Simple and Compound Interest

Before lending or investing, everyone would like to know the return he will be getting for this facilitation. The return or charge is the interest that he will get back. There is a formula for calculating the interest on the loan or money borrowed. It helps calculate return/ interest on investment on fixed deposits, mutual funds, short-term investments, etc. The interest could be simple interest or compound interest.

Interest Calculation Formula

The interest calculation formula shows the interest rate as a percentage of the principal for a particular period. The calculation of interest can happen on a monthly, quarterly, or annual basis. And there are different formulas for calculating interest or return for simple or compound interest.

When a lender lends money to a borrower for a certain period, the lender charges a certain percentage of the principal. This charge is the interest paid by the borrower. The percentage calculation is called the interest rate. The interest calculation on the principal happens by using this formula. The interest is the income of the lender for lending his money.

While the lenders charge interest from the borrower, interest received or receivable is also an income from the investment by the investor. In investment terms, interest is paid by the bank to its customer on bank fixed deposits, recurring deposits even on the savings bank account. Here the interest formula is used to calculate the interest on the money deposited in the bank by its customers.

Also Read: Compound Interest

There are two types of Interest calculation:

- Simple Interest

- Compound Interest.

The formula used for the calculation of simple interest and compound interest is different.

The Formula for Simple Interest

What is Simple Interest?

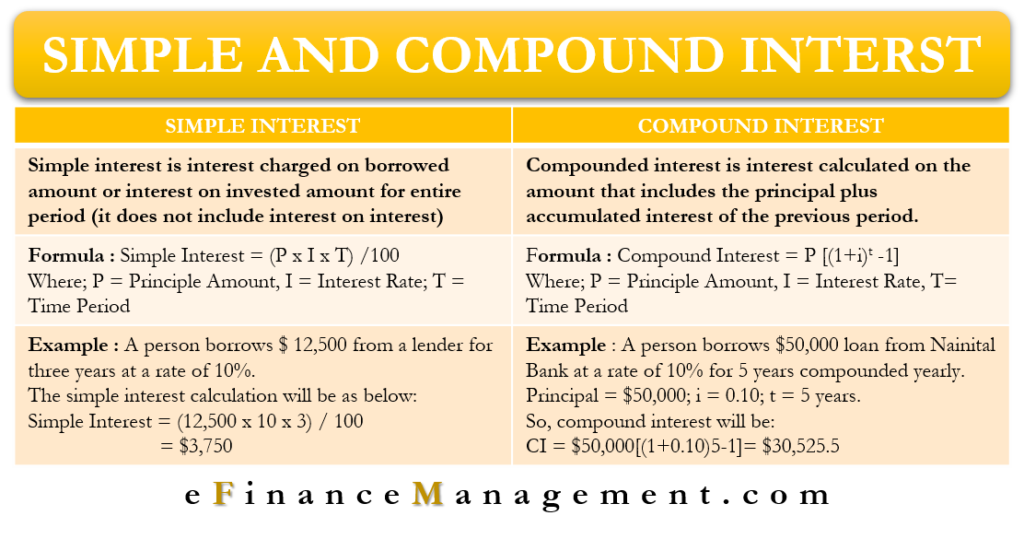

Simple interest is interest charged on the borrowed amount or interest on the invested amount for the entire period. It is a straight calculation of interest on the principal amount as per the mutually agreed rate and the time involved.

Simple Interest Rate Formula

Interest = Principal x Interest Rate x loan period

In short,

SI = PIT/100

Where,

P = Principal Amount of loan borrowed / money invested.

I = rate of interest charged by the lender / received by the investor

T = Time Period of the loan/ investment.

Examples of calculation of simple interest- yearly, half-yearly, quarterly, and monthly.

A person borrows $ 12,500 from a lender for three years at a rate of 10%. The simple interest calculation will be as below:

| 1. | Principle(P) | $12,500 |

| 2. | Interest Rate (I) | 10% |

| 3. | No of Years (n) | Three years |

So, the simple interest for three years will be $3750 (12500*10%*3)

For the half-yearly calculation of the simple interest, the formula will be:

SI = PIN/2/100 = PIN/200

Similarly, for quarterly simple interest calculation, the formula will be:

SI = PIN/4/100 = PIN/400

At the time of the loan repayment, the borrower pays principal plus interest to the lender.

So, in all the above cases, the repayment amount will be $16250, comprising of principal + Simple Interest for 3 Years (12500+3750). Please note that here since we are calculating only simple interest, irrespective of the quarterly, half-yearly, or yearly calculation, the amount of interest and total repayment amount will remain the same.

The Formula for Compound Interest

What is Compound Interest?

Compounded interest is interest calculated on the amount that includes the principal plus accumulated interest of the previous period. The interest calculation for the next period/new year happens on the principal plus accrued interest until the beginning of the year/period. This process continues until the tenure of the loan. It is also called as interest on interest because interest calculation happens on compounded principal amount (principal+interest).

So, in simple words, we can say the amount of the first-year interest becomes the principal for the second year & the amount of the second year is the principal for the third year, and so on. The interest and principal amount changes with time and period.

Interest rate formula for Compound Interest?

Compound Interest = P [(1+i)t-1]

Where,

- P = principal amount.

- i = r/100 annual rate of interest.

- n= no of years/periods

For calculation of half-yearly or quarterly compounded interest

Compound Interest = P [(1+i/t)nt-1]

Where,

- P = principal amount.

- i = r/100 = annual rate of interest.

- n= no of years / no of periods

- t= No. of times interest compounded in a year

Example of Compound Interest

A person borrows $50,000 loan from Nainital Bank at a rate of 10% for 5 years compounded yearly. Principal = $50,000

i = 0.10; t = 5 years. So, compound interest will be:

CI = $50,000[(1+0.10)5-1]= $30,525.5

Now, if the interest rate is calculated half-yearly, then compound interest will be

CI = $50,000[{1+ (0.10/2)} 2×5-1]=$31,444.73

Final Words

The interest calculation formula helps to make an important business decision regarding loans and investments. By comparing the interest rate or return rate of various investment schemes, we can choose the best option for financing. The calculation of interest on loans helps to figure out the prevailing rate in the market. And our ability to repay the loan amount in time.