What is Net Cash Flow?

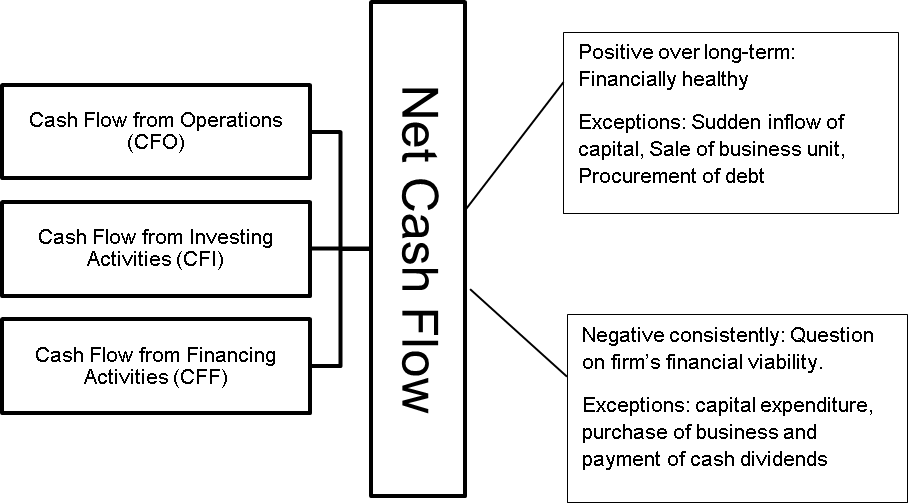

Net cash flow means the amount of cash generated by an operating business over a period of time, say one year, six months, or nine months. A business generates or invests cash in three main activities, which are: (1) Operating Activities, (2) Investing Activities, and (3) Financing Activities. Net cash flow is the aggregate of cash inflows and outflows from these three activities. It is nothing but the difference between cash inflows and outflows of a business. We also know it as an increase/decrease in cash and cash equivalents. Cash equivalents are those assets that are highly liquid and can be swiftly converted into cash and therefore are termed as good as cash many times. It is a good metric to analyze the liquidity of a business.

How can we Calculate Net Cash Flow?

Net cash flows can be easily found in the statement of cash flows. You can also determine the number by calculating the changes in cash balance stated in the balance sheet over two different periods.

Calculation from Statement of Cash Flows

We can calculate the net cash flow from the statement of cash flows with the help of the following equation.

Net Cash Flow = CFO+CFI+CFF

Cash from Operating Activities (CFO)

This is the net cash a business generates from the core operations of the business. CFO includes tax refunds or expenses and changes in working capital. CFO includes net profits adjusted with non-cash expenses and incomes and changes in working capital. Non-cash expenses are added back to profits, and non-cash revenues are deducted.

Cash from Investing Activities (CFI)

This is the net cash generated from sales and purchase of equipment and assets (tangible or intangible) and other capital expenditures for core operations. It also includes cash movement due to investments made outside the company like investing in other businesses, stock market, bonds, etc.

Also Read: Net Cash Flow Calculator

Cash from Financing Activities (CFF)

This is the net cash generated from the procurement and repayment of short and long-term debt, issuance of equity, purchase/sale of treasury stock, payment of dividends, etc.

It is to be noted that the net cash flow can be positive as well as negative. The best measure of the accuracy of net cash flow is it is equal to the changes in cash and cash equivalents. The latter denotes the difference between opening and closing cash balance.

Example of Net Cash Flows

Assume that Company X Ltd. is engaged in the manufacturing of article Y. Its cash flows from operating activity, investing activity and financing activity are $ 20,000,000 ($4,500,000) and $1,000,300, respectively.

| Particulars | ($) |

| Cash Flow from Operating Activities | 20,000,000 |

| Cash Flow from Investing Activities | (4,500,000) |

| Cash Flow from Financing Activities | 1,000,300 |

Net Cash Flows = 20,000,000 + (-4,500,000) + 1,000,300 = 16,500,300

Interpretation

As said above, cash flow can be either negative or positive. A positive cash flow determines gains, and negative cash flows represent company losses. In the example above, X Ltd. has a positive net cash flow of $16,500,300 which means the company has generated this cash in the current year from all its operations.

Also Read: Cash Flow Statement – Definition and Meaning

Calculation from Balance Sheet

We can also calculate net cash flows from the balance sheet. It is the difference between the cash balance from the balance sheet over two consecutive periods.

