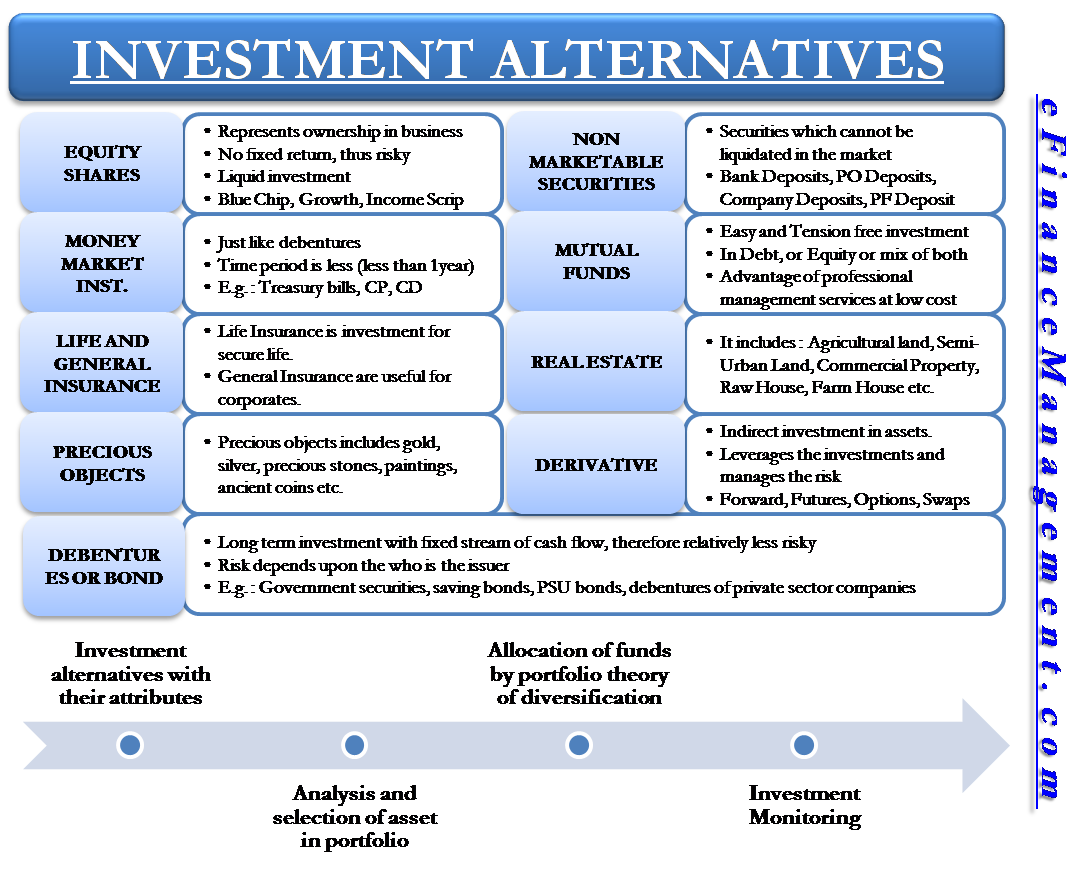

Different avenues and investment alternatives include share market, debentures or bonds, money market instruments, mutual funds, life insurance, real estate, precious objects, derivatives, non-marketable securities. All are differentiated based on their different features in terms of risk, return, term, etc. Let us see more about the investment avenues.

Investment Avenues

Are you searching for investment alternatives for parking idle funds? This article provides a comprehensive list of such investment alternatives. Investment in any of the options depends on the investment objectives, needs, and requirements of the investor. Corporates and individuals have different needs. Before investing, these alternatives of investments need to be analyzed in terms of their risk, return, term, convenience, liquidity, etc.

Equity Shares

Equity investments represent ownership in a running company. By ownership, we mean to share in the profits and assets of the company, but generally, there are no fixed returns. It is considered a risky investment, but at the same time, depending upon the situation, it is a liquid investment due to the presence of stock markets. There are equity shares for which there is regular trading; for those investments, liquidity is more otherwise; liquidity is not highly attractive for stocks with less movement. Equity shares of companies can be classified as follows:

- Blue-chip scrip

- Growth scrip

- Income scrip

- Cyclical scrip

- Speculative scrip

Debentures or Bonds

Debentures or bonds are long-term investment options with a fixed stream of cash flows depending on the quoted interest rate. They are considered relatively less risky. The amount of risk involved in debentures or bonds depends on who the issuer is. For example, if a government makes the issue, the risk is assumed to be zero. However, investment in long-term debentures or bonds has risks in terms of interest rate risk and price risk.

Suppose a person requires an amount to fund his child’s education after five years. He is investing in a debenture, with a maturity period of 8 years, annually with coupon payment. In that case, there is a risk of reinvesting coupons at a lower interest rate from the end of year 1 to the end of year five, and there is a price risk for an increase in the rate of interest at the end of the fifth year, in which price of a security falls. In order to immunize risk, investment can be made as per the duration concept. The following alternatives are available under debentures or bonds:

- Government securities

- Savings bonds

- Public Sector Units bonds

- Debentures of private sector companies

- Preference shares

Money Market Instruments

Money market instruments are like debentures, but the time period is less. It is generally less than one year. Corporate entities can utilize their idle working capital by investing in money market instruments. Some of the money market instruments are

Mutual Funds

Mutual funds are an easy and tension-free investment, and they automatically diversify the investments. A mutual fund is an investment only in debt or equity or a mix of debts and equity and ratio depending on the scheme. They provide benefits such as a professional approach, benefits of scale, and convenience. Further investing in a mutual fund will get the advantage of professional portfolio management services at a lower cost, which otherwise was impossible. In the case of an open-ended mutual fund scheme, a mutual fund gives investors assurance that a mutual fund will provide support to the secondary market. There is absolute transparency about investment performance to investors. On a real-time basis, investors are informed about the performance of the investment. In mutual funds also, we can select among the following types of portfolios:

- Equity Schemes

- Debt Schemes

- Balanced Schemes

- Sector Specific Schemes etc.

