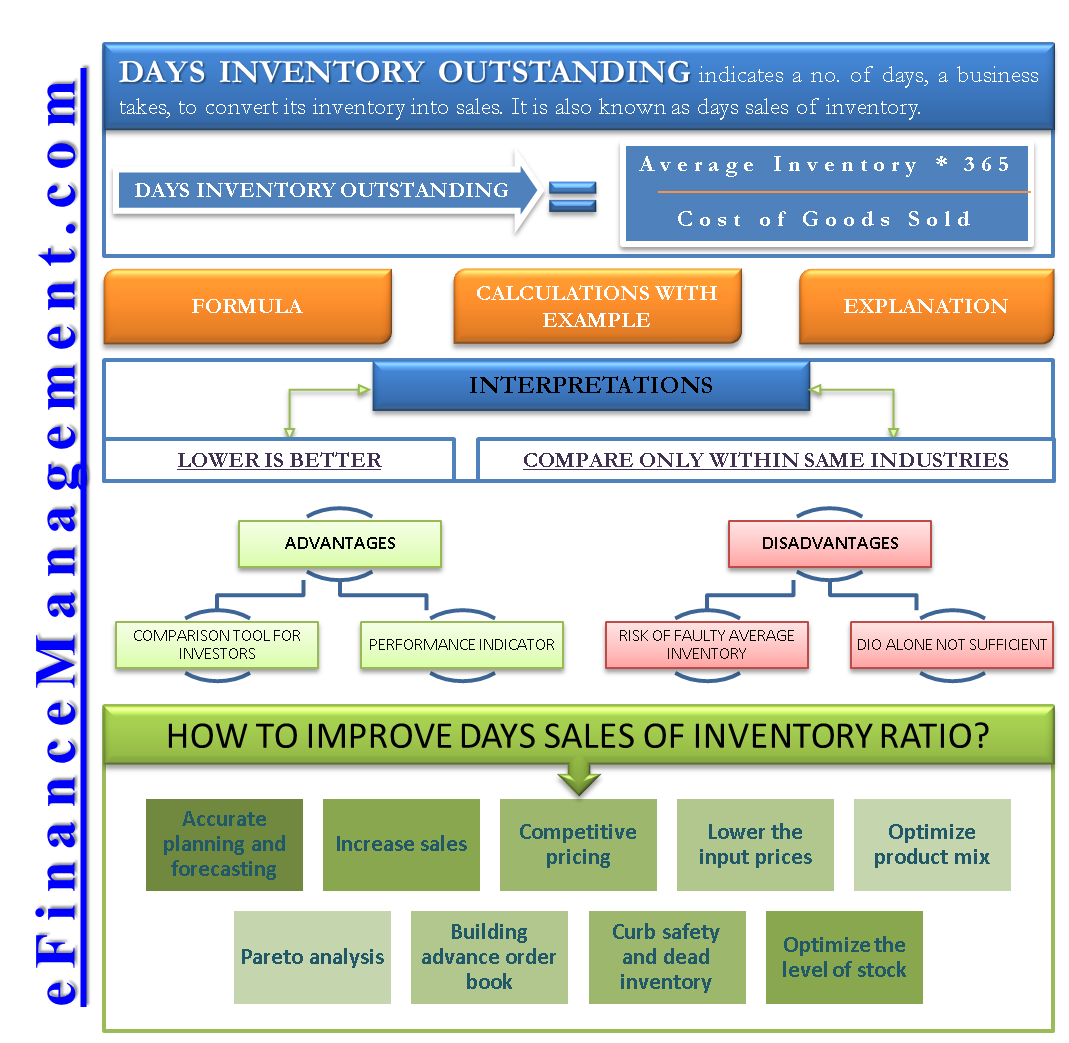

What is Days Inventory Outstanding (DIO)?

Days Inventory Outstanding (DIO) is a financial metric used to measure the efficiency of a company’s inventory management. It calculates the average number of days it takes for a company to sell its entire inventory. In other words, DIO shows how quickly a company is able to turn its inventory into sales revenue. Also known as days sales of inventory (DSI), it is an important performance indicator in working capital management.

