Meaning of Intangible Assets

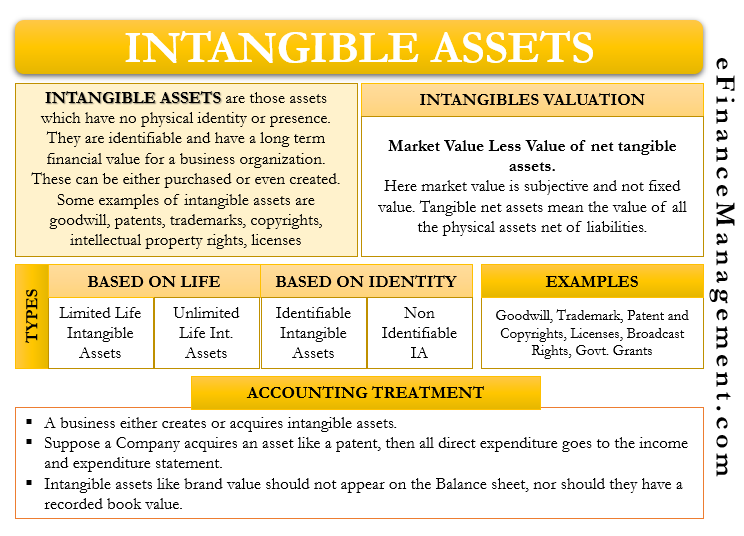

Intangible assets are those assets that have no physical identity or presence. And therefore, one can not touch or see those assets. But they are identifiable and have a long-term financial value for a business organization. They can be either created or acquired by purchasing from a third party. They are useful since they can help in generating revenues in an organization. Moreover, such assets cannot be used as a guarantee or collateral to get a loan; because the lender cannot take such an asset into custody in case of a default.

Some examples of intangible assets are goodwill, patents, trademarks, copyrights, intellectual property rights, licenses, etc.

Valuation of Intangible Assets

The formula for the valuation of intangible assets is:

The market value of the business less the value of net tangible assets

- The market value of the company is a subjective figure and not fixed. It depends upon various internal and external factors like goodwill and stability of the company, market conditions, urgency and need of the buyer, etc.

- Tangible net assets mean the value of all the physical assets net of liabilities. Assets will include inventory, banks, and cash balance, land, building, plant, and machinery, etc., whereas liabilities will consist of creditors, loans payable, etc.

How to Calculate Value of Intangible Assets with Example?

Let us suppose that company X decides to takeover company Y at a market value of US $500000. The value of net tangible assets is US$ 460000. Therefore, company X is paying US$40000 more than the value of net tangible assets. It is the goodwill worth US$40000 in the Balance Sheet.

Categories of Intangible Assets

Life of Intangible Assets

Limited Life

Few intangible assets have a limited life span. After the expiry of a specific period, they become redundant and are of no use to the company. Some examples of such assets are patents, trademarks, copyrights, and broadcasting rights.

Unlimited Life

Unlimited life intangible assets do not have a specific life span. They have value as long as the company continues to exist. Such assets are not amortized but are tested for impairment every year. Goodwill and brand value are examples of such intangible assets. If a business is not doing well continuously, it loses its goodwill and brand value. Hence, it needs to be evaluated for impairment every year.

Also Read: Intangible Assets and its Types

Identification of Intangible Assets

Identifiable

The characteristics of identifiable assets are that they are distinctly separable and identifiable from other assets. A company can sell them separately in case of need. Examples of such assets are patents, copyrights, trademarks, and intellectual property.

Unidentifiable

On the other hand, unidentifiable are such intangible assets that are not distinguishable or separable from other assets. Also, one cannot sell such assets separately. Goodwill is the most common example of such an asset.

Source of Intangible Assets

Purchased

A company may purchase or acquire a few intangible assets at the time or takeover of an existing company. Common examples of such assets are patents, trademarks, etc. These assets become part of the balance sheet, and then their amortization or evaluation for impairment takes place. Also, all the costs incurred by the company at the time of acquisition of such an asset are capitalized.

Internally Created

On the other hand, internally created intangible assets include assets that have been built or created over time. They have been developed over a number of years and have intrinsic value for the company. Such assets include brand value, goodwill, etc. They are usually not a part of the balance sheet.

An important point to be noted is that both the above types of intangible assets can be common, depending upon the situation. For example, at the time of acquisition of a company, goodwill will come under the “purchased intangible asset” category and will be a part of the Balance Sheet. But under regular circumstances, goodwill will be a part of the “internally created intangible assets” category and will not be a part of the Balance Sheet.

Examples of Intangible Assets

Following is a list of the most common intangible assets.

Goodwill

Goodwill is the value of the established reputation of a business over the years in monetary terms. It is valued at the time of transfer of ownership and is usually unidentifiable as it does not appear on the company’s balance sheet. It is the additional value that a buyer is willing to pay while buying a company above the net asset value of the business.

Goodwill of a company is created over the long term. It is visible in its brand name, customer base and relations with them, employee relation and satisfaction, patents in the name of the company, etc.

Trademark

Trademarks are logos, slogans, brands, or even the name of a product that differentiates it from other products. It has a legal connotation and tells that a product belongs to a specific company or that the company owns a particular brand. Thus, another company cannot use that or even a similar-looking or sounding logo, slogan, or brand name.

Patents

Similar to trademarks, a patent gives protection to innovation from being copied or used by some other company. In other words, a company can get a patent for a product, idea, technology, or process and legally prohibit other companies from using its innovation or discovery.

Copyrights

Copyright protects works of art, writing, music, composition, and architecture. Violation of copyrights is a punishable offense under the law.

Other than these, a few other such assets are:

- Licenses

- Broadcast Rights

- Government Grants

- Non-competition agreement

- Internet domain names

- Customer lists and relationships

- Order Pipeline

- Works of artistic importance

- Service contracts and lease agreements

- Trade secrets and know-how

- Research and development

You may like reading a detailed article on Types of Intangible Assets.

Accounting Treatment

A business either creates or acquires intangible assets. Suppose a company acquires an asset like a patent. All the direct expenditure, such as legal fees, application fees, etc., goes to the income and expenditure statement as an expense. It should appear on the balance sheet as intangible assets are amortized over a period of time.

On the other hand, intangible assets like brand value should not appear on the Balance sheet, nor should they have a recorded book value. In case a company acquires or purchases such an asset, it becomes a part of the Balance sheet as an intangible asset. As said earlier, the excess amount a Company pays over the net asset value becomes an intangible asset and will be shown on the Balance Sheet.

These assets may or may not have an identifiable useful life. Such assets are not subject to depreciation but amortization on a straight-line basis. The basis for amortization is their legal or useful life, whichever is shorter.

Intangible assets like goodwill have an indefinite useful life. Hence they are not subject to amortization. They may be subject to impairment after a proper reassessment. There is an entry of a loss in the income statement in case of impairment of such an asset.