What is Factoring Accounting?

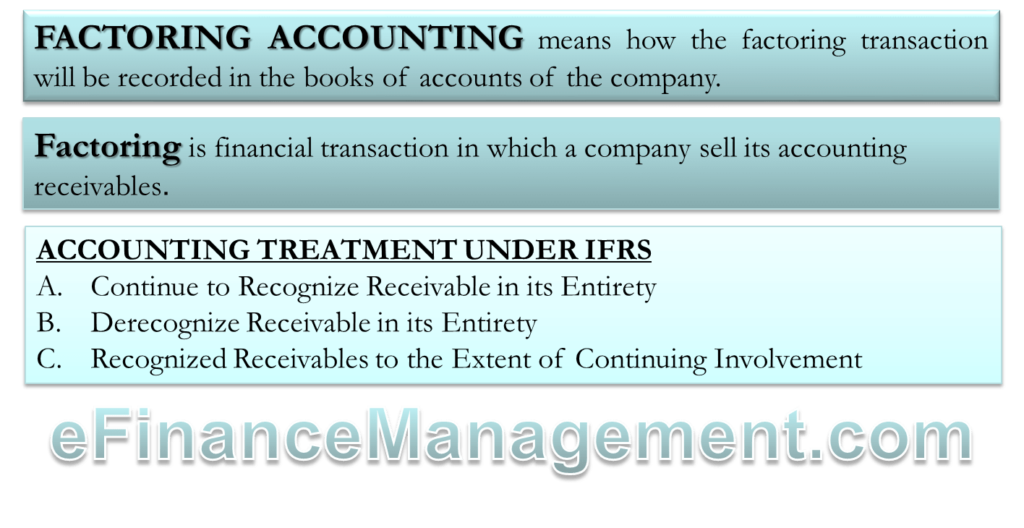

Factoring Accounting means how the factoring transaction will be recorded in the books of accounts of the company. Before we understand what is factoring accounting, we should understand what is factoring?

Factoring Definition

Factoring, also known as invoice factoring, is a financial transaction in which a company sells its accounting receivables. It is sold to a finance company, also known as the factor, at a discounted price for cash. Factoring is also known as accounts receivable factoring or account receivable financing.

Accounting Treatment under IFRS

IFRS 9 narrates about what is accounting treatment of invoice factoring, which is as follows.

Continue to Recognize Receivable in its Entirety

If the seller has to continue to recognize the receivables in their entirety, then the seller has to recognize the financial liability for the price (Consideration) received from the factor.

The asset & liability are recognized, measured & extinguished in line with the guidance of IFRS.

Derecognize Receivable in its Entirety

On derecognition of the financial asset in its entirety, the receivable against the debtor is replaced with receivable against the factor. Any difference between the carrying amount & sum of the price (consideration) shall be recognized in profit & loss.

Also Read: Recourse and Non-Recourse Factoring

Recognized Receivables to the Extent of Continuing Involvement

The extent of the seller’s continuing involvement in the transferred receivables is the extent to which it is exposed to changes in the value of receivables. For example, the seller’s continuing involvement takes the form of guaranteeing the credit risk of the transferred receivables. The extent of continuing involvement is lower of:

Amount of the receivable or the maximum amount of the consideration received that the Seller could be required to repay (‘the guaranteeing amount’)

Accounting Treatment for Factoring With Example

Now, the question is, what is the accounting treatment of such a transaction. Let us understand it with an example.

ABC Inc. has accounts receivables of $ 100,000. The company enters into a factoring agreement with XYZ Inc. factoring company. XYZ Inc. is ready to advance 80% & the rest will be kept as reserve. The factor will charge fees of 3% of receivables. ABC Inc. will receive any excess of a retained amount over bad debt after 3 months. One of the customers having a due of $ 25,000 has defaulted.

Journal entries in the books of ABC Incorporation

i) While Factor gives advance to ABC Incorporation

| Particulars | Debit | Credit |

| Cash

Loss of factoring Due from factor Accounts receivables | $ 77,000

$ 3,000 $ 20,000 |

$ 100,000 |

ii) After a customer has paid, ABC Inc. receives the reserve amount from the factor:

Retained amount = $ 100,000 – $ 77,000 – $ 3,000 = $ 20,000

Cash advance = $ 100,000 * 80% = $ 80,000 – $ 3,000 (Fees) = $ 77,000Loss on factoring (Fees) = $ 100,000 * 3% = $ 3,000

Since the bad debt amount is more than retained amount, ABC Inc. will pay $ 5,000 to XYZ Inc. as the risk is of ABC Inc. under factoring with recourse.

Under factoring with recourse:

| Particulars | Debit | Credit |

| Provision of bad debt

Due from factor Cash | $ 25,000 |

$ 20,000 $ 5,000 |

Under factoring without recourse:

| Particulars | Debit | Credit |

| Provision of bad debt Due from factor | $ 20,000 |

$ 20,000 |

Since XYZ Inc. bears all the risk, under factoring without recourse, ABC Inc. is not liable to pay any amount to XYZ Inc.

I need any updates you get please