Negative Interest Rate

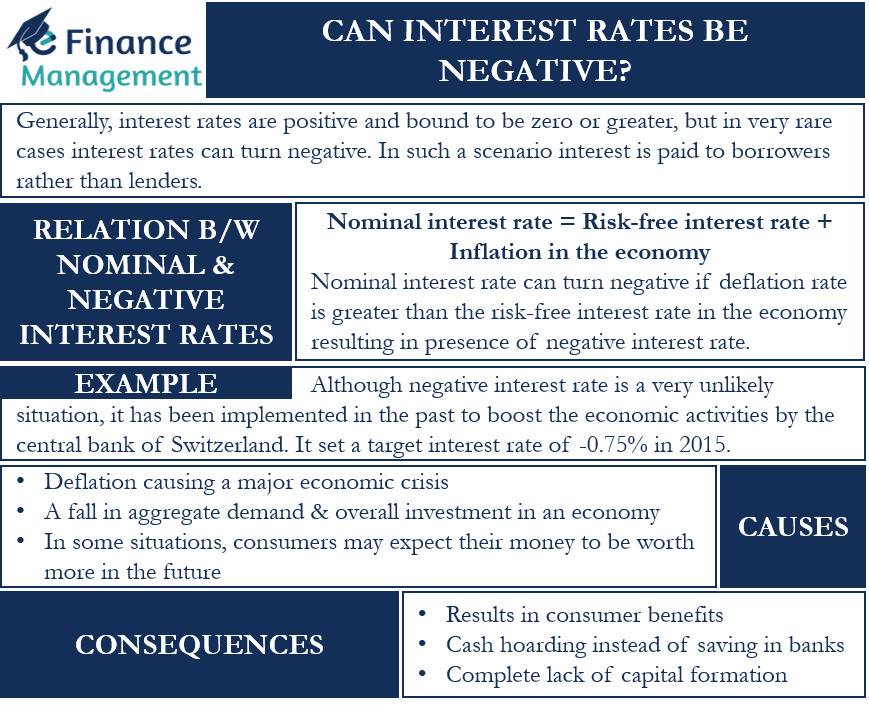

Generally, interest rates are positive and bound to be zero or greater, but in very rare cases interest rates can turn negative. In such a scenario interest is paid to the borrowers rather than lenders. The situation of a negative interest rate is highly unusual. It is used by policymakers during a period of deep recession or depression after monetary efforts and market forces have already pushed the interest rate to zero. Negative interest rates help policymakers to fight the situation of deflation in the economy.

The interest rate is pushed below zero in an economy to encourage lending and circulation of money in the economy. An increase in spending and investment helps to boost aggregate demand and push the economy out of recession.

One major concern for investors with savings accounts in a bank is that because of negative interest rates, the account holders are not paid any interest. Instead, the account is actually reduced because of a negative interest rate. This is done to promote consumption in the economy, as the money will be reduced from investors’ accounts even if it is not spent. This can lead to investors withdrawing money from bank accounts and hoarding it which causes further damage to the economy.

Relation between Nominal and Negative Interest Rates

Nominal interest rate = Risk-free interest rate + Inflation in the economy

A positive inflation rate increases the nominal interest rate in the economy. Hence, deflation leads to a fall in the nominal interest rate of the economy. As per the relationship mentioned above, the nominal interest rate can turn negative if the deflation rate is greater than the risk-free interest rate in the economy. Therefore, this results in the presence of a negative interest rate in the economy.

Also Read: Nominal Interest Rate

Example of Negative Interest Rates

The occurrence of negative interest rates is unusual. They need to be explained since they are counterintuitive. If the interest rate is negative, the borrower is compensated to take out a loan! This means that if a borrower borrowed $100 and returned it after a year, he would only be required to pay back $99 of it, assuming the interest rate of negative 1 percent.

Although the situation of negative interest rates is very unlikely, it has been implemented in the past to boost economic activities. The central bank of Switzerland set a target interest rate of -0.75% in 2015 in order to boost economic activities. More recently, the central bank of Japan set the target interest rate at -0.1%. This unusual monetary policy is adapted to push economic activities through spending and investment.

Causes of Negative Interest Rate

As strange as it may sound, in a negative interest rate environment the lenders may end up paying borrowers an interest rate for taking out a loan. Negative interest rates are often the result of a desperate and critical effort to boost economic growth through financial means. The following are the possible causes of a negative interest rate in the economy:

- Negative interest rates are set by central banks during deflationary periods. Deflation causes a major economic crisis and can result in a sharp decline in economic activities. This forces the policymakers to undertake difficult measures, including pushing interest rates below zero for improving overall economic conditions.

- In some situations, consumers may expect their money to be worth more in the future. This makes consumers hoard more money at the present. This results in a sharp decline in demand in the economy.

- In an extended period of recession or depression, the aggregate demand and overall investment in an economy can fall at an alarming rate. Therefore, negative interest rates are used by monetary authorities to improve economic activities.

Consequences of Negative Interest Rates

Consumer Benefits

Contrary to popular belief, only large banks and corporations will be able to take advantage of negative interest rates. The negative rates will not be advantageous to individuals. Because only the base rate will be negative, this will happen. Borrowers who can obtain credit at rates close to the base rate will gain.

Also Read: Deflation

Cash Hoarding

The economy would experience the opposite if interest rates were negative. They would compel customers to avoid using banks for their financial transactions. Instead of making deposits in a bank, people would be better off saving their money at home. Instead of promoting the cyclic flow of the economy, cash hoarding disrupts it. As a result, it is ineffective.

Governments also appear to have a remedy for this issue. All major economies are moving toward cashless transactions. This implies that money will only be available in digital form, ceasing to exist in its physical form. Therefore, keeping the money hidden under your mattress is not an option! People will be compelled to maintain their financial assets digitally. If they do not spend it all and continue the consumerist cycle, they will be forced to pay interest on the money.

Capital Formation

Negative interest rates’ worst consequence would be a complete lack of capital formation. All business ventures are launched with some of the entrepreneur’s savings. Savings would seem weird in this strange new world. Consequently, it would not be possible to create capital. Additionally, big firms, who compete with small enterprises, will unfairly benefit from negative interest rates acting in their favor.