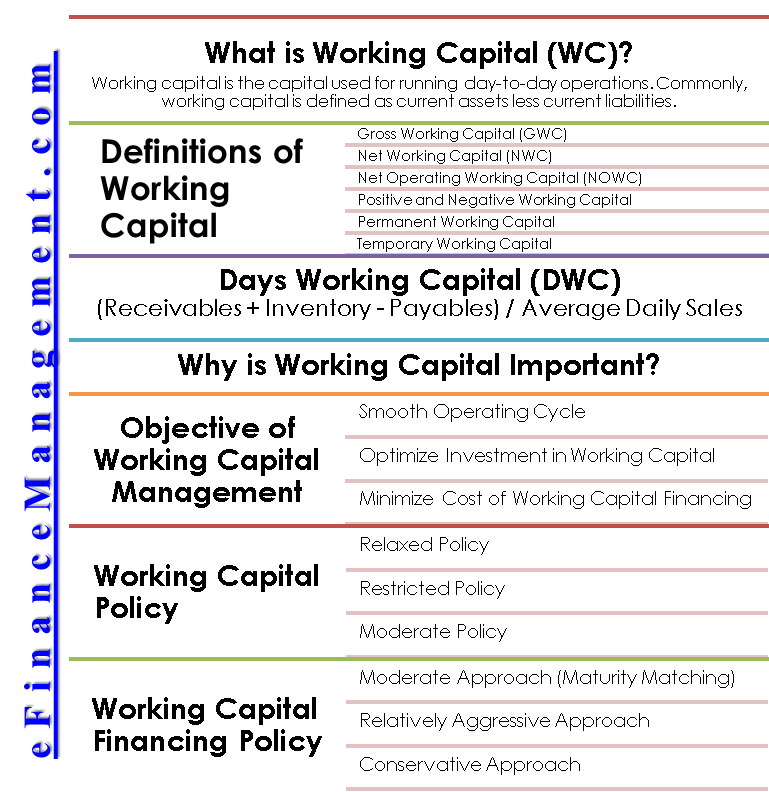

What is Working Capital?

Working capital (WC) is the capital that helps in running the day-to-day operations of a business. It is the gap between the current assets and current liabilities. WC is the lifeblood of a business and is concerned with financing for the short term.

It has various names such as revolving or fluctuating capital. The formula to calculate it is as follows:

Working Capital = Current Assets – Current Liabilities

Components of Working Capital

As stated in the above formula, WC is the excess of current assets over current liabilities. Thus, it has two components:

Current Asset

Assets that get converted into cash within a period of twelve months are current assets. These include cash and bank balance, accounts receivable, inventory, or any other assets that can be liquidated within one year.

Current Liability

Liabilities that are due for payment within a period of twelve months are current liabilities. These include accounts payable, outstanding expenses, short-term borrowings, and other liabilities maturing within one year.

Various Definitions of Working Capital (WC)

There are many prevalent definitions of WC for different contexts and purposes. These are also known as the various types of working capital. Let us try and cover each of the definitions first:

- Gross Working Capital (GWC): It refers to the Current Assets (CA) available with the business.

- Net Working Capital (NWC): When gross WC is reduced by the amount of current liabilities available with the business, it is called net WC.

- Net Operating Working Capital (NOWC): This concept is similar to net WC. The only difference is that it considers only the operating current liabilities and operating current assets

Non-operating current assets are those that are not used for the business’s core operations. And on similar grounds, non-operating current liabilities are those liabilities that are not related to the business’s core operations. Non-operating current assets include marketable securities, cash in excess of operating requirements, and other current investments not used for the core operations.

- Positive and Negative Working Capital: Positive working capital is when NWC or NOWC is positive. When they are negative, it is negative working capital.

- Permanent Working Capital: A certain level of working capital always remains invested in the business. The level of working capital never goes below this. This level of working capital is permanent (or fixed) working capital.

