What is an Auction Market?

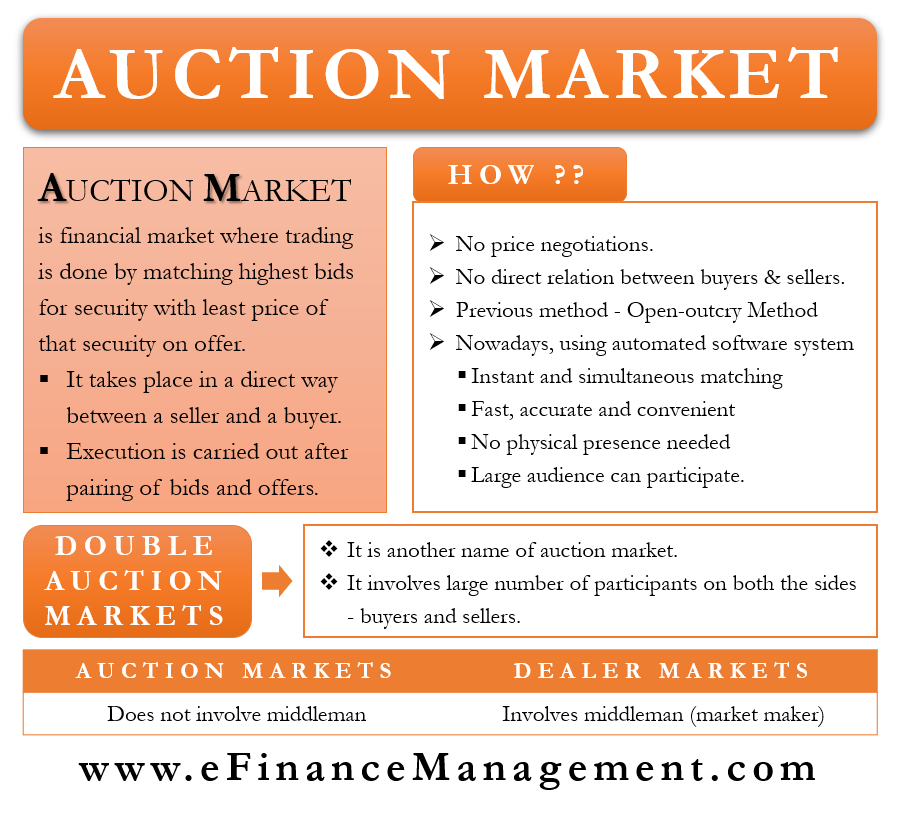

An Auction Market is a financial market where trading is done by matching the highest bids for a security with the least price of that security on offer. In other words, a trade occurs between a buyer who is willing to pay the maximum amount for security and a seller who is charging the least or best possible price for it. The buyers place a “bid” for security, whereas sellers place an “offer” for the same. Matching is done of the bid and the offer electronically. Trade takes place at the point where these two match.

Trading in an auction market takes place in a direct way between a seller and a buyer. And in this auction market always, there are a good amount of buyers and sellers available. Execution of an order is done after the pairing of eligible bids and offers. If no pairing or matching is available, the trade will not occur, and the bids and offers will stand as before.

How does Trading take place in an Auction Market?

Unlike the OTC markets in which negotiation for prices takes place, there are no such negotiations in an auction market. Buyers and sellers are not in direct touch with each other. Trading is done only by means of matching of highest bid price with the lowest offer price through the automated software system. Till the time these two don’t match, there is no occurrence of a trade.

In earlier days, trading was done by using the “open-outcry method.” The buyers and sellers would shout for their bids and offers. Matching bids would automatically qualify for a trade. If the bids and offers did not match, the buyers and sellers could negotiate and settle for a mutually agreeable price.

Also Read: Auctions

In modern times, trades in an auction market occur electronically. Hence, matching bids and offers are done instantly and simultaneously with their placing. This has made the auction process much faster, more accurate, and more convenient. Also, a large number of buyers and sellers can easily trade in the market without being present physically. This was not the case in the “open outcry method” marketplace. But this system does not allow any sort of one-to-one or direct interaction and negotiation. Between the parties involved in both the sides-selling and purchasing.

Example

The market price of any security is decided by matching the bid price and the ask price. For example, suppose the bid price for a financial instrument in an auction market is $10, $11, and $12, and the ask price is $12, $13, and $14. Hence the bid and ask price match at $12, which is the combination of a match of the highest bid price. And the lowest ask price. This becomes the market price of that financial instrument, and trade will take place at this price. The sellers asking for a price higher than the market price of $12 will not be able to sell their product. Similarly, all the buyers willing to pay lesser than the market price for that instrument will not be able to buy the instrument.

What are Double Auction Markets?

Another name for the auction market is “Double auction markets.” This is so because of the involvement of a large number of buyers and sellers. A regular auction involves one buyer and multiple sellers or vice-versa. This is, however, not the case in auction markets or the difference in auction markets. The participants are in large numbers in the auction markets on both sides – buying as well as the supply side.

Difference between an Auction vs Dealer Market

An Auction market does not involve any middleman in matching bids and asks. This is not so in the case of a dealer market. There is the involvement of a middleman, generally known as the “market maker.” Their job is to create liquidity and transparency in the market. They electronically display the market-making price or the price at which they are willing to buy a security (the bid price) as well as sell it (the ask price).

Also Read: English Auction

The remuneration for their services is the profits they earn by the bid-ask spread. The bid price is often more than what the seller is asking for his security or the ask price. This difference between the two prices is the bid-ask spread. This portion is the profit for the broker.

What are Treasury Auctions?

Treasury auctions are the auctions that are held for selling government securities in order to provide liquidity to the government. The general public, as well as big financial houses and institutions, take part in such auctions. And though the latter parties dominate such auctions. Such auctions occur electronically, and a wide variety of marketable securities with different maturities and yields are on offer. The instruments that are sold through such auctions include bills, bonds, notes, etc.

There are two types of options for bidding on such securities. These are competitive bidding and non-competitive bidding. Non-competitive bids have an upper limit for purchase of up to US$5 million per auction. Such bidders are mostly individuals and small investors with a limited kitty size. They agree to go by the rate, yield, and discount margins that are finalized for all in the auction process. Hence, they are certain to get a guaranteed portion of the securities on offer.

On the other hand, a bidder specifies his rate, yield, and discount margin at which he is willing to participate in the auction process in case of competitive bidding. Such bids have an upper limit of 35% of the offer amount available for every bidder. After the auction ends, such bids are put in a sequence of lowest to highest regarding the rate, yields, or discount margin. The bids are offered up to the available limits of the auction. The auction closes once the upper limit of securities on offer is reached or the bids are finished, whichever is earlier.

RELATED POSTS

- What are the Advantages and Disadvantages of Online Auction?

- Japanese Auction – Meaning, How it Works Advantage and, Reverse Japanese Auction

- Dutch Auction

- Minimum-Bid Auction – Understanding the term, Advantages and Disadvantages

- Exchange-Traded Markets – All You Need to Know

- Absolute Auction – Meaning, Use, Example, Benefits, and Risks