A Leasehold Improvement is the changes made to a rental property in order to meet the needs of a tenant. There can be various improvements such as installing partitions, floorings change, lightings or even painting. Leasehold improvements arise only when the lessee pays for enhancements.

In case the person who owns the place makes improvements, we call it capital improvements. The work and improvement that the lessor (owner) undertakes on improving the property depend on how marketable they want to make the property. If the lessor does not provide financial support for improvements, the tenant (lessee) will have to bear the cost and make necessary improvements as per their requirement.

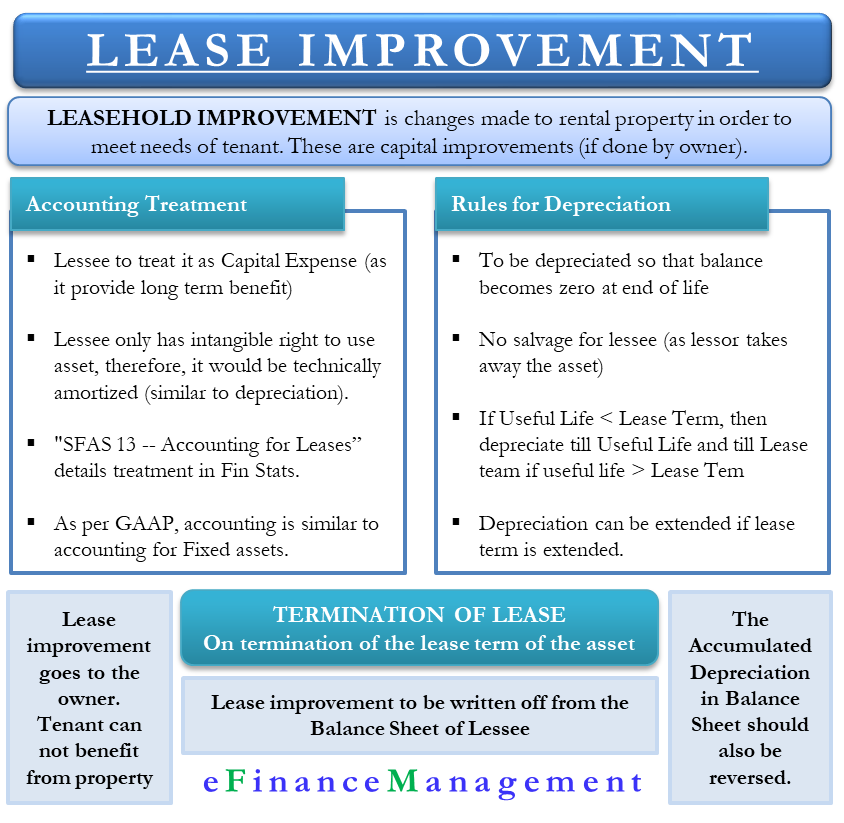

Accounting Treatment

Since these leasehold improvements provide long-term benefits, the lessee can’t show them as an expense in the year it incurs them. So, the lessee must treat it as a capital expense and depreciate over time.

Should you depreciate or amortize? Technically, the lessee only has an intangible right to use the asset during the lease term. And intangible rights are amortized (not depreciated) in accounting. So, the lessee should also technically amortize this. However, there is no real effect of using amortization over depreciation in the case of leasehold improvements.

Also Read: Depreciation

Leasehold Improvement under GAAP

“SFAS 13 — Accounting for Leases” details the treatment of leasehold improvements in the financial statements. As per the GAAP (Generally Accepted Accounting Principles), the accounting treatment for lease improvement is similar to the accounting for fixed assets. The lessee must depreciate the purchase cost of the improvement over the useful life of the asset in question.

For the depreciation purpose, the first thing that the lessee should estimate is the useful life of the improvements. Then, compare that useful life with the lease term. GAAP recommends using a straight-line basis for the depreciation until the useful life or the lease term, whichever is less. For instance, an improvement cost of $2000 would last seven years. The lease term, however, is five years. In this case, the depreciation term would be for five years, i.e., $400 per year.

Rules with Leasehold Improvement Depreciation

The lessee must depreciate all leasehold improvements to ensure the balance at the end reduces to zero. In most cases, there is no salvage as the lessor takes over the asset. GAAP associates following rules with the depreciation with the leasehold improvement;

Useful Life Basis

Suppose the leasehold improvement is estimated to have a less useful life than the term of the associated lease. In that case, the depreciation of the asset should be over the useful life. For example, the lessee expects the lighting to last for five years. However, the term of the lease is nine years. In this case, the depreciation would be for five years.

Also Read: Accelerated Depreciation Method

Extended Lease Term Basis

In case the lessee expects any extension or renewal of the lease, the lessee can extend the depreciation period to cover the additional term of the lease, limiting the useful life of the asset.

Lease term basis

If the life of the leasehold improvement is estimated to be equal to or more than the lease term, then the lessee should depreciate the improvement over the term of the lease. For example, the lessee expects marble flooring to have a useful life of ten years. But, the lease term is of eight years. In this case, the depreciation period should be eight years.

Writing Off Leasehold Improvement

Once the lease term expires or terminates, the leasehold improvements go to the owner as they are now a part of the property. After the termination goes into effect, the tenant company cannot benefit from the leasehold improvements, resulting in a loss of value.

Once the term terminates, the leasehold improvement should be written off from the balance sheet. If there is no scope for renewal of the lease, the tenant forsakes various leasehold improvements made to the rental property. Since the tenant now has no more control or benefits from these assets (improvements), it should strike off the same from the balance sheet as well.

As said above, the leasehold improvements get similar depreciation treatment as any other physical asset throughout the lease term. However, the company does not carry the leasehold improvement on its books once the lease term ends. Therefore, it must not carry the accumulated depreciation either. Thus, it should reverse the accumulated depreciation.

Example

Suppose a distributor of electrical appliances enters a lease for warehouse space. Although the location matches the distributor’s requirements perfectly, he needs to do some upgrades to make it usable. Negotiation and finalizing the deal suggest that the owner of the warehouse will pay $10,000 for building improvements. However, the distributor estimates the cost to be around $20,000. In this case, after all the construction and installation, the asset will be capitalized at $20,000, offset by an incentive credit of $10,000 from the property owner.

Final Words

Once the lease term ends, the improvements belong to the landlord unless the agreement states otherwise. If the tenant can take it along, then they must remove it without damaging the property. Even if they take it along, they need to follow the GAAP guidelines for accounting.

Also, read – Lease Accounting by Lessee and Lessor.

RELATED POSTS

- Accounting for Capital Lease – Steps, Accounting Entries and More

- Accumulated Depreciation – Meaning, Accounting and More

- Financial and Operating Lease Accounting by Lessee and Lessor

- Advantages and Disadvantages of Capital Lease

- Lease Vs Rent

- Accounting for Equipment Lease – Meaning, Treatment, and Example

The lesson are very crucial for learners and for updating the carrier

congratulation

keep it up and continue to send to me since it is helping me a lot for updating myself