What is CAPM?

As the name itself suggest, the Capital Asset Pricing Model (CAPM) is used for pricing the security with a given risk. This model describes the relationship between the expected return & risk in investing security. This article describes the advantages & disadvantages of CAPM.

CAPM shows that the expected return on a security is equal to a risk-free return plus a risk premium, which is based on the beta of the security. Assumptions of CAPM are the heart of the model.

Formula of CAPM

Ra = Rf + Ba (Rm-Rf)

Where,

Ra = Expected return on a security

Rf = Risk-free rate

Rm = Expected return of the market

Ba = Beta of the security

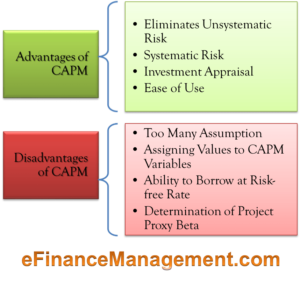

Advantages of CAPM

Eliminates Unsystematic Risk

CAPM assumes that the investor holds a diversified portfolio, similar to a market portfolio. A diversified portfolio eliminates unsystematic (specific) risk.

Systematic Risk

CAPM considers systematic risk, which is left out of other return models, such as the dividend discount model. Systematic risk, also known as market risk, is an important variable because it is unforeseen and often cannot be mitigated as it is not fully expected.

Investment Appraisal

An investor can also use CAPM for investment appraisal compared to other rates; it offers a superior discount rate. This model clearly links required return & systematic risk.

Ease of Use

CAPM is a simplistic calculation that can be easily stress-tested to derive a range of possible outcomes. Those outcomes provide confidence around the required rate of returns.

Disadvantages of CAPM

Too Many Assumptions

The CAPM model is based on too many assumptions, which many criticize as unrealistic. Therefore, it may not provide the correct results.

Assigning Values to CAPM Variables

Risk-free Rate (Rf): The commonly accepted rate used as the Rf is the yield on short-term government securities. The problem with using this input is that the yield changes daily, creating volatility.

Return on the market (Rm): The return on a stock market is the sum of the average capital gain and the average dividend yield. The market return can be negative in a short-term market. As a result, the long-term market return is utilized. The other major drawback is that these returns are backward-looking & not futuristic.

Beta (B): Beta values are regularly published on all stock exchanges regularly for all listed companies. The issue here is that uncertainty arises in the value of the expected return because the value of beta is not constant but changes over time.

Also Read: Cost of Equity (CAPM Model) Calculator

Ability to Borrow at Risk-free Rate

There are four major assumptions of CAPM. One of the assumptions is that investors can borrow & lend the funds at a risk-free rate. This assumption is unrealistic for the real world. Individual investors are unable to borrow or lend at the same return as the US government.

Therefore expected return calculated by the CAPM model may not be correct in this situation.

Determination of Project Proxy Beta

The problem may arise in using the CAPM to calculate a project-specific discount rate. Generally, equity beta & portfolio/investment beta are different. Therefore, the company needs to find a proxy beta for the project.

However, finding accurate proxy beta might be difficult and can affect the reliability of the outcome.

Conclusion

Research has shown the CAPM stands up well to criticism, although attacks against it have been increasing in recent years. Until something better presents itself, the CAPM remains a very useful item in the financial management toolkit.

That’s a great job