Fixed Asset Schedule: Meaning

A Fixed Asset Schedule is an integral part of the annual accounts of the company that includes a list of all fixed assets in the business. It acts as a source document that shows the closing balances of all fixed assets available at the end of the Financial Year. It is a detailed document that discloses the total quantum of fixed assets in the business, its historical cost, any purchase or sale of fixed assets during the financial year, description of fixed assets, and accumulated depreciation so far on each of the fixed assets.

Fixed Assets, also known as Non-Current Assets, are those long-term assets that help the organization perform its core operations regularly and thereby contribute to generating profits. Examples of Fixed Assets can be property, land, building, machinery, equipment, etc.

Are Accounting Schedules necessary?

In accounting, schedule preparation happens for cross-verification and audit purposes. Schedules justify the numbers and minute details reported in books of accounts. Schedules are also used by both internal auditors & external auditors to check their authenticity. Majorly used accounting schedules are the Schedule of inventory, Schedule of accounts payable, Schedule of fixed assets & Schedule of accounts receivable.

Therefore making schedules helps for justifying numbers projected in books of accounts.

Elements of Fixed Asset Schedule

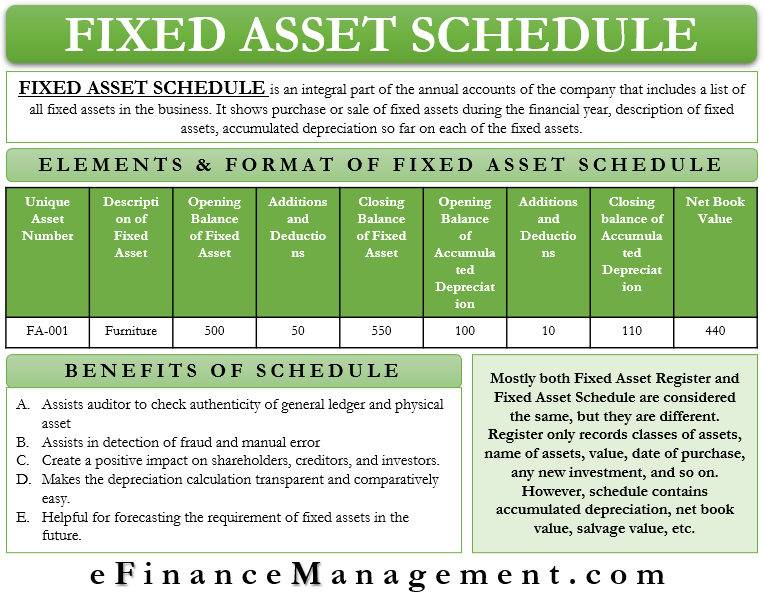

The Schedule lists all the fixed assets broadly and acts as a complete reference for all the movements. Components involved in the Schedule are as follows:-

Also Read: Fixed Asset Accounting

Unique Number to Assets

The first column of the Schedule depicts the unique number given to all the fixed assets. In big organizations, there is a large number of fixed assets. Hence, each asset has a unique number that helps in easy tracking and verification.

Description

The second column shows a description of the given asset. The description given is crisp and to the point.

Historical Cost

The Schedule also reports the historical cost of the fixed assets. Historical cost is the acquisition cost of assets by the organization. Generally, purchasing cost remains the acquisition cost. However, sometimes a machine or equipment needs additional expenses, like particular erection and installation expenses. Therefore, the acquisition cost includes such expenses also. Moreover, the acquisition cost is termed as the gross value of the fixed assets. The opening balance column in the Schedule indicates the same.

New Purchase and Sale of Fixed Assets

The Fixed Asset Schedule records all movements of fixed assets. Therefore, the purchase of any new fixed assets during the current financial year reflects under the head ‘Additions.’ Similarly, any sales of fixed assets are reflected under ‘Deduction.’ The final result is a closing balance of assets at its gross value.

Accumulated Depreciation

The next column of the Schedule includes the opening balance of accumulated depreciation, the addition of depreciation for the current financial year, disposals, if any, and the closing balance of accumulated depreciation to date. The opening balance of accumulated depreciation includes the total depreciation from the acquisition date until the last financial year.

Also Read: Fixed Asset

Net Book Value

The last component or column of the Schedule shows the total Net Book Value of fixed assets. And the Net Book Value comes after making all the above corrections. Moreover, this value should match with the closing balance of General Ledger, or if a separate ledger account is maintained for each fixed asset, then it should match with the same.

The components, as mentioned above, are essential and mandatory. A detailed Fixed Asset Schedule may have additional details like,

Salvage Value

Salvage value is the estimation of the sale value of the fixed assets in the open market. And it may also involve scrap value. A detailed schedule also reports scrap value for each of the fixed assets.

Depreciation methods

Organizations can use any depreciation method which suits their operations. A detailed schedule also reports the type of depreciation method used, be it a straight-line method or written down method, or any other. It is also possible that the management may use different depreciation methods for different fixed assets. It may depend upon the nature of the assets, the practice prevailing in the industry, or acceptable as per the accounting standards.

Impairment Charges

A detailed Fixed Asset Schedule also includes impairment charges for certain assets like goodwill, mines, etc. Impairment shows an unanticipated decline in the value of the assets. Impairment charges occur when the carrying value of assets is not recoverable in the current situation.

Thus the components, as mentioned above, complete the Fixed Asset Schedule.

Format of Fixed Asset Schedule

The below-mentioned format is not a standard and exhaustive format. Moreover, it can vary from company to company according to their requirements. The company usually has many fixed assets. But here, one sample entry is shown to understand and appreciate the details and information applicable to various columns.

| Unique Asset Number | Description | Opening Balance of Fixed Asset (Gross Value) | Additions or Deductions | Closing Balance of Fixed Assets | Opening Balance of Accumulated Depreciation | Additions or Deductions | Closing Balance of Accumulated Depreciation | Net Book Value |

| 123 | Furniture | 500 | 50 | 550 | 100 | 10 | 110 | 440 |

Benefits of Fixed Asset Schedule

- This Schedule helps the auditors to cross-check the authenticity of figures in the general ledger and physical existence.

- Internal management can also detect any fraud or manual error with the help of this Schedule.

- A Fixed Asset Schedule can also be created monthly or yearly.

- Detailed Schedules and disclosures create a positive impact on shareholders, creditors, and investors.

- It also makes the depreciation calculation transparent and comparatively easy.

- This Schedule is also helpful for forecasting the requirement of fixed assets in the future.

Difference between Fixed Asset Schedule and Register

Mostly both Fixed Asset Register and Fixed Asset Schedule are considered the same, but in reality, they are not. The Schedule is more authentic and accurate as compared to the Register. The Register only records classes of assets, name of assets, value, date of purchase, any new investment, and so on. In contrast, the Schedule contains accumulated depreciation, net book value, salvage value, etc. The Schedule is more detailed and shows the current picture.

Many organizations first prepare Register and, based on the same, prepare the Schedule. Since the Schedule encompasses all the requirements of the Register, most of the firms remove the Fixed Asset Register totally to avoid duplication.

Conclusion

A fixed Asset Schedule is an internal and essential part of the annual accounts for transparent reporting of financial results. It is not a compulsory document, but if prepared, then it benefits the organization and auditor from various angles. Fixed Asset Schedule can be prepared both under US GAAP and IFRS. And it complements the accounting ledger.

Thank you,

Very interesting and would like to learn more about Asset schedule.