Understanding the Term: Asset Refinance

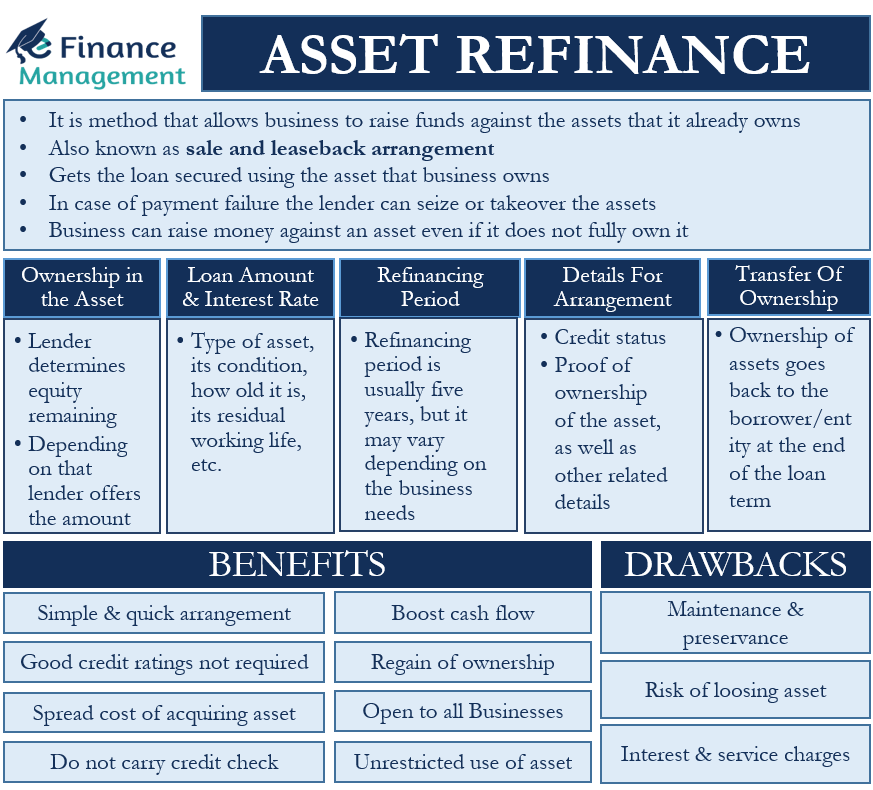

Asset Refinance is one of the ways in which a business can raise money for asset financing. It is one of the sources of finance for assets. Basically, it is a method that allows a business to raise funds against the assets that it already owns. Using this method, a business is able to free up cash tied to the asset it owns, thereby giving it quick access to funds. Another name of such type of financing is the sale and leaseback arrangement.

Similar to asset-based lending, asset refinancing enables a business to get the money that is secured using the asset that a business owns. Since the assets work as security in all such fundraise, timely repayment is of utmost importance. Else, in case of any failure of payment, the lender will have the right to seize or take over the asset provided for the security of the funding.

Thus, as we have discussed above, asset refinancing is a secured form of financing. A business can use a wide range of its assets for financing, including machinery, equipment, property, vehicles, and more. A business can put one or more assets for asset refinance depending on the money they need. Funds that a business gets from such a method can be used for any business purpose, such as towards working capital, buying new equipment, and more.

A point to note is that in asset refinancing, a business can raise money against an asset even if it does not fully own it. The amount of money a business gets, however, depends on the extent of ownership of that asset. So, we can say that the amount of money a business gets depends on the equity value of the asset that a business commands.

How it is Different from Asset Finance?

After reading the above points, many may question how it is different from asset finance, which also enables a business to get a loan against the asset. Though the two are similar, the difference is in the situation in which they apply.

Asset finance, for instance, comes into play when there is not any preexisting loan agreement. Basically when the asset is fully owned or there is no encumbrance upon that. It is, however, exactly the opposite in the case of asset refinancing. In such a situation the entity does have any existing loan arrangement on that asset.

Secondly, the loan agreement period is not yet over with regard to that asset. If the loan agreement is over or fully paid then it will become asset finance and not refinance.

Asset Refinance – How it Works?

Extent of Ownership in the Asset

In asset refinancing, it is the lender who determines how much equity is remaining in the asset of the business. Depending on the remaining equity, the lender offers a certain percentage of it as a lump sum. This way higher the extent of ownership in that asset, the higher will be the capacity to borrow.

Also Read: Difference Between Lease and Finance

For example, suppose a business acquires an asset using a hire purchase agreement and some balance is still left. Even in such a case, a business can raise funds using that asset. The lender, in this case, will pay off the hire purchase company, and then loan the money depending on the equity the business has.

So, in a way, a business transfers the ownership to the new lender while continue using the asset. We can also say that a business leases it back from the lender in exchange for monthly payments. This is why we call this method a sale and leaseback agreement.

Factors Deciding Loan Amount and Interest Rate

Other factors that determine the amount of money a business gets are the type of asset, its condition, how old it is, its residual working life, etc. These are the very factors Lenders use to decide and determine the interest rate to be charged for the arrangement.

Refinancing Period

The refinancing period is usually five years, but it may vary depending on the business needs. And, the repayment depends on the income that the asset is likely to generate.

Transfer of Ownership

The ownership of assets goes back to the borrower/entity at the end of the loan term. Or whenever the entire loan outstanding stands are cleared.

Details needed for such Arrangement

To apply for such financing, a business usually has to provide its credit status. Also, the business needs to provide proof of ownership of the asset, as well as other related details, such as year of purchase made, model, usage, and more.

Benefits of Asset Refinance

Following are the benefits of asset refinancing:

- It is a very simple and quick way for arrangement of funds.

- Along with giving funds, such a method gives the business an unrestricted use of the asset if the business meets the terms and conditions of the lender.

- Helps to spread the cost of acquiring the asset.

- Since the financing terms are usually fixed, a business can efficiently manage its budget.

- It helps a business boost their cash flow.

- Business gets back the asset ownership after the end of the agreement.

- Such an option is open to business even if it does not have a good credit rating, or did not qualify for an unsecured commercial loan.

- A business can get refinancing even if it does not have full ownership of the asset.

- Such a financing option is open to businesses of all types and sizes.

- Lenders do not usually carry a credit check to approve the loan.

Drawbacks of Asset Refinancing

Following are the drawbacks of asset refinancing:

- Interest and service charges may make this method more expensive to a business than using their own funds.

- The biggest issue and the risk remains of loosing the asset if it fails to make timely payments.

- Maintenance and preservance of the asset remains the responsibility of the business though the ownership rests with the lender.

Why go for Asset Refinance?

A business must consider the asset refinancing option if it is asset-rich but cash-poor. Doing this allows a business to leverage the value of its assets and free up valuable working capital to help a business grow.

Such a method could also prove a viable option for buying assets for which the hire purchase or lease arrangements are not available. Also, if the business needs extra working capital, or has an emergency cash need, then also a business can consider this option.

Moreover, even if a business does not have a decent credit rating and business performance, this option could prove very useful. Such financing could also offer an alternative line of credit to a business without impacting its existing bank financing.