What is Bankruptcy?

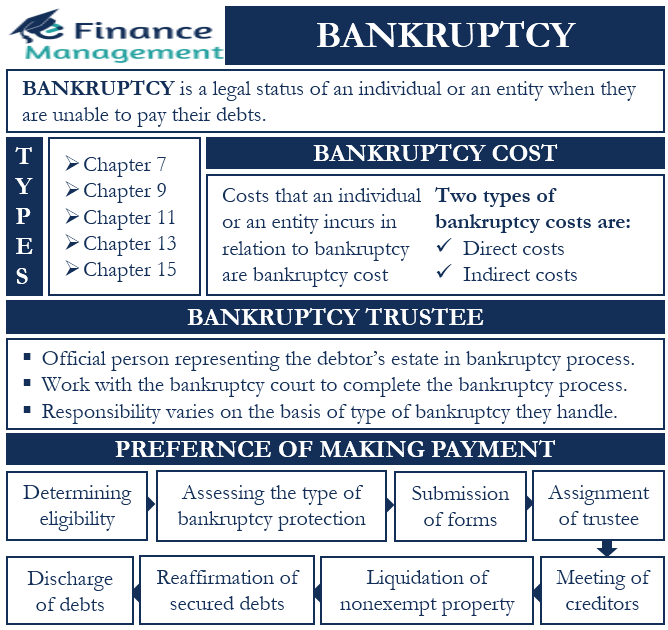

Bankruptcy is a legal status of an individual or an entity when they are unable to pay their debts. The process could release a firm or an individual from most of their debts and give them a chance to start, build or restructure again.

So, we can say that the process can end the debt collection and wage garnishment. Moreover, it could stop creditors from repossessing assets and foreclosing real estate. There could be many reasons why an individual files for bankruptcy. These reasons could be high leverage in capital structure, job loss, medical emergency, divorce, and more.

Types of Bankruptcies

Following are the most popular types:

Chapter 7

It is the most common bankruptcy, and we also call it a liquidation. In this, the remaining assets of a person or an entity are liquidated. The money from liquidation is used to pay back creditors. Under Chapter 7, the debtor is relieved from qualified, unsecured debt, such as credit card debt, personal loans, medical invoices, etc.

Chapter 9

Chapter 9 bankruptcy is mainly for municipalities such as cities and school districts. It helps them to pay back debts. It basically allows the municipality to restructure the debt and come up with a payback plan without losing its assets. Moreover, in the case of executing a repayment plan, this bankruptcy ensures that creditors do not get a hand on municipalities’ assets. This is also important from the perspective of maintaining continuous services to the public at large.

Chapter 11

Under Chapter 11, the company gets to keep running its business while liquidating its assets. Such a bankruptcy could result in a drastic reorganization of a company’s capital structure resulting in more equity and less debt. This bankruptcy is very tedious and expensive, and thus, it suits wealthy individuals and big companies.

Chapter 12

Chapter 12 bankruptcy is for family farmers and fishers. It enables family farmers and fishers to restructure their finances so as to avoid foreclosure or liquidation. Though it is similar to Chapter 13, it is more beneficial for farmers with massive debt and those who do not fall into Chapter 13 wage-earner classifications.

Chapter 13

This bankruptcy allows individuals to come up with a structured payment plan to repay the creditors. Such a bankruptcy suits high-income earners or those with valuable assets who do not want to part away with their assets. Unlike Chapter 7, Chapter 13 allows individuals to keep their assets while repaying the creditors. In Chapter 7, all non-exempt assets are seized or repossessed until an individual pays back the debt.

Chapter 15

It is the newest bankruptcy that deals mainly with international cases. This bankruptcy lays down principles for filing bankruptcy across borderlines, such as when bankruptcy involves more than one country.

Among all these types, Chapters 7, 11, and 13 are types of Voluntary Bankruptcy.

