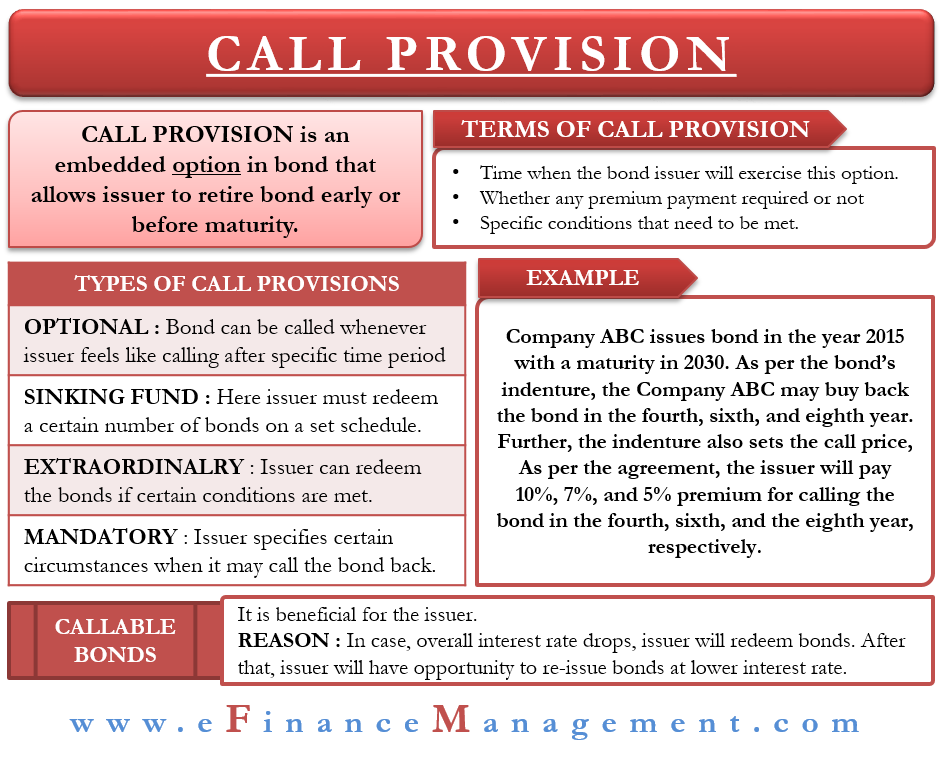

A Call Provision is a provision or a clause, or an embedded option in the bond that allows the issuer to retire the bond early or before maturity. It is a provision in a bond’s indenture that enables the issuer to call or redeem the full or part of the issue before the maturity date. It is only an option for the issuer, not an obligation.

One may also call it a redemption provision or a provision that makes the bond callable. Usually, the indenture may include one or more call dates.

An issuer generally exercises this provision when the interest rate drops. It allows the issuer to re-issue the bonds with lower interest rates. When the issuer uses this option, they redeem the bonds at par or a premium above the face value. After exercising the opportunity, the bondholder ceases to receive any more coupons.

A call provision is not just for the bonds but can be for other debt instruments as well, such as preference shares. The presence of such an arrangement makes that debt instrument less valuable to the investors as it limits their chances of earning a higher interest rate during the low-interest rate scenario.

Also Read: Callable Bonds

However, most callable bonds come with call protection to protect the bondholders. This call protection ensures that the bond stays alive for a certain period until which the issuer can’t exercise the call provision.

Usually, corporate and municipal bonds (not Treasury) are callable bonds. In 1984, the U.S. Treasury last came up with a callable bond. Even those bonds could only be called five years before the maturity date. Since then, every U.S. Treasury bond has been non-callable.

Terms of Call Provisions

An issuer can include any provision in the bond’s indenture as long as it is legal. Usually, a call provision will carry the following terms:

- The time when the bond issuer will use this option.

- Whether or not the issuer will pay any premium to the investor.

