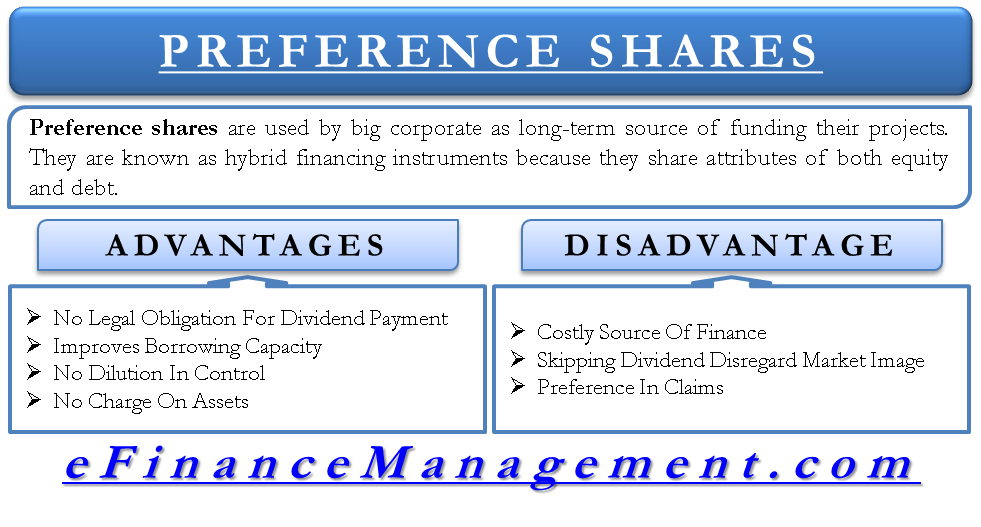

Preference shares are hybrid financing instruments having several benefits and disadvantages of using them as a source of capital. Benefits are – an absence of a legal obligation to pay the dividend, improved borrowing capacity, saves dilution in control of existing shareholders, and no charge on assets. The major disadvantage is that it is a costly source of finance and has preferential rights everywhere. Let us see more about the advantages and disadvantages of preference shares

Preference shares are used by big corporate as a long-term source of funding for their projects. They are known as hybrid financing instruments because they share attributes of both equity and debt. It is important to analyze the benefits and disadvantages of using preference shares as a medium of financing.

Benefits of Preference Share

There are several benefits of a preference share from the point of view of a company which we will discuss below:

No Legal Obligation for Dividend Payment

There is no compulsion to pay preference dividends because nonpayment of dividends does not amount to bankruptcy. This dividend is not a fixed liability like the interest on the debt, which has to be paid in all circumstances.

Improves Borrowing Capacity

Preference shares become a part of net worth and therefore reduce debt to equity ratio. This is how the overall borrowing capacity of the company increases.

Also Read: Preference Shares and its Features

No dilution in control

The issue of preference share does not lead to a dilution in control of existing equity shareholders. It is because there is no attachment between voting rights and the issue of preference share capital. The preference shareholders invest their capital with a fixed dividend percentage, but they do not get control rights with them.

No Charge on Assets

While taking a term loan, security needs to be given to the financial institution in the form of primary security and collateral security. There are no such requirements, and therefore, the company gets the required money, and the assets also remain free of any charge.

Disadvantages of Preference Share

Costly Source of Finance

Preference shares are considered a very costly source of finance which is seen when compared with debt as source of finance. The interest on the debt is a tax-deductible expense. In contrast, the dividend of preference shares is paid out of the company’s divisible profits, i.e., profit after taxes and all other expenses. For example, the dividend on preference share is 9%, and the interest rate on debt is 10%, with a prevailing tax rate of 50%.

The effective cost of preference is same i.e. 9% but that of the debt is 5% {10% * (1-50%)}. The tax shield is the main element that makes all the difference. In no tax regime, the preference share would be comparable to debt, but such a scenario is just an imagination.

Also Read: Types of Preference Shares

Skipping Dividend Disregard Market Image

Skipping dividend payments may not harm the company legally, but it would always create a dent on its image. While applying for debt or any other kind of finance, the lender would have this as a major concern. Under such a situation, counting the skipping of dividends as an advantage is fancy. Practically, a company cannot afford to take such a risk.

Preference in Claims

Preference shareholders enjoy a similar situation to that of an equity shareholder but still get a preference in both payments of their fixed dividend and claim on assets at the time of liquidation.

Quiz on Advantages and Disadvantages of Preference Shares

This quiz will help you to take a quick test of what you have read here.

RELATED POSTS

- Cost of Preference Share Capital

- Preferred Stock Vs Bond: Meaning, Differences and More

- Convertible Preference Shares –Meaning, Advantages, and More

- Hybrid Financing and Various Such Instruments

- Advantages and Disadvantages of Equity Finance – from Company’s Angle

- Benefits and Disadvantages of Debentures

Sir I invested money in micro leasing and funding ltd odisha in cumulative preference share . can I refund my invested money