The time value of money is one of the key concepts in finance. It helps analysts and others to find the present and future value of cash flows. However, to get the time value of money, the interest rate is the most vital ingredient. In this article, we will discuss what this interest rate is made of, or the components of interest rate.

Before we detail the components of interest rates, it is important to understand the concept and relevance of interest rates in finance.

Importance of Interest Rate

In simple words, we can say that interest rate establishes the relationship between the present and future value of money.

Suppose someone asks for a $100 loan today and promises to pay $95 one year from now. Will you be okay with it? The answer will be no.

Now, what if in return for $100 today you get $105 a year from now? This arrangement looks better. This $5 extra that you are getting is the interest. Or, we can say $5 is the compensation that you are okay with for lending the money now. So, the interest rate, in this case, will be 5% ($5/$100).

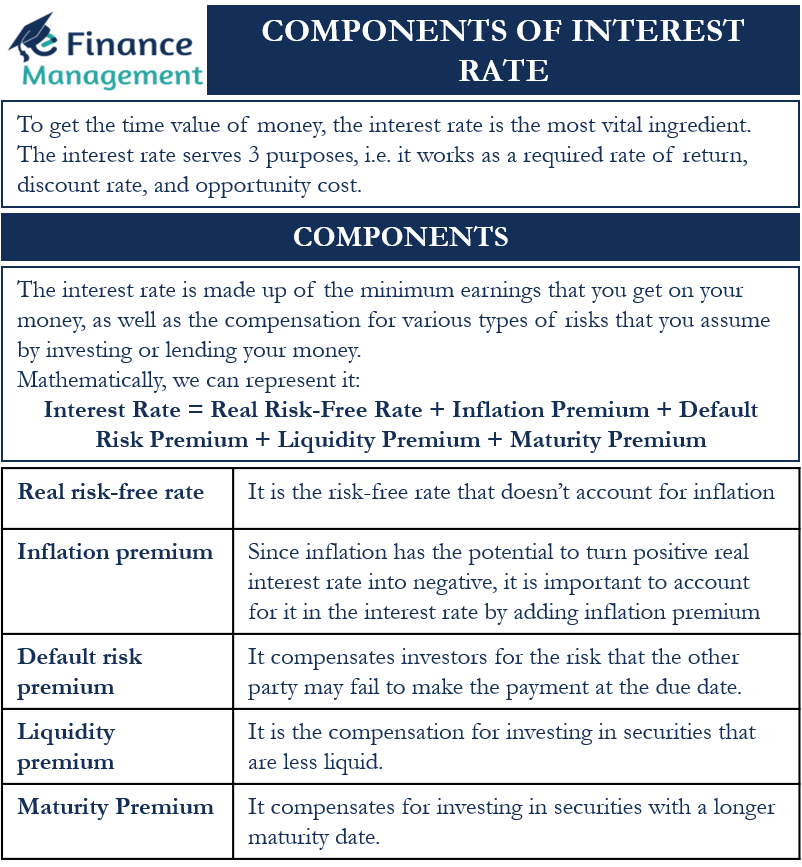

This interest rate serves three purposes, i.e. it works as a required rate of return, discount rate, and opportunity cost. Since you were okay with $5 one year from now, so we can say it was what you required to part away with $100 now. Thus, the interest rate works as the required rate of return.

Also Read: Determinants of the Time Value of Money

Similarly, if we discount the $105 by 5% for a year, we will arrive at a present value of $100. So, the 5% interest rate works as the discount rate as well.

Lastly, the interest rate also serves as the opportunity cost. This is because you decided not to put $100 to any other use because you were getting a 5% interest rate. So, this interest rate is your opportunity cost.

Generally, we use these three terms (required rate of return, discount rate, and opportunity cost) interchangeably in place of interest rate.

(We recommend reading our article – How is the Interest Rate related to the Required Rate of Return, Discount Rates, and Opportunity Cost? to know more about it.)

Now that you have an idea of what the interest rate is and its importance, let’s understand its components.

Components of Interest Rate

When we say that interest rate is the required rate of return, we mean it is the rate that compensates investors for the risks they take by lending or investing their hard-earned money, as well as providing them with the minimum earnings. The risks could be that the other party could go bankrupt and will be unable to pay back the money. There is also a risk that the value of the investment will drop because of inflation. There are other risks as well.

So, we can say that the interest rate is made up of the minimum earnings that you get on your money, as well as the compensation for various types of risks that you assume by investing or lending your money.

The best way to denote the minimum earnings is the risk-free rate. And, talking about the risks, there are mainly four types of risks that broadly covers all risks for an investor. These are inflation risk, default risk, liquidity risk, and maturity risk.

So, we can say that the interest rate is the sum of the risk-free rate and the compensation or premium for assuming these four risks. Mathematically, we can represent it:

| Interest Rate = Real Risk-Free Rate + Inflation Premium + Default Risk Premium + Liquidity Premium + Maturity Premium |

Components of Interest Rate (in Detail)

Let’s understand each of the above components in detail:

The risk-free rate is the interest rate that a completely risk-free security offers. And, the real risk-free rate is one that doesn’t account for inflation. We can get the “real” risk-free rate by deducting the current inflation rate from the treasury bond yield with a duration that matches your investment period. In reality, however, there are no securities that are totally risk-free.

An inflation premium is a rate that compensates investors for the expected inflation. Inflation reduces the value or purchasing power of money over time. Suppose, security offers an interest rate of 6% but the inflation level rises by 1% in the same year. In this case, inflation will lower the real return on the security to 4%. Since inflation risk has the potential to turn positive real interest rate into negative, it is important to account for the inflation risk in the interest rate by adding an inflation risk premium.

If we add an inflation risk premium to the risk-free rate, we get the nominal risk-free rate. So, instead of taking the real risk-free rate and inflation risk premium separately, we can take the nominal risk-free rate. One widely used nominal risk-free rate is the interest rate on a three-month U.S. Treasury bill (T-bill). This is because U.S. T-bills enjoy the backing of the U.S. government and are highly liquid.

The default risk premium, as the word suggests, compensates investors for the risk that the other party may fail to make the payment at the due date. This premium depends mainly on the creditworthiness of the parties. The creditworthiness, in turn, depends on several factors, such as the borrower’s credit history, financial standing, and the assets (if any) they own.

The liquidity premium is the compensation for investing in securities that are less liquid. The term ‘less liquid’ here means securities that we can’t easily convert into cash at a fair value. The U.S Treasury bills are very liquid as you can easily buy and sell large quantities of T-Bills in the open market. Similarly, securities from small companies are usually less liquid. This is why such securities offer a higher interest rate in comparison to securities from bigger players. The higher interest rate compensates investors for investing in illiquid securities.

Lastly, the maturity risk premium compensates for investing in securities with a longer maturity date. We all know that the future is uncertain. So, the more the maturity, the more will be the chances of something unfavorable happening to the investment due to the micro or macro factors. For instance, three years back no one had thought that the COVID-19 pandemic would hit the financial markets so hard. The general rule is that the higher the maturity, the more will be the maturity risk premium.

We can easily find the maturity risk premium by subtracting the interest rate on the one-year Treasury bill from the same duration Treasury bill that you are looking to invest in. For instance, if you want to invest for 10 years, then you need to deduct the interest rate on the one-year Treasury bill from the interest rate of the 10-year Treasury bill.