Effective Annual Rate

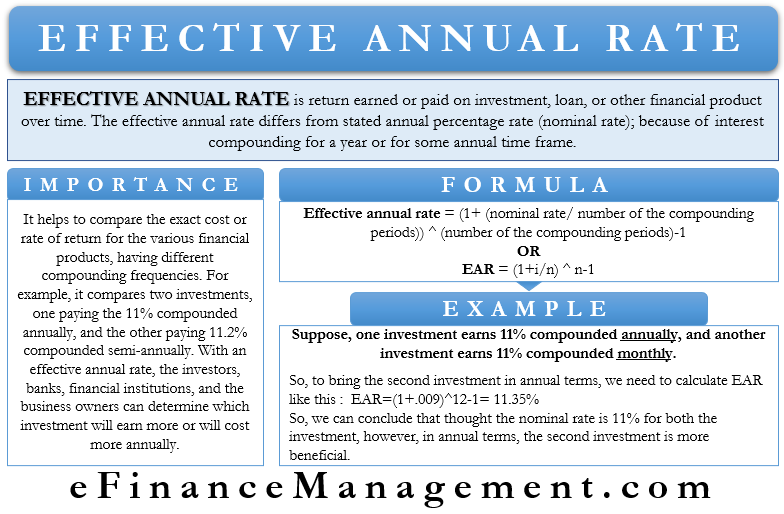

An effective annual rate is a return earned or paid on the investment, loan, or other financial product over time. EAR’s other synonyms are the effective yield or net yield, effective interest rate or net rate of return, or annual equivalent rate. The effective annual rate differs from the stated annual percentage rate (nominal rate); because of the interest compounding for a year or for some annual time frame. It helps compare the different financial products having different compounding periods (weekly, monthly, quarterly, and yearly).

Only the nominal interest rates are given in the normal course of business as per the standard practice. And not the effective or net rate of return. Normally, the interest is given as the nominal or stated annual interest rate. However, the interest compounding happens several times a year, and the actual interest earned on the investment or the actual expense in the case of a loan is higher than the nominal rate. This higher rate is called the effective annual rate.

Effective Annual Rate and its Importance

The effective annual rate helps to compare the exact cost or rate of return for the various financial products or options available to one but has varying compounding frequencies. For example, it compares the two investments, one paying the 11% compounded annually and the second paying the 11.2% compounded semi-annually. With an effective annual rate, the investors, banks, financial institutions, and business owners can determine which investment will earn more or will cost more annually. It makes their task of choosing and comparing easier amongst the various investment options.

Effective Annual Rate Formula

The formula is basically like the compound interest calculation formula. So, to calculate the effective annual rate, you need 3 items:

- Principal Amount of investment or Loan;

- Nominal Rate of Interest; and

- Periodicity of compounding.

Thus, we adjust the nominal interest rate to the number of periods when the compounding will happen during the whole term of the deposit or loan.

Also Read: Effective Annual Rate Calculator

Effective annual rate= (1+ (nominal rate / number of the compounding periods)) ^ (number of the compounding periods)-1

How to Calculate the Effective Annual Rate?

To calculate the effective annual rate using the formula, follow the following steps:

Establish the Stated or Nominal Rate

We see the stated or nominal rate on the heading of the loan or investment agreement. For example, the nominal annual rate is 10% compounded annually.

Determine the Number of Compounding Periods

The compounding periods can be monthly, quarterly, semiannually, or annually. The monthly compounding periods are 12 (for there are 12 months in the year) and 2 semiannually (twice a year). Similarly, the compounding periods are 4 for quarterly, one for annually, and 365 for daily.

Apply the Formula

Now we apply the formula,

EAR = (1 + i / n) ^ n – 1

Where i= interest rate

n= number of the compounding period

For calculation, you can Effective Annual Rate Calculator.

Example 1

Now, let’s take an example to see the use and calculation of the effective annual rate.

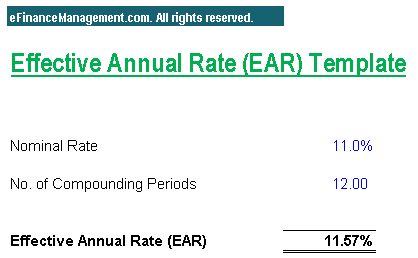

Suppose you have a choice between two investments. One investment earns 11% compounded annually, and another investment earns 11% compounded monthly. Can we consider these investments to be equal? The answer is no. Why? To determine that or to arrive at a conclusion, we need to check the EAR that will give us the right indication.

By using the formula of the EAR, we calculate the EAR for 11% compounded annually…

EAR= (1+11%/1)^1-1=11%

And for the investment compounded monthly,

EAR=(1+11%/12)^12-1= 11.57%

From this, we can see that the rate is higher when we have more compounding periods.

This example shows that though the nominal interest rates of both the investments are the same, i.e., 11%, the actual or effective annual rate differs. The reason for this is that when we compound monthly, the interest we receive is monthly rather than on an annual basis. In this case, we not only earn the interest on the actual principal amount but also we earn the interest on the interest we have earned each month. Therefore, a monthly compounding investment will receive higher returns than annually or quarterly compounding investments.

EAR formula helps us compare the different nominal rates having different compounding periods to determine the investment that will provide the best return to the investor. Similarly, in the case of loans, the effective annual rate of interest allows the borrower to compare the loans different banks provide to select the least costly loans.

Example 2

Now let’s take another example,

Let’s assume you have won a lump sum money in an event. After paying all the necessary fees and taxes, you finally receive $ 12000. Now you decide to deposit it in a safe investment, like the Certificate of Deposit in a bank. The two banks in your state have attractive offers. Bank A’s offer is an interest rate of 5% per annum. And the same will be calculated at every half-yearly interval. Another Bank B’s offer is an interest rate of 5% per annum for a 5 year period, where interest calculation will happen at quarterly rests.

In simple terms, the compounding rules state that when we compound the interest more times in a given period, the better, the effective rate will be.

Coming back to the example, Bank A will offer an effective annual rate of 5.062% per year, calculated below.

EAR={(1+.05/2)^2 -1}=5.062%

Bank B will offer an effective rate of 5.095% per year, calculated below.

EAR={(1+.05/4)^4-1}=5.095%

With these calculations, we see that depositing the money in Bank B will be beneficial as the effective annual rate of Bank B is high. In other words, as the frequency of compounding is more for Bank B; hence, the investment or deposit with Bank B will yield more effective returns even though the annual rate of interest offered by both the banks is the same at 5%.

Cautions

Financial institutions and lenders indulged in practices of lending money by indicating lower nominal interest rates. And they do not clarify or give the effective rate of interest to attract the borrowers and thus to get more business. However, while attracting customers to make deposits, they advertise an effective annual rate as it is always higher than the nominal rate of interest.

Read Types of Interest Rates to learn more about different types of interest rates.

What effect does compounding interest more frequently than annually have on its future value and the effective annual rate

Compounding of interest more frequently results in an increase in the effective annual rate. And, the process of calculating future value is termed compounding, so, this will ultimately lead to increased future value.