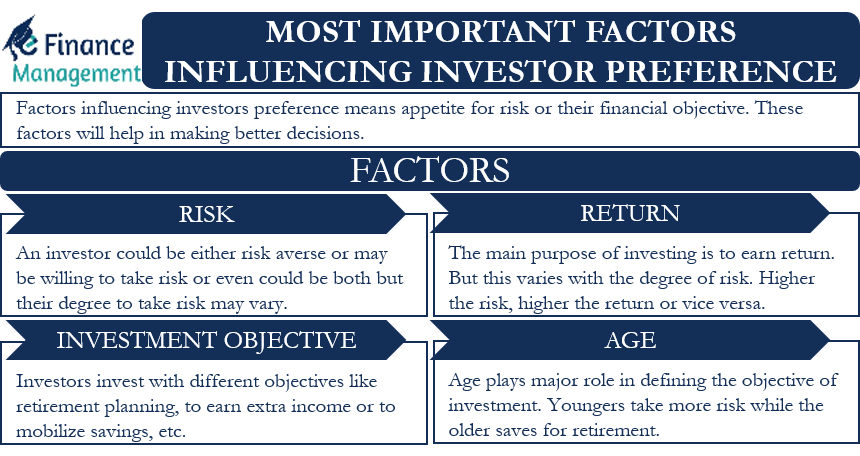

When we talk about finance and the finance world, there are two important concepts: investment and investor. However, both concepts are interdependent and interlinked because investing is the activity and that is carried out by the investor. Almost all of us as individuals and all economic organizations and even NGOs can be loosely called investors. This is because we all invest at some point, perhaps regularly, from our savings or funds accumulated. However, almost every investor has a different preference for investing. In other words, all investors have their own investment channels, and all investors do not invest in similar types of instruments/assets. There are a few important factors that influence investor decisions at each stage. And that is why the investors differ in their investment preferences.

When we say that not everyone makes the same kind of investment, it means that there are different types of investors. Although all investors want a return, they have different preferences for investing. For instance, some may prefer to invest in equities, while others choose debt instruments. They do so because each investor is different, and therefore they have different approaches and different investment requirements. The mindset here could mean their appetite for risk or their financial objectives.

Every investor needs to know the various factors that should guide their investment plan and decisions. Knowing these factors well would help them make better decisions and plan their investments correctly according to their ideology and requirements.

Four (4) Factors Influencing Investor Preference

Let’s take a look at some of the most important factors influencing investors’ preferences:

Risk

As we all know, every investment carries a certain risk, which is negligible to high. Therefore, this is the most important factor influencing investors’ decisions. As already mentioned, different investors have different risk appetites. Some investors are risk-averse, while others like to take the risk, which can be moderate or aggressive. Risk-averse usually opt for safe investment options such as gold and fixed income securities. Or they may put their money in the bank or buy a property. On the other hand, those who take risks can put their money into stocks, futures, and other instruments.

Also Read: Portfolio Investment

One point is that we cannot classify every investor as risk pro or risk-averse. An investor can be both, but their preference for risk would be different. So, for example, an investor would be okay with 20% risk, while another might prefer 70% risk.

Return

Earning a return is another primary objective of investment. However, not all investments would yield the same return. Generally, the investments that generate higher returns are also riskier, and the investments that offer lower returns are less risky. For instance, bonds provide a fixed return but are less risky than stocks with much higher potential returns.

We all need to recognize that return and risk are interdependent and that there is a close relationship between the two. And investors need to compromise on one aspect to get the better of another. If, for example, an investor wants more return, he should also take more risk, and if an investor does not want to take too much risk, he must compromise on the return he expects.

Investment Objective

Every investor has a different investment objective. For example, some investors want to invest for their retirement, others want an additional income, some invest only to earn a return, etc. So investors invest on the basis of their goal. For example, those who invest in retirement would invest in less risky instruments. On the other hand, those who only want to achieve a return would be fine with risky investments.

Also Read: Risk-Return Tradeoff

There are also investors who invest for a certain period of time or to achieve a short-term goal. For example, those who plan to buy a house would put their money into less risky investments.

Age

Yes, age is also one of the key factors influencing investor preferences. In the investment world, if you are young, you are at an advantage. This is because you can give your investment more time. Or you have more time for compound interest to work for yourself. Also, when you are young, you can afford to take more risks. Because at the early stage, there are not many responsibilities and at the same time have enough money at your disposal or a regular source of income to take care of your daily needs.

By contrast, if you are middle-aged, you are likely to start saving for your retirement. So, your preference shifts towards relatively safe investments. Also, you have relatively little money to invest. This is because most of the money goes toward securing affordable living.

Final Words

All of the above factors play a crucial role in influencing investor preferences. It is possible that one or more of these factors have a greater influence on investment decisions than others, but this varies from investor to investor. For example, one investor may attach more importance to the investment objective or cost of capital, another may consider risk more important, and another may consider a return as the ultimate goal.

One thing to bear in mind is that the importance of these goals can change as an investor makes progress in life and career. Moreover, these factors are also interlinked. This means one factor would ultimately lead to other factors—for example, age and risk. If a person is young, he is more likely to be a risk pro, and when he grows old, he shifts towards being risk-averse.

Frequently Asked Questions (FAQs)

Age plays a major role in choosing between different types of investment, as younger people are willing to take risks while middle-aged people are more focused on retirement planning. And hence they will go for a less risky investment as compared to young age people.

The following are the five most important factors influencing investor preference: risk, return, investment objective, investment horizon, and age.

Since the future is uncertain, we invest today to generate revenue in the future. If we invest freehand without taking into account the various factors, we can make losses and forget to generate a return. This makes it necessary to consider various factors before making investment decisions.

Investments give us financial security, generate additional income, provide retirement benefits, etc.