What do we mean by Portfolio Management Theories?

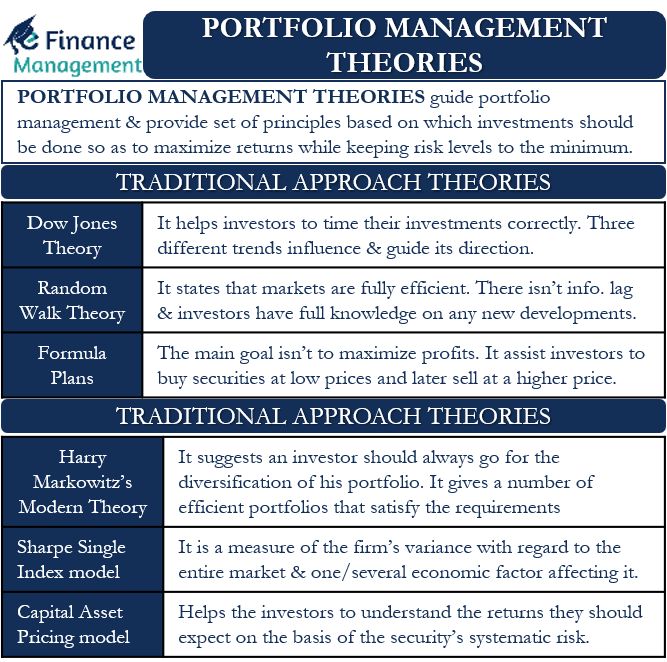

A portfolio is a mix of a number of financial assets and investments. It may include stocks, commodities, bonds, money market instruments, real estate, articles of value such as art and paintings, diamonds and jewelry, and even cash. Portfolio management is the planning, organizing, and implementing of decisions to create an optimum investment mix. This mix should be in accordance with the long-term financial objectives of the investor, keeping in mind his risk and return expectations. Portfolio management theories are the theories that guide portfolio management. They provide a set of principles on the basis of which investments should be made so as to maximize returns while keeping risk levels to the minimum.

There are primarily two approaches to portfolio management theories. The traditional approach mainly comprises of three theories- the Dow Jones theory, the Random walk theory, and the Formula theory. Then comes the modern approach that primarily consists of Harry Markowitz’s Modern Portfolio management theory, Sharpe’s theory of portfolio management, and the Capital Asset Pricing Model. The traditional approach theories focus more on the income and capital appreciation of the investors while keeping in mind their income and liquidity expectations, the safety of their principal amount, and the time frame to realize those objectives. The modern approach aims to maximize the returns an investor expects from his portfolio for a given risk level. This theory does not aim at just income and capital appreciation but focuses more on risk and return analysis.

What are the main Portfolio Management Theories?

A number of portfolio management theories have come up with the emergence of time. Let us have a look at a few of the important models.

Traditional Approach Theories

Dow Jones Theory

The basis of this theory is a hypothesis by Charles Dow. According to him, the stock market movements are not random. Three different trends influence and guide its direction, and these trends are cyclical in nature. They determine the current status of the market and where it will go in the near future. The theory helps investors to time their investments correctly. It helps to identify when the security is at its lowest price levels on the basis of the past trends of the price movements of the securities. Based on this theory, the securities and investments in the portfolio can enter or exit.

Also Read: Portfolio Management

Primary Movements

The primary movements are long-term movements of security prices on a stock exchange. The time period under consideration should be over a period of more than a year. These are also termed as basic structural trends.

Secondary Reactions

The secondary reactions are the corrections that are restraining in nature. They restrict the primary movements. Secondary reaction movements are in the opposite direction of the former. They last temporarily for a period of three weeks to three months or so.

Minor Movements

Minor movements are the daily movements of the security prices. Hence they are not very large and are insignificant. Due to their presence for a very short period, they do not have much analytical value too. Because the portfolio construct is for a long-term horizon and minor movements do not affect the decision.

Random Walk Theory

The other name for the Random Walk theory is the Efficient Market Hypothesis. It states that the prices of securities on the stock exchange do not relate to their previous trends. Hence, it is not possible to predict future stock prices.

