What are Assets in Accounting?

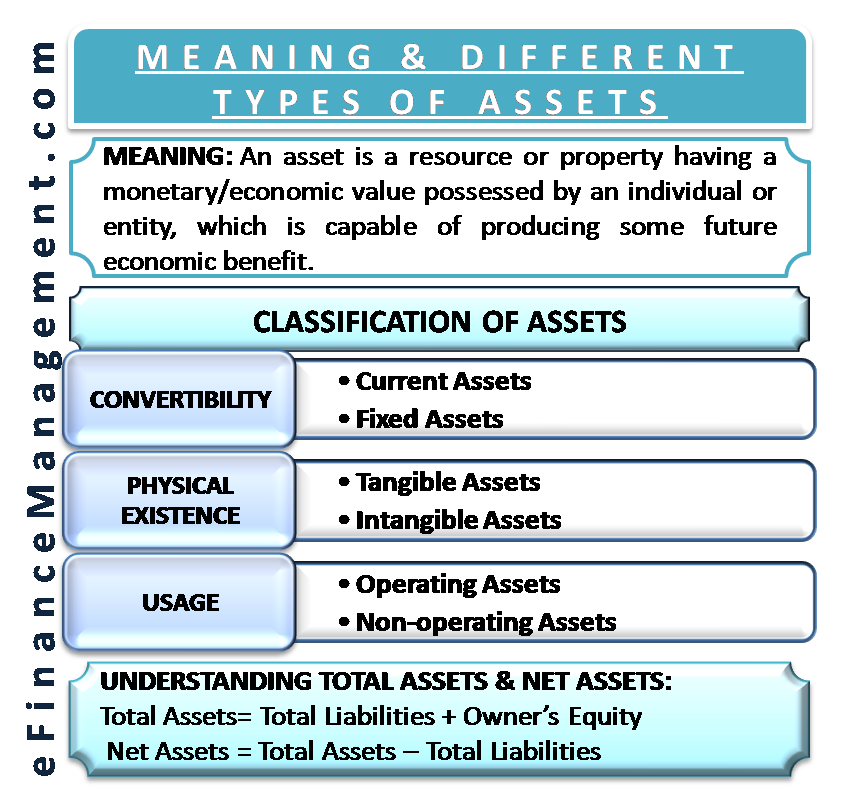

An asset is a resource or property having a monetary/economic value possessed by an individual or entity capable of generating some future economic benefit. Assets are generally brought into the business to benefit from them and to increase the value of a business. In simple language, it means anything that a person “owns,” say a house or equipment. In the accounting context, an asset is a resource that can generate cash flows. The assets are recorded on the balance sheet. They are found on the right-hand side of the balance sheet and can also be referred to as “application of funds.” The assets include furniture, machinery, accounts receivable, cash, investments, etc. We shall discuss various types of assets in this article.

Assets are classified into different types based on their convertibility to cash, use in business, or basis of their physical existence. Assets are a part of the balance sheet and are stated at historical cost less depreciation deducted so far or at cost or at cost or market value, whichever is lower.

Classification of Assets

Assets are generally classified in the following three ways depending upon nature and type:

On the Basis of Convertibility

One way of classifying assets is based on their easy convertibility into cash. According to this classification, total assets are classified either into current assets or fixed assets.

Current Assets

Assets that are easily convertible into cash like stock, inventory, marketable securities, short-term investments, fixed deposits, accrued incomes, bank balances, debtors, bills receivable, prepaid expenses, etc., are classified as current assets. Current assets are generally of a shorter lifespan than fixed assets that last for a longer period. Current assets can also be termed liquid assets.

Also Read: Assets vs Liabilities – All You Need To Know

Fixed Assets

Fixed assets are of a fixed nature in the context that they are not readily convertible into cash. They require elaborate procedure and time for their sale and converted into cash. Land, building, plant, machinery, equipment, and furniture are some examples of fixed assets. Other names used for fixed assets are non-current assets, long-term assets, or hard assets. Generally, the value of fixed assets generally reduces over a period of time (known as depreciation).

On the Basis of Physical Existence

Another classification of assets is based on their physical existence. According to this classification, an asset is either a tangible asset or an intangible asset.

Tangible Assets

Tangible assets are those assets that we can touch, see and feel. All fixed assets are tangible. Moreover, some current assets like inventory and cash fall under the category of tangible assets too.

Intangible Assets

We can not see, feel or touch Intangible assets physically. Some examples of intangible assets are goodwill, franchise agreements, patents, copyrights, brands, trademarks, etc.

These are also classified under assets because the business owners reap monetary gains with the help of these intangible assets. A company’s trademark, brand, and goodwill contribute to the marketing and sale of its products. Many buyers purchase goods only by seeing their trademark and brand in the market.

Also Read: Fixed Asset Accounting

On the Basis of Usage

According to the third way of classification, assets are either operating or non-operating. This classification is based on the usage of the asset for business operations. Assets that are predominantly used for day-to-day business are classified as operating assets, and other assets which are not used in operation are classified as non-operating.

Operating Assets

Operating assets are those assets that are required for the current day-to-day transaction. In simple words, the assets that a company uses for producing a product or service are operating assets. These include cash, bank balance, inventory, plant, equipment, etc.

Non-operating Assets

All assets that are of no use for daily business operations but are essential for establishing business and its future needs are termed non-operational. This could include some real estate purchased to earn from its appreciation or excess cash in the business, which is not used in operation.

Understanding Total Assets and Net Assets

The meaning of total assets is truly reflected in the accounting equation as the sum total of liabilities and owner’s equity. While “Net Assets” is a term used to state the difference between total assets and total liabilities. Consequently, it can be noted that net assets and owner’s equity are virtually the same, i.e., both represent the difference between “Total Assets” and “Total Liabilities.”

Total Assets = Total Liabilities + Owner’s Equity

Net Assets = Total Assets – Total Liabilities

The following table will give you a clear picture of the types of assets:

| Current Asset | Fixed Asset | Tangible Asset | Intangible Asset | Operating Asset | Non-operating Asset |

|---|---|---|---|---|---|

| Cash | Land | Land | Goodwill | Cash | Goodwill |

| Bank Balance | Road | Road | Patents | Bank Balance | Patents |

| Investments | Building | Building | Brand | Inventory | |

| Inventory | Furniture | Furniture | Trademark | Stocks | |

| Stock | Plant | Plant | Copyright | Prepaid Exp | |

| Receivables | Machinery | Machinery | Receivables | ||

| Prepaid Exp. | Equipment | Equipment | Plant | ||

| Cash | Machinery | ||||

| Inventory/Stock |

Quiz on Meaning and Different Types of Assets.

I really enjoyed this tuition

ITS REALLY USEFULL

The information really helped, thank you so much!

it was helpful information

Your explanation is clear and useful for me.

thanks for ur help sir.it was very helpful.

Thankssssssssssss sir

This is very informational. Thank you so much sir..

explianed in a simple way nice information thnk u

Very appreciable.

thanks for your info.. thank you so much..

Very precisely defined. Thank u..

thanks really.

easy to understand and very useful for me.

thank you

It is very meaningful

fentastic class

thanks for the help sir

Thank for giving information

This is nice!

I am actually delighted to glance at this weblog posts which includes tons of useful data, thanks for providing these kinds of information.

Really above statement clear all my doubts.