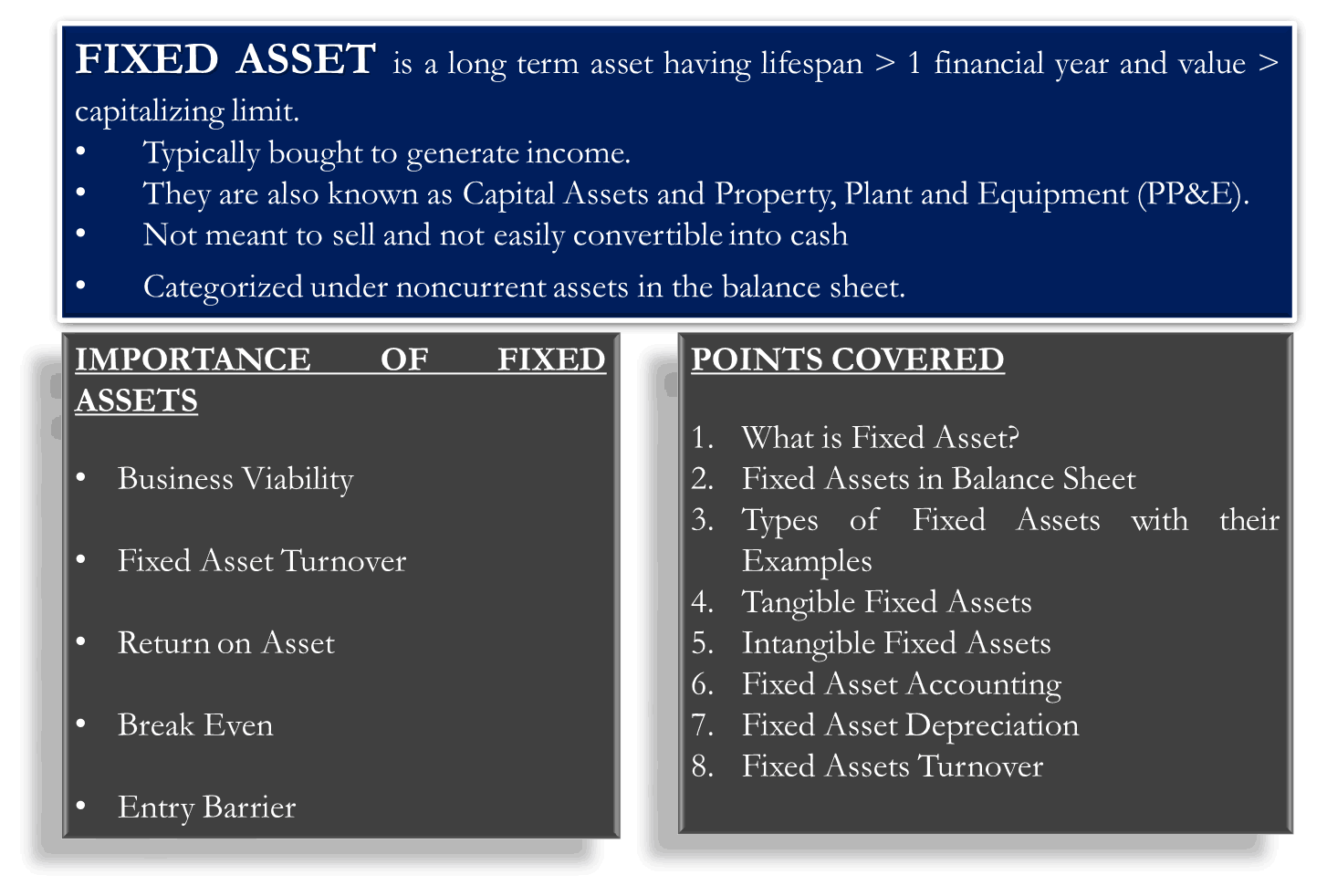

What is Fixed Asset?

A fixed asset, in accounting, is defined as a long-term asset having a lifespan > 1 financial year and a value > capitalizing limit. They are typically bought to generate income. They are also known as Capital Assets and Property, Plant, and Equipment (PP&E). These assets are normally not meant to sell or are not easily convertible into cash and therefore are categorized under non-current assets on the balance sheet.

