such instruments will seldom vanish from the markets, or the companies offering them do not pose a threat of running away. Also, there is little chance of a steep fall in the investment value. The flip side of this strategy is that the returns from such a portfolio will be low, limited to the market’s performance, and not very high or extraordinary. The opposite of risk aversion is “Risk Tolerance.”

Risk tolerance is a term that measures the quantum or the level of risk that an investor is willing to take and bear. A risk-tolerant investor has the ability to tolerate risks or face uncertain consequences of making investments. Hence, they can make investments in a bit more risky financial instruments with a view to earning more handsome profits. They have a long-term view of making higher profits even if they suffer a few losses in the short run. Risk tolerance levels help managers and fund houses to design and shape the investment portfolios of their clients. According to the risk tolerance levels, one should decide where, when, and how much to invest. A less risk-tolerant investor should go for low-risk investments, whereas a high-risk-tolerant investor should go for high-risk instruments.

Factors affecting Risk Tolerance?

One has to consider numerous factors while measuring or analyzing the risk tolerance level of an investor. Some of them are:

Risk Tolerance Impact by Investment Horizon

The investment horizon or time period that an investor has decides the risk tolerance level to a large extent. If an investor has a long-term horizon and plans to stay invested over a period of a few years, he can take a high-risk-tolerant approach. On the other hand, if an investor plans to keep his investments for just a few months or a couple of years and wants a certain amount of return, he will take a less risk-tolerant approach. Thus, higher risks can be taken with a long-term horizon than a short-term horizon.

Age of the Investor

The age of an investor has a lot of impact on his risk tolerance levels. Prudence says the risk tolerance level of an investor decreases with the growing age, other things being constant. Hence, young investors can afford to take more risks than older investors. Young people, by nature, can bear market fluctuations better. Also, even if they suffer short-term losses, they have a long time ahead to cover their losses.

Portfolio Characteristics

A portfolio with financial goals of stability and security of investment will adopt a less risk-tolerant approach. On the other hand, investors with portfolio goals of quick and more returns will adopt a higher risk tolerance approach.

Also, risk tolerance levels will increase with the increase in the size of the portfolio. Bigger portfolios can afford to take higher risks in comparison with smaller portfolios. The bigger portfolios will not take many hits even if a security or two give negative returns. Whereas in the case of smaller portfolios, this will not be the case. They will suffer when even one security gives negative returns, and hence, they will adopt a low-risk-tolerant approach.

What are the Types of Risk Tolerance?

There are three main categories of investors on the basis of their risk tolerance levels.

Aggressive Investors

Aggressive investors aim for high returns from their investments within a short span of time. Thus they have high-risk tolerance levels. They are usually rich with the ability to invest substantially. Also, they have good information about the market.

The usual investments of such investors include equities, derivatives, and risky market instruments. They shy away from safe and low-return investments such as bonds. Such investors earn handsome profits when the markets do well. Also, since the investments come with high risk, they suffer big losses at the time of poor performance of the market.

Also Read: Risk-Return Tradeoff

Moderate Risk Investors

Moderate risk-taking investors come after the aggressive investors in terms of the magnitude of risk they undertake in their investments. With lower risk comes lower but safer return expectations from the portfolio.

The investment portfolio of such investors comprises a mix of equities, derivatives, bonds, and ETFs. They have a small or negligible investment in high-risk market instruments that can lead to heavy losses in times of poor market performance. Hence, their portfolios do not see large upward and downward movements.

Conservative Investors

Conservative investors take the least amount of risk while making their investment decisions. They go for safe and steady investments, even if the returns from them are marginal or limited. They totally avoid risky asset classes and instruments whose returns fluctuate a lot or are uncertain. Instead, they invest in very safe instruments such as government bonds, bond funds, and ETFs. Hence, their portfolio grows slowly and steadily, with maximum protection and the least possible risk.