Bankruptcy Cost

The costs that an individual or an entity incurs in relation to the bankruptcy is what we call bankruptcy cost. This cost includes the costs that an individual or entity incurs both before and after the bankruptcy. These costs include legal fees, documentation fees, trustee/custodian fees, and more. These costs could vary from company to company.

There are primarily two types of Bankruptcy Costs:

- Direct costs

- Indirect costs

Bankruptcy Trustee

It is an official person that represents the debtor’s estate in a bankruptcy process. In the U.S., the United States Trustee, which is an officer of the Department of Justice, appoints the trustee.

The trustee has to work with the bankruptcy court to complete the process. A point to note is that the trustee can not act without permission from the court, and the bankruptcy judge has the final say on the distribution of assets.

The trustee’s primary role is to assess and recommend the debtor’s needs as per the U.S. Bankruptcy Code. But the responsibility can vary by the type of bankruptcy proceeding they are handling. For instance, under Chapter 7, the trustee’s primary responsibility is to oversee the sale of assets and distribution of the proceeds to the creditors. And in Chapter 11, the responsibilities are different as the debtor in Chapter 11 aims to emerge from bankruptcy and continuous operation.

Read more about the Responsibilities of a Bankruptcy Trustee with regards to Different Bankruptcies.

Bankruptcy Process

The following steps are common in all the types of bankruptcy:

Determining Eligibility

The very first step is to determine whether or not you are eligible to file for bankruptcy. As per the law, the petitioner needs to wrap up the credit counseling within 180 days of filing. So, unless you provide the court with a certificate of accredited credit counseling, you can not move forward with the bankruptcy.

Means Test

This is the process that involves assessing the assets and liabilities of the petitioner to determine what type of bankruptcy protection they are eligible for.

Submission of Forms

The petitioner now needs to provide relevant forms with accurate details to the bankruptcy court. If the petitioner fails to disclose any material information, it could lead to bankruptcy fraud. It is crucial that all assets and liabilities are part of the various schedules that you submit to the court with the petition.

Assignment of Trustee

After the petitioner files all the paperwork and the court finds it appropriate, the court will assign a trustee for the case. The trustee will help the debtor with the remaining bankruptcy process, including determining the assets that the petitioner can liquidate to pay the debt.

Meeting of Creditors

It is the meeting of all creditors, where the creditors can question the debtor on the details of debts submitted to the court. Creditors can also challenge the petitioner’s plan to discharge the debt.

Liquidation of Nonexempt Property

If there is any asset that one can liquidate to pay back the debt, then the trustee has to decide whether or not to seize that asset.

Reaffirmation of Secured Debts

The trustee will now work on the list of secured debts. In this step, the petitioner can reaffirm the debt. This means deciding whether or not the filer plan to continue making payments.

Financial Management Course

The process involves the debtor attending a financial management course on budgeting and finances. The primary objective of the course is to train the debtor so that one does not fall into similar financial issues again. The debtor will have to provide proof of the completion of the course.

Discharged of Debts

This step involves discharging the unsecured consumer debt. Once the petitioner discharges the debt, the bankruptcy gets complete. These debts could be credit cards, personal loans, and other similar debts. Now the debtor will be free from these debts and move ahead for a fresh start.

Preference for Making Payment

When someone goes bankrupt, they do not have enough money to pay back all the creditors. However, if the person pays back one creditor and not others, we call it a preferential payment.

Such preferential payment in bankruptcy could complicate things for an individual or an entity. So, when a court appoints a trustee, they can recover such money from the preference creditor. The trustee can then redistribute that amount among the creditors.

As per Section 547 of the U.S. Bankruptcy Code, if an entity or an individual pays any creditor within 90 days of filing, then the court has the power to recover that money. The two objectives of this provision are to ensure fairness and equality and make it harder for aggressive creditors to collect money from the person filing for bankruptcy.

Along with the 90 days requirement, there are a few more criteria for a payment to qualify as a preferential payment. For instance, the debt must be more than the assets, and the payment amount should be more than $600. The debt must be incurred before making the preferential payment. And the payment should be to a “non-insider” creditor.