Also Read: Portfolio Management Process

The theory states that markets are fully efficient. There is no information lag, and the investors have full knowledge about any new developments in the company, industry, or economy as a whole. The prices of securities instantly adjust to any information. Hence, historical prices will in no way indicate the future price movements of those stocks. In fact, the prices move in a random way, and the only way to make abnormal profits or returns is by undertaking some additional risk.

Formula Plans

Formula plans are mechanical revision procedures and techniques to minimize losses for investors. Their main goal is not to maximize profits and returns. These techniques assist the investors in buying securities when they are at low prices and later selling them when they are at a higher price.

In the case of using Formula plans, the amount to invest is known, and two types of portfolios are made. One portfolio is aggressive in nature that invests in risky assets and stocks. The other portfolio is of defensive nature, and investments are made in safe assets such as government bonds, debentures, etc. The ratio of investments in both types of portfolios is also known in advance. Monitoring of such portfolios is done on a periodic basis so that changes can be done in time in case of need. Asset balancing is an important variant of this plan.

Modern Approach theories

Harry Markowitz’s Modern Portfolio Management Theory

This theory assumes that markets are efficient. Investors tend to invest on the basis of the returns they expect and the standard deviation or variance of those returns. The theory analyzes a number of portfolios consisting of different securities and assets. It helps to choose the most efficient portfolio among them. It suggests an investor should always go for the diversification of his portfolio. Diversification helps to spread its risk among different asset classes. The theory finds out the best possible combination of assets that will make a portfolio most efficient by using various statistical analysis tools and mathematical programs.

The theory makes use of variance, or standard deviation of the returns one expects from investments to construct efficient portfolios. The indicator of the efficient portfolios is – (i) Yielding the maximum possible returns on the investment on a given level of risk or (ii) Yielding the desired return at the least possible risk. Substitution of assets and change in the proportion of various assets can be done with each other to find out the optimal portfolio with the least amount of variance of the returns. The process gives a number of efficient portfolios that satisfy the requirements.

Sharpe Single Index Model

This model is a more simple version of Markowitz’s model. It measures the return and risks of security. It simplifies the mathematical calculations and the diversification method of the portfolios. The basis of the theory is the assumption that the returns from an asset or security are in association in a linear way with a single superior index such as the market index. The market index should consist of every security that is being traded on the stock exchange.

The theory assumes that the majority of securities have positive covariance. Also, their behavior is similar to macroeconomic changes. Each firm has its own variance, and Beta denotes it. It is a measure of the firm’s variance with regard to the entire market and one or several economic factors affecting it. Change in responsiveness to the macroeconomic factors affects the covariance among the stocks. Multiplying the stock Beta with the market variance will give the covariance of each stock. Once you subtract the market returns, there is no correlation among the residual returns. The main advantage of this model is that it significantly reduces the number of calculations to be done in the case of big portfolios consisting of a large number of securities.

Capital Asset Pricing Model

The Capital Asset Pricing model helps the investors to understand the returns they should expect on the basis of the security’s systematic risk. The model helps to correctly price the securities in the capital market, keeping in mind their risk as well as the cost of capital. The theory assumes that there will be no change in the risk-free rate in the near future. Also, it assumes that there are no transaction costs, no shortage of funds at the risk-free rate, no personal taxes, and the presence of perfect competition where no individual investor can affect the market prices.

There is a time value of money as well as the risk associated with investments. The investors look to get compensation for it. The theory states the risk-free rate of interest to compensate for the time value of money. Beta denotes the potential risk of a security in a portfolio. A beta value higher than one suggests that the security risk is higher than the market. A beta of less than one means that the stock is less risky than the market.

The market risk premium is any return that an investor expects over and above the risk-free rate. The market risk premium is multiplied by a stock’s Beta, and then the risk-free rate is added to the result. The answer is the rate of return an investor needs. Also, it can be of use as a discount rate to find out the correct value and pricing of an asset.

Final Words

Portfolio Management is an important exercise in today’s times. In today’s times’ asset managers, mutual funds, pension funds, insurance companies, and even corporates use various theories and a mix of them to manage the quantum of funds available to them. Obviously, the idea is to make handsome returns in line with the stated objectives. Modern theories impress upon earning a return with a given amount of risk. And there, they all would like to excel compared to competitors in terms of generating better than market/alpha returns.