What is the Retention Ratio?

The retention ratio is the quantum of earnings the business re-invests/retains in the business for future growth and other requirements. After realizing profits, a business has two options – distribute all the earnings/profits to the shareholders as dividends or retain the funds in the business for future requirements. A third option is the combination of these two options. That is to partially distribute the earnings as dividends to its shareholders and balance to keep with itself to invest it back in the business. The latter option is known as retained earnings. The use of the retained funds varies from business to business and is used at the discretion of the management and in accordance with the prevailing business dynamics.

How to Calculate Retention Ratio?

The retention ratio is thus the ratio of the retained earnings to the total earnings of the business for the year under consideration. There are various ways to calculate this ratio. And the relevant formulas are as below:

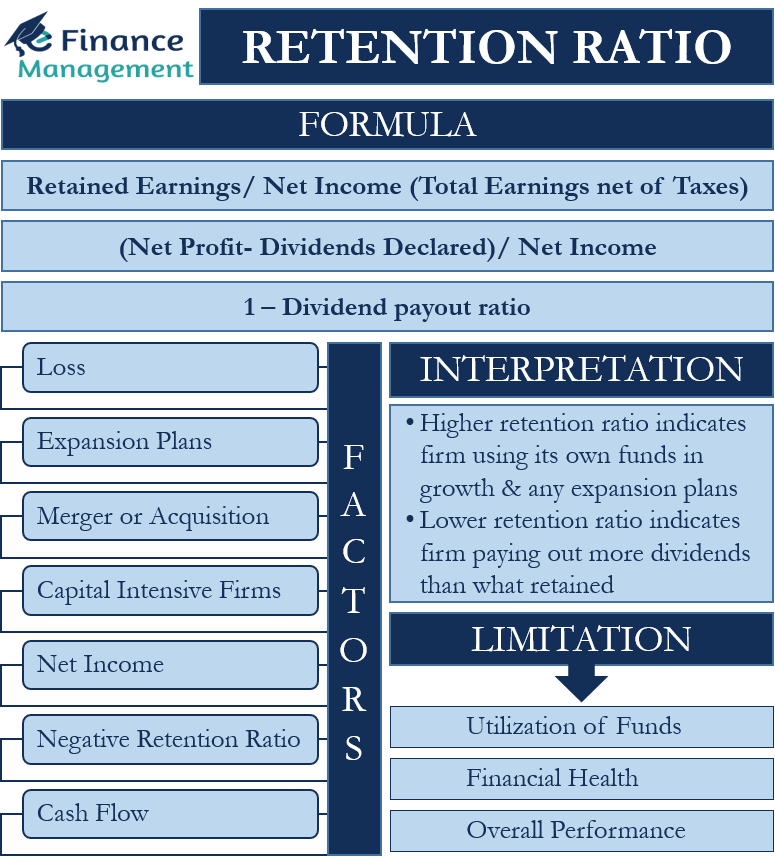

Retention Ratio Formula

Retained Earnings/ Net Income (Total Earnings net of Taxes)

Or

(Net Profit- Dividends Declared)/ Net Income

Or

1 – Dividend payout ratio

Where, Payout ratio = Dividends/Net income or Dividend per share/Earnings per share (EPS)

To calculate the Retention ratio,

1. one can pick up the retained earnings from the shareholder’s funds in the equity section of the balance sheet.

2. Another way is to deduct the total dividends declared from the Net profit of the year.

The retention ratio will help one understands the prospects of a firm. Ideally, when a firm is retaining a major chunk of its profits, it will usually fall under the bracket of growing firms. And, a stable firm will pay out more as cash to its shareholders. The prospects are different depending upon the stage of development the business is at.

Interpreting Retention Ratio

Growth is fuelled by capital, that is, money. If the firm is growing and hoarding profits, utilization is necessary for development. Idle cash does no good rather planning the cash in the desired manner to buy equipment, employ human capital or diversify the business.

Also Read: Retained Earnings Calculator

Retained earnings are like collecting the cash from profits to fuel the future funds or business. If a firm is short of cash, then it will have to meet the capital requirements by employing debt or equity. Heavy reliance on debt or equity makes a firm risky as an investment. Hence, choosing the right capital structure is crucial for long-term growth and success.

A higher retention ratio indicates the firm uses its own funds to fuel growth and any expansion plans. A lower retention ratio indicates the firm pays out more dividends than what it retains. The retention ratio varies from industry to industry.

Retention Ratio for Different Stages of a Company

The life cycle of a company or industry starts from the embryo stage, then goes to growth leading to maturity, and then the decline stage. The retention policy in each case is different. And comparing companies, from a single criterion of retention or dividend payout ratio, for two different industries or stages of development will not do justice. A growing, new start-up is likely to retain 100% of the earnings to sustain and expand into the development of the business. One such industry currently is the technology companies like Blockchain and Artificial Intelligence. And they are investing their profits to scale up and create a successful business. At the same time, a stable or matured company in the FMCG or telecommunication sector will prefer distributing dividends to its shareholders. Say, the stage of the company and the industry prospects play an important role in deciding the retention policy. Apple, for example, has a high retention ratio as it believes in innovation and up-gradation of technology. The plan makes sense as the firm retains a huge sum every year.

A higher retention ratio may create higher profits in the long term, increasing the value of the firm and hence its stock price. The investors benefit from the long-term capital gains from the company. This is, of course, subject to the performance and proper utilization of funds by the firm.

Also Read: Dividend Payout Ratio Calculator

As Warren Buffet says, a higher retention ratio is worth only when the company creates value for shareholders. He devised retained earnings to market value ratio, which indicates the value created by the firm. A 2.5 times ratio indicates the firm has created value twice that of the amount invested.

Factors Affecting the Retention Ratio

Many factors affect the retention ratio. This includes both qualitative and quantitative decisions.

Loss

One of them being losses. If a firm has not made profits since its inception, particularly when talking about start-up companies, then retaining money to grow and expand will be its first priority.

Expansion Plans

If a firm plans to diversify or expand its operations, it will be retaining a huge sum of its profits. The retained funds, along with the other sources of finance, will fund the business expansion plans.

Merger or Acquisition

As the retention ratio varies from year to year if a firm is planning to acquire or merge, then the policy of dividends can change. In such cases, a firm prefers to retain profits rather than pay out as dividends.

Capital Intensive Firms

Examples include automobiles; capital equipment manufacturers will require more cash to scale up their business. Hence, in the period of expansion, the retention rate might go high.

Net Income

As the denominator of the ratio is Net income, it is also affected by the earnings the firm makes in a given year.

Negative Retention Ratio

If the dividends paid to shareholders are higher than the profit earned during the year, then the retention ratio is negative. Tesla has negative retained earnings; this indicates that the firm is paying out more to its shareholders than what it earns. This means that Tesla has a negative retention ratio.

Cash Flow

The status of cash flow also affects the retention ratio or dividend distribution decision. Though earnings are good, the company faces a funds shortage (maybe higher working capital, stuck with large tax refunds, etc.). In such a situation also, the company would like to avoid or reduce the dividend quantum and would like to retain the maximum earnings.

Limitations of the Retention Ratio

Utilization of Funds

It does not indicate that the firm is utilizing the funds well. After the investments, the return is equally vital for the growth of the firm. The indication of efficiency has nothing to do with the higher or lower ratio.

Financial Health

Along with the retention ratio, a firm also has to look out for the Net profit the firm is generating. A high ratio does not always indicate the sound financial health of the firm.

Overall Performance

Like other financial ratios, it should not be viewed in isolation. Analyzing the ratio considering other ratios will provide a fair analysis of the overall performance of the firms.