- Temporary Working Capital: You get temporary working capital when you reduce the permanent WC from the net operating WC. Temporary working capital keeps fluctuating.

Permanent and temporary working capital is nothing but the bifurcation of net operating working capital based on a fluctuation. The primary reason to bifurcate is to achieve financing efficiencies. For example, long-term financing options can finance permanent working capital needs and on the contrary, short-term financing options can finance temporary WC.

- Zero Working Capital: It is a new trend in the business world. Here, the level of current assets is equal to the level of current liabilities.

Days Working Capital (DWC)

Day’s working capital is a measurement of working capital requirements based on the time period. It is an approximate method to calculate the working capital requirements. It indicates that in how many days cash invested in the raw material is received back by the business in the form of collection from Debtors. Based on the working capital cycle, the working capital requirement is calculated as under:-

Annual Expense of the Business*Working Capital Cycle/ 365 Days

The above calculation assumes that the annual expenses are spread evenly throughout the year.

It works as a performance indicator. The lower the days’ working capital, the better the performance in terms of a business’s ability to manage its WC.

Also Read: Days Working Capital (DWC)

Why is Working Capital Important?

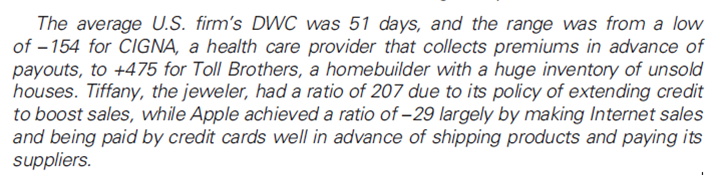

Why is it a crucial term? And why do organizations throw a lot of importance on their management? Look at the excerpt from the book Financial Management by Brigham.

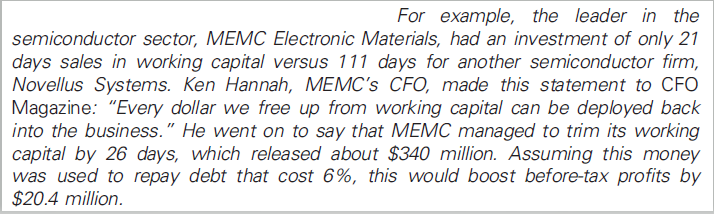

After reading this, you can dedicate the variation in DWC to different operating environments of different industries. You will find huge variations within industries also. Just read the following:

I hope this will make us realize the importance of the management of working capital.

Objectives of Working Capital Management

Since working capital affects the routine activities of a business, its effective utilization becomes the key concern for management. There are 3 primary objectives of working capital management, viz.

- Smooth operating cycle

- Optimize investment in WC

- Minimize the cost of working capital financing

Working Capital Financing Strategies

On moving toward the end of this article, a question that still remains unanswered is – “how does a business fulfill the working capital financing needs?”. A business can opt from various sources available to finance its working capital. But, what mix of long and short-term options works best? There are three most prevalent working capital financing strategies. These take the concept of permanent and temporary working capital as the basis for long-term and short-term financing options respectively.

- Maturity matching or hedging strategy

- Conservative strategy

- Aggressive strategy

Working Capital Financing Policies

On the basis of the above-mentioned financing strategies, a business may frame its policies on how much to invest in current assets. These policies are working capital financing policies. There are three types of working capital financing policies.

- Relaxed policy

- Restricted policy

- Moderate policy

Wrapping Up

Working capital is financing for the short-term. Its mismanagement may lead to the failure of the business as a whole. The requirement for WC varies from industry to industry and even from business to business in the same industry. There are various factors that determine its quantum.

Also, read Operating Capital to learn about the difference between working capital and operating capital.

You are a genius, I’m so proud of your voluntary contribution and sacrifice to the finance industry, I’m a private banker and an investor in private companies-Dickson… Dallas Texas, USA.

Thank You So Much for such an insightful article