Annuity and perpetuity are financial instruments for investment. An annuity is a stream of equal cash flows that occurs at equal intervals over a given period. A perpetuity is a financial instrument that pays a fixed amount of money at set intervals over an infinite period of time. In this article, we will learn about the differences between growing perpetuity and growing annuity.

Difference between Growing Perpetuity and Growing Annuity

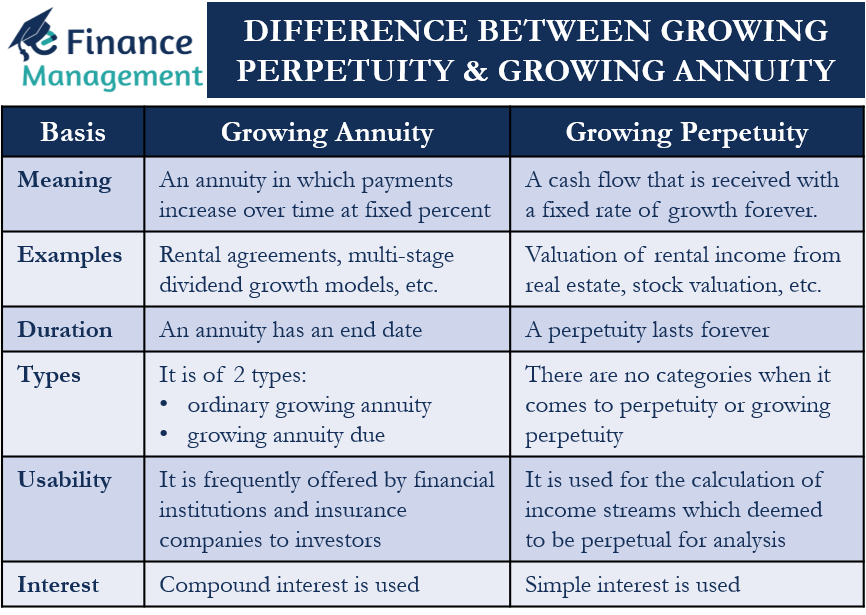

Following are some of the points mentioning the difference between growing perpetuity and growing annuity.

Meaning

The term “growing annuity” describes a certain annuity in which payments increase over time at a fixed percentage. The other commonly known names of growing perpetuity are increasing or graduated annuity. While growing perpetuity is a cash flow that is received with a fixed rate of growth forever. The growth rate remains constant for the infinite life of perpetuity.

Examples

Common examples of growing annuities are rental agreements, investment policies, multi-stage dividend growth models for a company, etc. Examples of growing perpetuity include the valuation of rental income from real estate, stock valuation, etc.

Duration

The growing annuity has a fixed duration. It has a finite stream of cash flows that grow at a constant rate. Whereas, the duration of a financial instrument is not fixed in the case of growing perpetuity. The duration of a growing perpetuity is infinite or forever which grows at a constant rate. Therefore, an annuity has an end date while a perpetuity lasts forever.

Also Read: Present Value of Growing Annuity

Types

A growing annuity is of two types: an ordinary annuity or an annuity due. The major difference is the timing of payments made on the contract. In an ordinary growing annuity, the payments take place at the end of each period. Whereas, in a growing annuity due, the payments take place at the beginning of each period. While there are no categories or types when it comes to perpetuity or growing perpetuity.

Usability

Financial institutions and insurance companies frequently offer growing annuities to investors. It is the most commonly used financial instrument for financial planning and retirement savings. On the other hand, the concept of growing perpetuity is generally used for the calculation of income streams such as dividend or rental income on real estate property which are deemed to be perpetual for analysis.

Type of Interest

The two types of interest rates that financial institutions use to calculate a sum of money on an investment or loan are either compound interest or simple interest. For growing annuities, compound interest is used for the calculation of the present or future value of the annuity. The use of compound interest is possible because the time period of an annuity is finite.

In the case of growing perpetuity, there is no fixed time period of cash flows. Perpetuity is for forever. Hence, it is not feasible to apply the concept of compound interest to growing perpetuity. Therefore, it uses simple interest for the calculation of the present or future value of an investment.