Interest is an award that all debenture holders receive for investing in the debentures of a company. Usually, the company pays the interest at the regular interval at the pre-set rate of interest on its face value. The treatment of interest is that it is a charge on profit.

When a company issues the debentures, it is under the obligation to pay the debenture holder the interest at the pre-set rate at regular intervals until the company pays off the debentures. The percentage is a part and the parcel of the name of the debenture, such as 6% debenture, 11% debenture, etc., and the interest that is payable we calculate it at the nominal value of the debenture.

The company has to pay the interest to its debenture holders if it acquires any profit. The interest on debentures is a charge to the profit of the company. According to the Income Tax Act, 1961, the company should deduct income tax at the recommended rate from the interest payable on the debentures if it surpasses the guided limit. This is known as TDS (Tax Deducted at source). The company collects this tax and later deposits it to the income tax authorities. The debenture holders can assign the TDS amount against the tax due from them.

Read Characteristics of Debentures to learn more about it.

Treatment of Interest on Debenture In Accounting

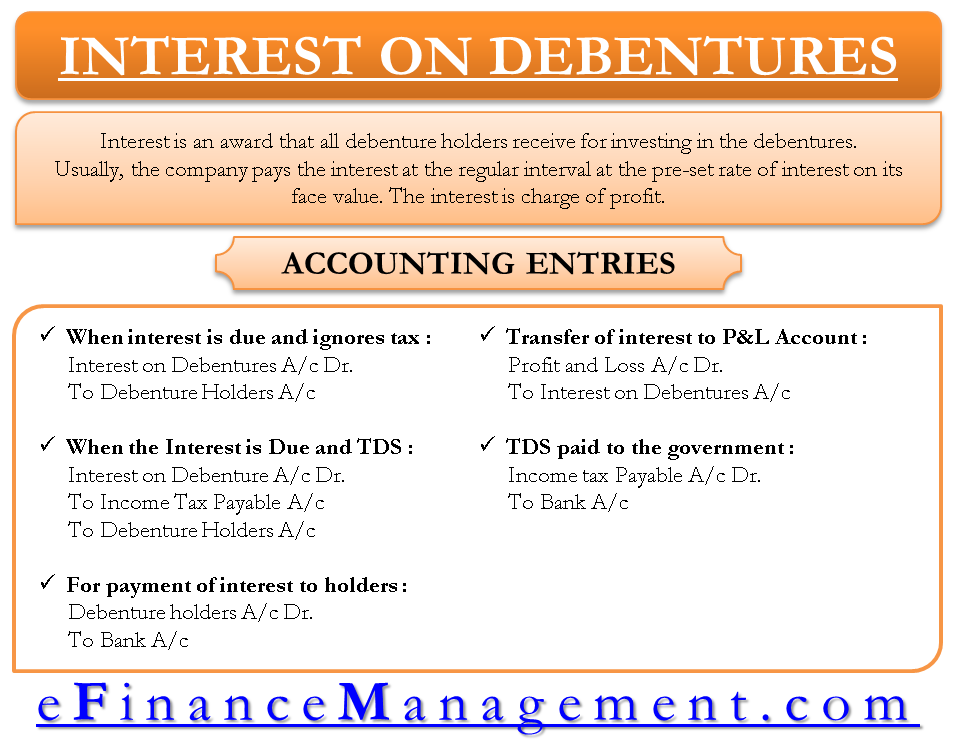

The journal entries that the company record in the books regarding the Interest on debentures;

Accounting Entries

When interest is due and ignores the tax

When the Interest is Due and tax deduction at source

For payment of interest to debenture holders

For payment of interest to debenture holders

Tax deducted at source paid to the government

Accounting entries for interest on debentures and TDS are as follows:

When interest is due and ignores the tax

Interest on Debentures A/c Dr.

To Debenture Holders A/c

(being interest payable)

When the Interest is Due and tax deduction at source

Interest on Debenture A/c Dr.

To Income Tax Payable A/c

To Debenture Holders A/c

(Being amount of interest due and tax deduction at source)

For payment of interest to debenture holders

Debenture holders A/c Dr.

To Bank A/c

(being the amount of interest paid to debenture Holders)

Transfer of interest on debentures to Profit and Loss Account

Profit and Loss A/c Dr.

To Interest on Debentures A/c

(interest on debenture account transferred to profit and loss account)

Tax deducted at source paid to the government

Income tax Payable A/c Dr.

To Bank A/c

( tax is paid to the government authorities)

Some points to remember regarding interest on debentures

- It is always a charge on the profit that the company acquires.

- It is calculated at a pre-set rate of interest at a nominal value

- The company does not pay interest on the debentures which are issued against the collateral securities

- The rate of interest is set at the time of issue of debentures

- At the end of the year, the balance of the interest on the debenture account is to be transferred to the profit and loss account

- If there is an amount of interest that is accrued and due to be paid is not paid, this is referred to interest accrued and due or interest outstanding

- The interest accrued (due or not due) on debentures is shown under the head Current Liabilities under the subhead other current Liabilities.

Illustration

A company issues 11 % debentures of 11 lakhs, redeemable at par after 6 years from the issue date. The company pays the Interest on debentures annually. The TDS rate is 20%. Pass the journal entries for year 1.

Also Read: Debentures in Accounting

Solution

When interest is due and ignores the tax

Interest on Debentures A/c Dr. 1,21,000

To Debenture Holders A/c 1,21,000

(being interest payable)

When the Interest is Due and tax deduction at source

Interest on Debenture A/c Dr. 1,21,000

To Income Tax Payable A/c 24,200

To Debenture Holders A/c 96,800

(Being amount of interest due and tax deduction at source)

For payment of interest to debenture holders

Debenture holders A/c Dr. 96,800

To Bank A/c 96,800

(being the amount of interest paid to debenture Holders)

Transfer of interest on debentures to Profit and Loss Account

Profit and Loss A/c Dr. 1,21,000

To Interest on Debentures A/c 1,21,000

(interest on debenture account transferred to profit and loss account)

Tax deducted at source paid to the government

Income tax Payable A/c Dr. 24,200

To Bank A/c 24,200

( tax is paid to the government authorities)

Read Debenture Accounting for a detailed article on accounting entries of issues and redemption of debentures.