Net Cash Flow = Cash Balance for 2020 – Cash Balance for 2019

Example of Net Cash Flow Calculation

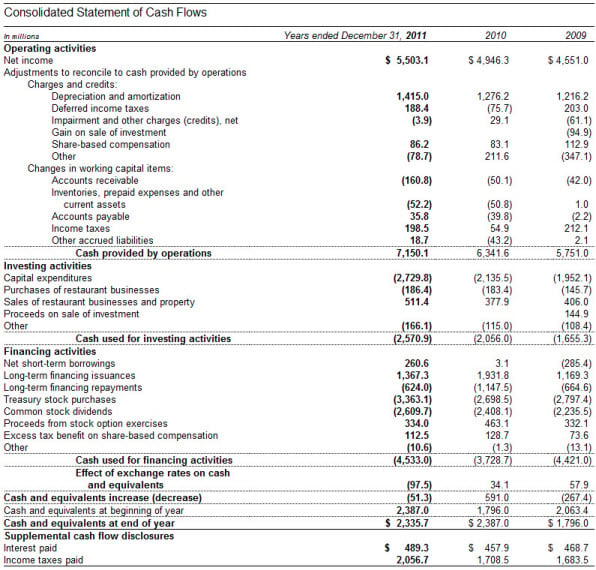

In the above example for the year 2011,

Cash from operating activities (CFO) is $7,150.1 million

Cash from investing activities (CFI) is $(2,570.9) million

and cash from financing activities (CFF) is $(4,533.0) million

Hence, the Net Cash Flow for 2011 is CFO + CFI + CFF + Effect of Exchange Rate=

= 7150.1 – 2570.9 -4533 – 97.5 = -51.3 = $(51.3) million

Use Net Cash Flow Calculator for a quick calculation.

Difference between Net Cash Flow and Net Income

- There is often confusion between net cash flows and net income. Though they may sound similar, both are diametrically opposite concepts. Net income is the resultant earning an organization has after adjusting all the operating & non-operating expenses and taxes from the total revenue earned. In contrast, net cash flow is the aggregate of all the cash generation by the organization over a period. If an organization has $200 as net income, it doesn’t imply that it has generated $200 cash in that period. However, if an organization has a net cash flow as $200, it means that it has been able to generate that amount of cash in that period.

- Net income is a result of the accrual basis of accounting, wherein you recognize all the expenses in the same period of the revenue earned. Net cash flow, on the other hand, we look at the outflow and inflow of cash and cash equivalents during a period.

- In the calculation of net income, it is not necessary that all the expenses need to be in cash. Depreciation and amortization are non-cash expenses included in the calculation of net income. For arriving at net cash flow from operations, you only take cash expenses into consideration.

Also, read Cash Flow Vs. Fund flow

Why is the Net Cash Flows Important?

Net cash flow is the driving force behind an organization, and it facilitates the following important activities.

- Core business operations,

- Investment in new technology

- Research and product innovation,

- Expansion in new markets,

- Repurchase stock,

- Increase equity financing

- Reducing debt

However, while analyzing net cash flows, we don’t just need to see whether they are positive or negative, but we must also know the time frame and its reason. For example, an organization may have invested a huge sum in purchasing equipment to manufacture a new product line. The cash flow might turn negative in the short run because of this move. However, in the long run, this new product could result in increased cash generation for the organization, which will make the cash flows positive. Similarly, Net cash flows can be negative if the organization has repaid a big portion of the debt, but this may not impact its viability in the long term. Hence, the analysis has to be multidimensional when it comes to net cash flow.

In the above example also, we have a negative cash flow. However, it is more due to capital expenditure, purchase of restaurant business, and payment of cash dividends. Though these transactions have brought down the cash levels, it does not necessarily mean that the business is financially unviable.

Taking all these factors into consideration, if an organization is able to maintain positive cash flow over the long term, an investor will consider it financially healthy. On the other hand, if an organization reports negative cash flows consistently, it is a big question on its viability. The inability to meet its day-to-day expenses related to operations, investments, and financing reduces its potential to attract long-term investors.

Cautions

Net cash flows represent the difference in cash and cash equivalents of the company in two periods. However, it fails to provide a view of the liquidity and solvency position of the company.

Read more about other Methods of Financial Analysis.

Quiz on Net Cash Flow.

This quiz will help you to take a quick test of what you have read here.

I truly wanted to compose a word so as to thank you for some of the lovely tips and hints you are sharing at this website. My prolonged internet investigation has at the end of the day been rewarded with beneficial knowledge to talk about with my close friends. I ‘d point out that most of us readers are undeniably endowed to dwell in a good network with very many awesome professionals with useful tactics. I feel extremely privileged to have come across your web site and look forward to some more exciting times reading here. Thanks once again for a lot of things.

Thanks for sharing this article. This will definitely help me to manage my finances. It’s a big help for me to do my accounting. This post is very useful for business owners like me. I’ll definitely return to this site.

Thanks for sharing this. I need to calculate my business net cash flow. This article is very informative and helpful. This will help me to do my task faster and easier. This is a very useful post.

You have writtern some really good points in your blog and I will definitely share this with my colleagues to have some tips.

On the other hand, I have also started wiriting on a similar niche and I need you to please review my write up here : How to calculate Cash Flow.

Let me know what you think of it. I’d be glad. Thanks

Thanks, Gena for the appreciation. It’s good to know that you also write for a similar niche. We have gone thru and definitely, the write-up was good. Thx

Thanks for sharing this. I need to calculate my business net cash flow. This article is very informative and helpful. This will help me to do my task faster and easier. This is a very useful post.