Interest rate is one of the most prominent topics of the “Time Value of Money”. It is the required rate of return for a particular investment. It is the market rate of return that investors and savers required to get them to lend their funds willingly. For a borrower, the interest rate is the amount charged for the borrowed sum of money. That is, it is a percentage of the total amount of the loan.

In this article, we will learn about the relationship of the interest rate with the required rate of return, discount rate & opportunity cost. But before diving deep into that, it is important to learn about nominal and real risk-free rates of interest. And how they are related to interest rates.

Nominal and Real Risk-free Rate

The real risk-free rate of interest is a theoretical rate on a single-period loan that has no expectation of inflation in it.

The nominal risk-free rate of return does contain an inflation premium. Risk-free government bonds, such as US treasury bills or T-bills, are quoted on the nominal risk-free rate of return.

The approximate relation is:

Nominal risk-free rate = real risk-free rate + expected inflation rate

Interest rate is essential for the calculation of the nominal risk-free rate of return. A rise or fall in interest rates in the economy directly impacts the nominal risk-free rate of return. Therefore, it has a huge impact on the market’s risk-free rate of return and an investor’s overall expectation of the return on investment.

Also Read: Real Risk-Free Rate of Interest

Required Rate of Return

Interest rate is one of the most important components of determining the required rate of return. It is the sum of real risk-free rate and compensation for 4 types of risks. All financial securities and borrowings have a required rate of return. Financial securities may have one or more types of risk. And each added risk increases the required rate of return on the security. The following are the types of risk:

- Default Risk: It is referred to the risk that a borrower will not make promised payments in a timely manner.

- Liquidity Risk: It is referred to the risk of receiving less than the fair value of an investment when it is sold in open market operations.

- Maturity Risk: The prices of longer-term bonds are more volatile than those of shorter-term bonds and require a maturity risk premium.

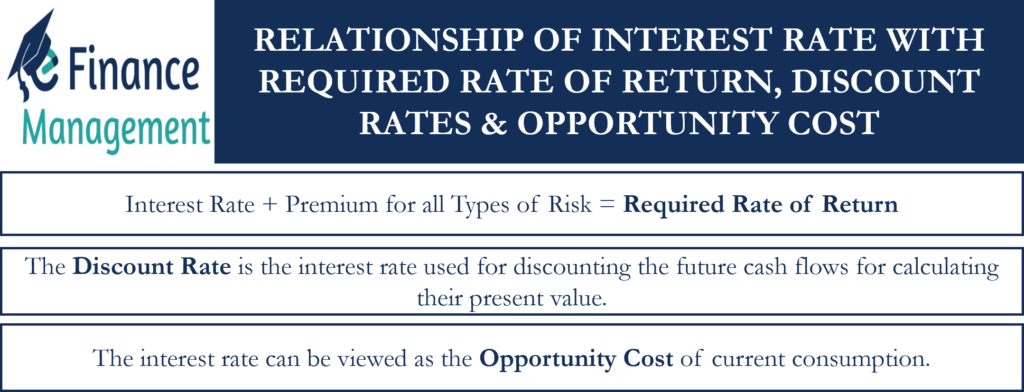

All the factors mentioned above of potential risks are added as premiums to the nominal risk-free rate of return for calculating the required rate of return of security. And, as mentioned above, the interest rate is important for the calculation of the nominal risk-free rate. Therefore, the interest rate plays an important role in determining the required rate of return.

Discount Rate

The discount rate is the interest rate used for discounting the future cash flows for calculating their present value. The idea of a discount rate is frequently used, particularly when deciding on capital budgeting decisions and potential investment opportunities.

Interest rates are also referred to as discount rates. In fact, the terms are often used interchangeably. The interest rate is a substitute for the discount rate. This is because it is the cost that a business incurs in order to raise additional funds for investment. Hence, a business or investment must be able to earn a return equal to or greater than the interest rate for it to be relevant.

The discount value is calculated using the interest rate applied to the cash raised. For example, let’s assume that an individual can borrow funds at a rate of 12% to invest in a business opportunity. In this case, the individual should discount expected future cash-flows of business by 12% in order to calculate the present value of cash-flows.

Opportunity Cost

Almost all business decisions require a trade-off among various potential options. The concept of opportunity cost arises when there are more than one options to choose from while making a financial decision. Opportunity cost is the value of what you lose when you choose between two or more options.

The interest rate can be viewed as the opportunity cost of current consumption. For example, let us assume that risk-free government bond, such as US treasury bill (T-bills) offers a rate of return of 5% on investment. In this case, any investor or businessman investing in a potential project or investment opportunity is foregoing the opportunity to earn a 5% risk-free interest rate by making investments in T-bills. Therefore, this 5% is the opportunity cost of a potential investment opportunity in this case.

Hence, the interest rate is a substitute for opportunity cost, especially when it is the case of investment decisions.