- What (if any) specific conditions need to be met before the issuer can exercise this option.

How does Call Provision work?

As said above, the bond’s indenture will include info on when and how the issuer will call the bond back. Let us understand the call provision with the help of an example.

Company ABC issues bond in the year 2015 with a maturity in 2030. As per the bond’s indenture, the Company ABC may buy back the bond in the fourth, sixth, and eighth years. Further, the indenture also sets the call price, i.e., the amount that the issuer needs to pay to redeem the bond. As per the agreement, the issuer will pay a 10%, 7%, and 5% premium for calling the bond in the fourth, sixth, and eighth years, respectively.

A point to note is that the premium decreases as we move towards the maturity date. This premium is known as the call premium, and it is the difference between the price that the issuer pays and the face value.

Types of Call Provisions

There are four types of redemption provision:

Optional

Under this, the issuer can call the bond whenever they want. Usually, such type of provision comes with a time limitation, which means that the issuer needs to wait for a specific time before calling the bond back.

Sinking Fund

Under a sinking fund, the issuer must redeem a certain number of bonds on a set schedule. For example, there may be a provision requiring the issuer to redeem 10% of the bonds each year. It will ensure that all the bonds are redeemed at the end of ten years.

Extraordinary

Under this, the issuer can redeem the bonds if certain conditions are met. For example, government issues bonds to raise money for a new road project. Such bonds may include a provision for extraordinary redemption if the project is scrapped.

Mandatory

It is similar to the extraordinary one. But under this, the issuer specifies certain circumstances when it may call the bond back.

Callable Bond – Good for Issuer

A callable bond usually benefits the issuer. In case the overall interest rate drops, the issuer will redeem the bonds. After that, the issuer will have the opportunity to re-issue the bonds at a lower interest rate. Or we can also say that the provision allows the issuer to refinance its debt when the interest rate drops below the standard that which issuer is paying on the bond.

On the other hand, if the overall interest rates go up, the issuer has no obligation to exercise the option. The issuer can continue to pay the interest on the bond at a rate that is less than the market rate.

The bondholders have an option to sell the security in the secondary market. However, they will get less than the face value due to a lower coupon rate.

Is it Bad for Investors?

A bond with a call provision is usually not in the interest of the bondholders. Though investors won’t lose the principal, they may lose interest. The presence of such a provision adds two risks for an investor.

First is the reinvestment risk. When the overall interest rates drop, the issuer is more likely to exercise the call provision. So, when the issuer uses the option, it leaves investors with cash. The investor needs to reinvest this cash in a low-interest-rate environment.

The other risk is that a call provision limits the potential price appreciation of the bond. In the falling interest rate scenario, the callable bonds may not get the type of appreciation they would have reached otherwise. As any appreciation in such a situation would remain maximum up to its call price. So, we can say that a real yield of such a bond is generally less than its yield to maturity.

Why Invest in Callable Bonds?

In all, we can say that callable bonds are worth less than similar non-callable bonds. But, if investors get fair compensation for taking such risks, then these bonds may not be a bad investment. The reward can be in the form of a premium paid to the investor when the issuer exercises the call option.

Also, the presence of call protection makes the bond less harsh on investors. Call protection, as said above, ensures that the issuer recalls the bond after a certain period.

Also, callable bonds usually offer a higher interest rate than a similar non-callable bonds. The higher interest rate is provided to the early call option exercising risk.

Final Words

A callable bond offering a higher coupon rate could be a good investment. However, if the objective of your investment is to fix a specific percentage of return for the long term, then such an investment may not be right for you.

RELATED POSTS

- Bond Indenture – Meaning, What it Includes, Advantages and More

- Call Options – Meaning, How it Works, Uses, and More

- Yield to Call – Meaning, Formula, Example and More

- In Substance Defeasance

- Stock Warrants – Features, Types, Benefits And More

- Receiver Swaption – Meaning, Pricing, Suitable For and More