Assets are very important for businesses, as well as for individuals. The number and quality of assets that one owns go a long way in determining the creditworthiness and sustainability of any organization or individual. These very assets help us store, transfer, and generate wealth for the country, businesses, or individuals. In the financial world, assets are the term of the Balance-Sheets that give us the total worth of that business.

We generally divide assets into two categories – Real and Financial. Real assets are the assets that a business or investor owns, such as land, building, and more. On the other hand, a financial asset is liquid assets that one can easily or quickly convert into cash, such as stock, bonds, securities, etc. To get a better understanding of the two concepts, it is important to know about the meaning and differences between Real vs Financial assets.

Real vs Financial Assets – Meaning

As said above, financial assets are non-physical assets. One can quickly convert them into cash. A point to note is that such assets represent a claim on the underlying value of another asset. One unique feature of financial assets is they carry some monetary value (monetary assets). But, one can’t realize that value unless it is exchanged for cash. So basically, these assets do not have any intrinsic value of their own.

Real assets are generally the physical assets that help a company to generate revenue. They carry an intrinsic value of their own, unlike financial assets, and thus, are important to a business. Their intrinsic value is because of their substance and properties. They are more popular with investors for several reasons – tax benefits, less correlation with equity, attractive return, and inflation protection.

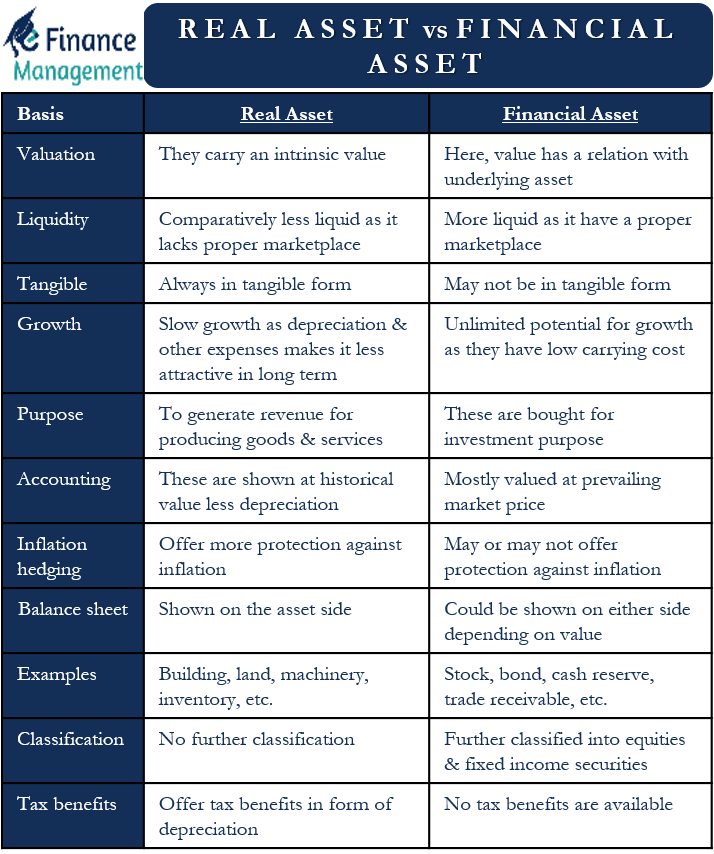

Real vs Financial Assets – Differences

Here we can draw an analogy with the investments. Because the differences between both these types of assets are the same as what could be between the real and financial investments. Knowing this, hopefully, will make it easy for us to realize the differences between real and financial assets. Let us now elaborate on the differences between real and financial assets:

Valuation

All real assets carry an intrinsic value. While the value of the financial assets has a relation to the underlying asset. The underlying asset may be tangible or intangible.

Liquidity

As said above, the financial assets are liquid, and one can easily and quickly convert them into cash. Also, financial assets have a proper marketplace, facilitating quick conversion into cash.

Real assets, however, are not as liquid as financial assets. Since they are usually of high value, it takes time to find a buyer and convert them into cash. Moreover, they also lack any proper marketplace.

Also Read: Meaning and Different Types of Assets

Tangible

Financial assets may not necessarily have a physical form. Real assets, in contrast, are present in physical form.

Growth

The growth in real assets could be very slow. Moreover, depreciation and other expenses may make real assets less attractive in the long term. In contrast, financial assets offer unlimited potential for growth. They have a low carrying cost as well. However, they are usually riskier than real assets.

Purpose

The primary objective of holding real assets is to generate revenue. Such assets basically help a business to produce goods and services. In contrast, financial assets help investors to generate income. Or, we can say one buys financial assets for investment purposes.

Accounting

One can measure the financial assets at amortized cost and fair value depending on the nature of the assets. One shows real assets at their historical value less depreciation in the accounts. While financial assets are usually valued based on their prevailing market prices, if that exists. Otherwise, these are valued as per the likely converted value in the opinion of the management, considering the strength of the individual financial asset.

Inflation Hedging

Real assets offer more protection against inflation as the value of such assets and the income they help generate grow with inflation. On the other hand, financial assets may or may not protect against inflation risk.

Balance Sheet

Real assets are shown on the asset side of the balance sheet. Financial assets could come on either side, depending on their value.

Trade

Since financial assets are liquid, list on the exchange, and have a marketplace, they are very easy to trade. On the other hand, real assets lack a proper marketplace and are thus difficult to trade.

Examples

Some popular examples of financial assets are Stocks, bonds, cash reserves, bank deposits, trade receivables, and more. Buildings, land, machinery, inventory, real estate, and more are popular examples of real assets.

Classification

Financial assets have a further classification – equities and fixed income securities. There is no such classification for real assets.

More Reliable

At the time of financial crises, the real assets are more reliable. This is because they usually don’t lose their value much in comparison to the financial assets. Financial assets, on the other hand, can get more volatile during financial distress.

Tax Benefits

Real assets offer tax benefits in the form of depreciation. There are no such tax benefits with the financial assets.

Real vs Financial Assets – Similarities

Even though the financial and real assets are different, there are a few similarities between them as well since they are a type of assets. Following are the similarities between financial vs real assets:

- The valuation of both assets depends on their ability to produce cash flows.

- The presence of either of the asset can help a business or individual survive the crises. For instance, if a business has cash reserves, it can use them to keep operations running. And, if a business has a rental property, it can lease it out to compensate for the loss in revenue.

Final Words

Both the assets are very important, especially the real assets. Thus, it is crucial to be familiar with the differences between them. This is because any changes in these assets will have a varying impact on your business and income. Also, understanding the difference between the two will help us refine our financial goals.

Quiz on Real vs Financial Assets

This quiz will help you to take a quick test of what you have read here.

splendid explanation , but my question is how can i break down a capital into buying assets on a balance sheet .

then break it down in forecast ?

i have a hard time on mapping it down on excel features

starting at at the Capital first then make a 10 to 15 year forecast