Life Insurance and General Insurance

They are one of the crucial parts of good investment portfolios. Life insurance is an investment for the security of life. The main objective of other investment avenues is to earn a return, but the primary goal of life insurance is to secure our families against the unfortunate events of our death. It is popular among individuals. Other kinds of general insurance are helpful for corporates. There are different types of insurance which are as follows:

Also Read: Portfolio Investment

- Endowment Insurance Policy

- Money Back Policy

- Whole Life Policy

- Term Insurance Policy

- General Insurance for any kind of assets.

Real Estate

Every investor has some part of their portfolio invested in real assets. Almost every individual and corporate investor invest in residential and office buildings. Apart from these, others include:

- Agricultural Land

- Semi-Urban Land

- Commercial Property

- Raw House

- Farm House etc

Precious Objects

Precious objects include gold, silver, and other precious stones like diamonds. Some artistic people invest in art objects like paintings, ancient coins, etc.

Derivatives

Derivatives mean indirect investments in the assets. The derivatives market is growing at a tremendous speed. The significant benefit of investing in derivatives is that it leverages the investment, manages the risk, and helps in doing speculation. Derivatives include:

- Forwards

- Futures

- Options

- Swaps etc

Non-Marketable Securities

Non-marketable securities are those securities that cannot be liquidated in the financial markets. Such securities include:

- Bank Deposits

- Post Office Deposits

- Company Deposits

- Provident Fund Deposits

Read more about Portfolio Management.

Steps or Process of Selecting Investment Alternatives

Investment Alternatives with their Attributes

Investment alternatives for any person are divided into real and financial assets. Real assets deal with property, precious objects, etc. Though real asset takes a large portion of money when it comes to investment, significant efforts for making investment decision are dedicated to financial assets. Any investment has two aspects – time and risk. An investment in an asset is a sacrifice of current consumption to get some return in the future. Assets are expected to generate cash flows, and the probabilities of variation in the expected cash flow in the future give rise to risk. So, all the alternatives are analyzed for their time and risk factor before selecting a particular asset for investment.

Analysis and Selection of Assets in a Portfolio

Broadly, the investment in the financial asset can be divided into equity, debt, and cash or cash equivalent. These alternatives play an important role in building a portfolio. One asset helps in offsetting the weakness of the other. But, even within these broad financial assets, there are many alternatives available. So, the question arises, “where to invest?” or “which asset to select?” Just building a portfolio will not ensure a better return. So, a proper analysis should be carried on before deciding the specific securities among different asset classes. In the case of stocks, generally, fundamental or technical analysis is adopted. Whereas, in the case of debt, factors like yields, rating, tax shelter, and liquidity are considered. A part of the portfolio is also allocated to cash and cash equivalent for liquidity and contingencies or any sudden opportunity.

Allocation of Funds by Portfolio Theory of Diversification

The riskiness of an asset can be measured alone and also in a portfolio. The magic of diversification can be seen when assets are assessed in a portfolio. So, portfolio theory emphasizes that instead of investing your money into one asset, spread it between different investment alternatives. However, what amount should be allocated to what asset class or alternative depends on an individual’s investment objective and constraint? Within the parameter of one’s objectives, a better return can be achieved with the help of proper investment management.

As soon the money is divided into different assets, the attributes of all these assets form a base for assessing the portfolio, e.g., risk & return of individual investment avenues. The expected return of a portfolio is the weighted average of the expected returns on the individual asset with weights as the percentage of the portfolio or the amount of investment in the individual asset. Please note that the portfolio risk is not the weighted average of the risks of individual securities. Instead, the risk is measured by considering the covariance of securities. Therefore, mixing asset classes can help moderate the risk.

Investment Monitoring

Investment management does not just end with building the portfolio, but the work starts here. Now, one needs to monitor, review and upgrade it regularly. An investor should make sure that at the correct time investment is made and at the proper time investment is sold. Also, performance evaluation of the same is crucial because feedback of results can only ensure you whether you have made the right investment decisions or not. No time is too late to build a portfolio because it can be tailored as per the needs and objectives of the individual. However, a better return can be achieved if one believes in and follows the investment management process.

Quiz on Various Avenues and Investments Alternative

It is a nice information

thank you for making it simple..n understandable

thank you for providing all compleate information about investment avenues

Thank you for providing very simple important information.

very good but can be added more financial avenue like public provident fund (PPF ) , Sukanya samradhi account etc , thanks for writing.

I am a senior faculty in the department of commerce at Telangana university. I referred your study material it is more useful to the students.

Tq

I need this kind of explanation…easy to understand.

A good understandable information in simple language it was very helpful.

I am a student in this information was most useful for everyone.

Thanks for positive feedback. Pl keep visiting the site for more such topics.