Days Inventory Outstanding Formula

The formula for DIO is simply expressed as follows:

Days Inventory Outstanding = (Average Inventory / Cost of Goods Sold) * 365

where,

- Average inventory is the average inventory value at the beginning and the end of the financial year.

- The cost of goods sold is the same as represented in the income statement. It includes all the expenses relating to the production of goods and services sold. It normally includes material, labor, and overheads.

A point to note is that sometimes we use ‘sales’ as the denominator for calculating this ratio due to difficulty in finding the right cost of goods sold for any reason. But it is not the right practice. Because, when inventory, i.e., our numerator, is valued at cost; the denominator should also be valued at cost.

The reciprocal of this ratio gives us inventory turnover ratio, which is expressed in times rather than no. of days.

Days Inventory Outstanding Example

Let’s take a small example and look at how we can calculate this metric.

- Inventory value at the beginning = $40,000

- Inventory value at the ending = $60,000

- Cost of goods sold = $300,000

Therefore, average inventory = $50,000 (i.e., ($40,000 + $60,000)/2)

Days Inventory Outstanding = ($50,000 * 365) / $300,000 = 60 Days

We can call 60 days as 2 months. From another angle of looking at it, we can also say that the frequency of replacing the inventory is 2 months. So, effectively, in the example, the firm is converting its inventory into sales 6 times a year (6 = 12 Months / 2 Months).

The figure of 60 days in the above example represents that the inventory that enters the entry gates of a firm will go out of the exit gates in 60 days, becoming part of the finished goods of the firm. If the firm is a manufacturing concern, these 60 days would comprise the days of storing the raw material, processing the material on the production floor, staying in the stage of goods in process, finishing the goods in process, packaging, and dispatching.

Also Read: Days Sales Outstanding

In bookkeeping or accounting terms, the following process takes place. If we look at it, the inventory is created as an asset in the balance sheet on the date of receipt of the inventory, or it could be on the date of booking of the invoice in the accounting system.

| Events | Date | Remarks |

|---|---|---|

| Purchase order placed by purchasing team for raw materials | 10 June | |

| The vendor accepts the order and raises the invoice | 13 June | |

| The vendor dispatches the raw materials from his factory | 14 June | |

| Raw material received at the factory & a goods inward receipt is prepared after proper verification of quality and quantity of goods with PO | 20 June | Days of Inventory Begins |

| Raw material issued for production | 30 June | |

| Raw material becomes goods in process | 25 July | |

| Goods in process becomes finished goods and stored in warehouse | 30 July | |

| Finished goods sold to customer and dispatched | 10 August | Days of Inventory Ends |

Ideal Days Inventory Outstanding Ratio

The apparent interpretation of this metric is “Lower the Better.” But why is lower better?

A lower days inventory outstanding (DIO) ratio is generally preferred, as it indicates that a company is able to sell its inventory quickly and efficiently. This means that the company is generating cash flow and can reinvest the money back into the business or pay off debts.

Assume that a firm has blocked the working capital of $20,000 in inventories. Now, at the rate of 12% a year, the interest cost of holding the inventory would be $2,400. I have a simple question for you. Will the interest cost change if the company is able to reduce the inventory conversion cycle from 2 months to 1.5 months? No, because the amount of working capital blocked in inventory is still the same. Hence, the interest cost is going to remain fixed. It will neither change if the conversion time becomes 4 months nor when it becomes 1 month.

Here is the real opportunity of taking advantage of financial leverage. When we know that interest costs will remain fixed, the management of the firm should focus on speeding up the inventory movement. This will directly show its positive impact on gross profits and consequently on net profits in the income statement.

However, the ideal DIO ratio can vary depending on the industry and the company’s business model. For example, companies that sell high-priced, specialized goods may have a longer DIO because it takes longer to find a buyer for their products. Similarly, companies that sell fast-moving consumer goods may have a shorter DIO because they need to maintain a high level of inventory to meet demand.

Ratio Higher than Industry Average

If a company’s DIO ratio is significantly higher than the industry average or its own historical performance, it may indicate poor inventory management practices. For example, if a company is holding onto inventory for too long, it may suggest that the company is overstocked, has low demand for its products, or is experiencing difficulties with its sales and distribution channels. This can lead to the obsolescence of the inventory and result in higher costs due to storage, insurance, and other expenses.