Fixed Assets in Balance Sheet

A balance sheet consists of assets, liabilities, and capital by shareholders. Further, there are different types of assets: current and noncurrent assets. Current assets are liquid assets that can be converted into cash within a period of one year. At the same time, noncurrent assets include fixed assets, investments by the company, capital work-in-progress, etc., which are not easily converted into cash. In the balance sheet, the fixed asset value is reported after deducting accumulated depreciation. It is rare, but there are chances of value being affected by an impairment or revaluation.

Visit Revaluation of Fixed Assets

Types of Fixed Assets with their Examples

There are two types of fixed assets viz. Tangible Fixed Assets and Intangible Fixed Assets

Tangible Fixed Assets

Examples of these assets are land, building, property, plant, equipment, computer, vehicle, machinery, etc. In short, the assets, which you can touch, are normally categorized as tangible assets.

Intangible Fixed Assets

Example of intangible fixed assets includes computer software, patent, trademark, copyright, goodwill, etc. In a similar fashion, you can define intangible fixed assets that you cannot touch.

Also Read: Fixed Asset Accounting

Fixed Asset Accounting

In financial accounting, fixed assets are treated in the following three ways.

- Depreciation or Amortization for Tangible Assets and Intangible Assets, respectively.

- Impairment of Asset – This is normally done when the Asset’s market value goes below the net book value of the Asset.

- Selling or disposing of the Asset

Read our detailed article on Fixed Asset Accounting

Fixed Asset Depreciation

Depreciation of fixed assets is done to calculate and include the cost of using fixed assets in the profit and loss statement. There are different methods of calculating depreciation – Straight Line Method, Accelerated, Double Declining Balance, and Units of Production Method, Written Down Value Method. A corporation must report a financial statement with a consistent policy of depreciation, and if the policy is changed, it has to be reported separately. Fixed asset depreciation is also a crucial area because the net profit shown in the financial statement is quite dependent on the method of depreciation.

So, it is very important for an analyst to consider this point. In addition to that, the management of the company should understand the purpose of charging depreciation. It is to retain a part of the company’s profit so that when the replacement of fixed assets is required, the company can have sufficient funds to replace them. Depreciation should not be charged just to complete a formality. Since the objective is to avail sufficient funds to replace the asset at the end of its useful life, it is important to consider the inflation factor also and thereby make an additional provision for the same. Selection of method of depreciation is also very important.

Fixed Assets Turnover

The fixed asset turnover ratio is a financial metric to understand how many times the revenue is earned relative to its investment in fixed assets.

Formula

Fixed Assets Turnover Formula = Net Revenues / Average Net Fixed Assets

Net revenue is the revenue exclusive of the returns and taxes, and Average Net fixed assets mean fixed assets less depreciation.

Importance of Fixed Assets

Business Viability

Fixed assets are very important from the beginning. Without considering the value of fixed assets, the possibility of fixed asset turnover, and the life of an asset, it is not possible to accurately understand the viability of the business.

Fixed Asset Turnover

Once we have already invested in the fixed assets, the prime concern of the businessman is to keep a check on fixed asset turnover. There are plants that run 24 X 7 for producing any product. Lack of orders/sales can affect underutilized fixed assets or reduce fixed asset turnover. The business can fall prey to losses, especially due to the cost of using the assets, i.e., Depreciation.

Also Read: Meaning and Different Types of Assets

Return on Asset

Financial health is also determined in relation to the return on assets (ROA).

Break-Even

The concept of break-even and margin of safety is largely influenced by dependence on fixed assets.

Entry Barrier

One of the Porter five forces talks about barriers to entry. The fixed asset is one of the prime Contenders as a barrier simply because the higher the investment in these assets, the larger the amount of total investment becomes.

Decision making/Investment decision

Importantly for any investment decision, it is very essential to forecast the requirement of fixed assets in the business. Any wrong estimation of fixed assets will be very harmful in decision-making.

Continue reading – Fixed Asset Register.

Very understanding and basic explanation on how Fixed Asset is used or how it works.

Love your work…

It makes me want to read on.