Understanding Bank Guarantee

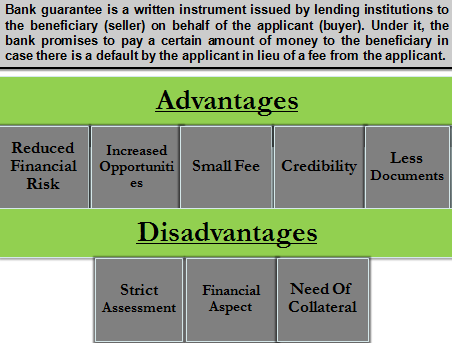

A Bank guarantee is a written instrument issued by lending institutions to the beneficiary (to whom the guarantee is provided, generally the seller) on behalf of the applicant (generally, the buyer). As the name suggests, under it, the bank promises to pay a certain amount of money to the beneficiary in case there is a default by the applicant. It basically compensates the beneficiary (seller) if the applicant (buyer) fails to make payment for the same. The bank charges a fee from the applicant for undertaking such a guarantee. Let us see in detail the advantages and disadvantages of a bank guarantee.

Advantages of Bank Guarantee

Reduction of Financial Risk

The need for bank guarantees arose because of the increased defaults by the buyers. Sellers were not willing to supply goods to unknown buyers without receiving payments. A sense of mistrust was present. Bank guarantees solved this issue by acting as an assurer to the seller, i.e., the beneficiary in our case. The sellers, after obtaining bank guarantees, are ready to supply goods. It brought down their financial risk to a substantially low level.

Increased Opportunities

By having bank guarantees itself, a business can grasp opportunities in the market that were previously unavailable to it. Public perception would be developed that a bank stands with a particular business. Having a bank as a partner is always a sign of the inherent strength and faith in the business.

Small Fees

The fees charged by the banks are also very nominal. It ranges from about 0.5% – 1% of the amount guaranteed by the bank. Due to its nominal nature, the fees do not significantly impact the profits of the business.

Also Read: Bank Guarantee

No Need for Advance Payments

Advance payments to the sellers have become a thing of the past. It means that the buyer can defer his cash outflow to a later date. By deferring payments, the available funds can be utilized currently to fuel extra growth.

Increased Credibility

Banks exercise extensive credit monitoring. They have specialized staff and tools that can accurately assess a business’s financial health. Hence, the credibility of the entity enhances as the banks back it. The banker’s trust would reflect that the performance of the business is great and that there is no risk of default.

Less Documentation

In bank guarantees, there is a lesser requirement for documentation. Only the information about the concerned parties, the details about the transaction about which guarantee is sought, financials of the applicant are generally demanded by the banks. The level and extent of documentation may change depending on the lender’s policy and credit period.

Disadvantages of Bank Guarantee

Strict Assessment by Banks

When the applicant approaches the bank seeking a bank guarantee, the bank assesses the applicant’s creditworthiness and financial health. The bank makes an elaborate financial analysis of the applicant before issuing such a guarantee. Sometimes, this process becomes quite complicated, leading to either obtaining no guarantee or causing hindrances in getting a guarantee.

Also Read: Letter of Guarantee

Financial Considerations

Another demerit of bank guarantee is that it is unsuitable for loss-making businesses. The banks even refrain from entities with low cash reserves, weak credit policies, etc. Moreover, businesses that operate on a low-profit margin are hesitant to take bank guarantees as their margins are not significant enough to absorb fees.

Collateral

Charging a certain fee for extending bank guarantees is sometimes not enough. The banks may demand collateral in the form of movable assets of the company. The banks would also like to cover themselves if they had to make the payment to the beneficiary. Pledging collateral security with a bank would reduce the company’s strength to finance its working capital in the future.

Conclusion

A Bank guarantee has its own advantages and disadvantages. Before applying for a bank guarantee, a business must make a complete analysis of its financial situation and requirements. The decision to obtain a bank guarantee must be thoughtful, keeping in mind the risks involved, the forecasted business performance, and the stability of the business. The benefits of a bank guarantee like smooth domestic or international trade, expansion of operations, enhancement of creditworthiness, etc., should also be considered.

Continue reading Stand by Letter of Credit vs. Bank Guarantee.