Ratio Lower than Industry Average

On the other hand, if a company’s DIO ratio is significantly lower than the industry average or its own historical performance, it may indicate that the company is experiencing supply chain disruptions or difficulties in sourcing raw materials. This can result in stockouts, which can lead to lost sales and damage to the company’s reputation. Additionally, if a company is unable to maintain adequate inventory levels, it may be forced to pay higher prices for raw materials or rush orders, which can increase costs and reduce profitability.

Why do we Calculate Days Inventory Outstanding?

There are various reasons and benefits of calculating this metric. These are as below:

Performance Indicator

Internal management uses it as a tool or as a performance indicator for employees responsible for effective inventory management. When the appraisal of relevant employees is linked with this metric, they are bound to think, focus and bring positive change to the overall inventory processes.

Forecasting Future Cash Flows

DIO can help forecast future cash flows as it indicates how long it takes a company to convert its inventory into sales. This information can be used to plan for future cash flows and make informed investment decisions.

Comparison with Industry Averages

DIO comparison can help identify areas where a company is underperforming or excelling, and make informed decisions about how to improve performance.

Identifying Supply Chain Issues

A high DIO ratio can indicate that a company is experiencing supply chain issues, such as problems with sourcing raw materials or delays in production. This information can be used to identify and address issues in the supply chain to improve overall efficiency.

Comparison Tool for Investors

By now, you would agree that it can work as a great tool for investors when they are rating two companies on their efficiency in inventory management. We have already covered in detail what we should be careful about while comparing the two companies.

Disadvantages of Days Inventory Outstanding

Like any other ratio, this ratio also has its own limitations. Let’s look at them.

Risk of Faulty Average Inventory

The real idea behind taking the average is to take an average inventory held by the company throughout the year. For the sake of ease, we take an average of opening and closing inventory for finding out this ratio. This thing creates a mess. Suppose a company has intentionally increased its inventory at the time of year closing genuinely in expectation of a sudden big order. The figure of average inventory as per the stated formula will not represent a true average inventory of the firm in a real sense. One of the ways to overcome the problem of calculating average inventory is to take an average beginning inventory of 12 months. This, to a great extent, eliminates the problem of seasonality that we just discussed. Or we can also take the help of sophisticated ERP for this purpose for Greater accuracy.

DIO Alone is not Sufficient

This metric is not sufficient alone. By this, I mean you can’t say with confidence that a company’s inventory management is good or bad without comparing it with its peers in the same industry. Even after that, suppose a company is heavily investing in inventory because it has started catering to retail customers (where the orders are urgent) directly from the factory, which the other players in the sector are not doing. In this case, the extra margins earned by serving directly to retail markets compensate for the cost of holding inventory.

How to Improve Days Inventory Outstanding?

There are several ways to improve Days Inventory Outstanding (DIO) and reduce inventory levels. These are:

Optimize the Level of Stock

One of the most important ways to reduce days inventory outstanding is to streamline the inventory management process. This can be achieved by using automated systems to track inventory levels and reorder points, which can help to reduce overstocking and understocking.

Curb Safety and Dead Stock

Another way to improve DIO is to implement just-in-time (JIT) inventory management. JIT involves ordering inventory only when it is needed, which helps to reduce carrying costs and minimize the risk of inventory obsolescence. This requires close coordination with suppliers and a reliable supply chain.

Addressing Bottlenecks

Another approach to improve DIO is to implement more efficient manufacturing processes, which can help to reduce the amount of time it takes to produce goods and move them through the supply chain. This can be achieved by investing in new technology or equipment, or by redesigning production processes to eliminate bottlenecks and improve throughput.

Optimize Sales and Distribution

Companies can improve DIO by optimizing their sales and distribution channels. This involves improving demand forecasting and sales planning, as well as optimizing distribution networks to reduce delivery times and costs. By doing so, companies can ensure that inventory levels are aligned with customer demand and that products are delivered to customers in a timely and cost-effective manner.

Others

- Competitive pricing of the firm’s product can also boost sales if the product sales are price sensitive.

- Working on the product mix of the firm and determining the top-selling products.

- Implement Pareto’s 80:20 Principle on the inventory to invest in the right inventory contributing the maximum to the profits.

- Focus on building an advance order book so that the planning of inventory becomes even more efficient.